Chandra Dhakal: The cost of doing business has gone up significantly

Chandra Prasad Dhakal is the senior vice president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI). Dhakal, who will be elevated to the President of the FNCCI in April 2023, is also the Chairman of IME Group which has interests in banking, remittance, IT, tourism, automobile, energy, insurance, infotainment, and communications sectors. The Annapurna Express caught up with Dhakal to talk about the current business environment, issues being faced by the private sector, and IME Group's investment plans. Excerpts: Nepal’s economy is currently going through a deep slowdown. How is the business of IME Group at present? Nepal's economy began to face external sector pressure and liquidity problems in the aftermath of the Covid-19 pandemic. This pushed both the government and private sector into a big crisis. The current situation is worse than what was experienced during the 2015 earthquake and Covid-19 pandemic. Businesses are not getting enough funds to finance their investments and expand their business, which has directly affected their confidence which is detrimental to the economic growth of the country. In such a situation, the IME Group is performing fairly. Since our investments and businesses are expanded over different sectors, a shock could be cushioned by other businesses. However, this time every sector of business is affected. Yet, our drive to expand the investments and contribute to the local and national economy has continued even during the hard times. Currently, we are expanding our investments to tourism infrastructure projects such as cable cars, resorts, and the manufacturing sector. How is the Nepali business community facing current macroeconomic challenges? What are the major challenges at present? The first impact of the current economic challenges is the shortage of funds on the domestic front and various restrictions on imports on the external front. Although macroeconomic indicators like the foreign exchange reserves, the balance of payment, and bank rates are being corrected gradually, challenges like poor government expenditure, higher inflation, external sector pressure, high-interest rates, and financial sector vulnerability persist which are affecting the private sector. Likewise, the guidelines on working capital loans have also created new problems for the private sector. Although some of our demands regarding the guidelines have been addressed, many are yet to be incorporated in the amendment. The cost of doing business has gone up significantly and most industries have stalled their new investment plans while many industries are running at a very limited capacity which also has repercussions on revenue and employment. This situation demands collaborative efforts from the public and private stakeholders whereas the government and regulatory bodies like Nepal Rastra Bank should exhibit flexibility to provide relief to the private sector. What should be the priority of the new government to bring the economy back on track? What are your expectations from the new government? The government should facilitate the private sector by creating a business-friendly environment. It should help promote domestic businesses and facilitate to bring foreign direct investment. One of the biggest maladies of our economic progress is low capital expenditure which has affected the manufacturers of construction materials, contractors, and employees in the sector at the same time. The new government should work to clear all legal and policy-related barriers and bottlenecks to create a business-friendly environment in the country. The country cannot be developed without proper mobilization and development of the private sector, which has more than 75 percent contribution in employment generation and revenue collection. The private sector is the creator and adopter of new technologies, and it is the only one that can supply services at a price that is both reasonable and competitive. Therefore, the government should ensure the active participation of the private sector in all policy-level works and move ahead taking the private sector into confidence. The FNCCI leadership met with the Prime Minister and Finance Minister. How serious are they to resolve the issues being faced by the private sector? I found Prime Minister Pushpa Kamal Dahal and Deputy Prime Minister and Finance Minister Bishnu Prasad Paudel very serious and concerned in terms of addressing the present economic challenges. They are open to listen to the problems that we are facing and discuss possible solutions. As the business community looks up to the government for relief and facilitation during the crisis time, they have duly assured us to bring things back to normal. Meanwhile, there is a need to provide support to the private sector businesses affected by the economic slowdown and increasing interest rates. What long-term policy measures the private sector wants from the new government to make doing business in Nepal easier? There are several issues that the government needs to improve to create an investment-friendly environment in the country. The most pertinent issues are land, labor, infrastructure, resource, tax, and local issues. There are many issues related to these topics. The government should work hand in hand with the private sector to resolve all the issues and create a business environment in the country. The merger of Global IME Bank and Bank of Kathmandu has been completed. Now, how do you see Global IME Bank in the future? The Global IME Bank has become the largest bank in the country. We want to create a strong and resilient financial institution in the country that could not only run everyday banking facilities but also support investors and business persons to finance their business ventures. We recently merged the Bank of Kathmandu with the GIBL which has made the institution stronger. However, it is just a part of our journey. In the future, the bank aims to expand its banking and other services to other countries. We currently have representative offices in Australia, the United Kingdom, and India. We have reached almost the final stage in opening our branch in South Korea. We have given great importance to the digital financial system as promoted by the Nepal Rastra Bank and currently working on infrastructure development for digital security. With the acquisition of two hotels in Kathmandu and Pokhara as well as taking forward two new cable car projects, your group seems to be investing in a big way in the tourism sector. What are the new plans of IME Group in the tourism sector? Yes, you are right. The IME Group wants to test its mettle in the tourism business as well since it is the sector that will boom once the current economic hurdles are resolved. Nepal has a high potential of attracting 2.5 million tourists in the next 3-5 years while the middle and upper middle class in the country has developed a culture of visiting new places in and out of the country. In such a situation, we need to create better and more reliable tourism infrastructure in the current as well as potential destinations. The Chandragiri Hills project has transformed the entire Chandragiri area and is attracting hundreds of thousands of tourists every year. Likewise, another cable car project in Rupandehi connecting a hill station in Palpa, and another in Gaindakot of Nawalparasi East are near completion and will come into operation shortly. Similarly, we have plans to construct cable car projects in all seven provinces of the country. In the next few months, you will be the president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI). What plans have you envisioned as the new president of the country's apex business body? I was elected as the senior vice-president in the election of the FNCCI as per the statute of the organization, so I will be elevated to leadership for the next three years after the annual general meeting in April this year. My general priorities would be the promotion of the interest of all members of the FNCCI, the promotion of the private sector and policy lobbying, and maintaining the trust of the government at various levels, political parties, and other stakeholders. Meanwhile, I will try to change the perception towards the private sector since there is still a feeling that the private sector only earns profits and shy away from fulfilling its responsibilities to society. We have long failed to tell people and society about the importance of the private sector as the engine of economic growth and employment. As the president of the FNCCI, I will also coordinate with public and private organizations to boost the economy, create jobs, and increase domestic production. The capacity of the district and municipal chambers will also be enhanced according to their potential and opportunities in the local economy.

Six hours daily power cut in industrial areas

With Nepal Electricity Authority (NEA) struggling to import sufficient electricity from India, industrial corridors across the country are now experiencing six hours of daily power cuts. NEA has been enforcing load shedding of three hours each in the peak hours of morning and evening in the industrial areas across the country. According to industrialists, such power cut has been happening now from 6-9 am in the morning and 5-8 pm in the evening. Industries in major industrial hubs such as Biratnagar, Birgunj, Hetauda, and Bhairahawa have been hard hit by the latest power cut. Although Nepal has started exporting surplus electricity to India during the wet season, it has to import electricity in the dry season to meet the power demand. It is because almost all of the power production in the country is based on run-of-the-river hydropower plants. The dry season runs from December to April while the wet season lasts from May to November. According to NEA, the run-of-the-river type hydropower projects usually produce less than 40 percent of their installed capacity as water levels in the rivers decrease significantly during the dry season. Currently, the total installed capacity of hydropower plants in Nepal is 2,300-2,400 MW. However, the current electricity generation is around 1,100 MW, whereas the demand during peak hours is 1,600-1,700 MW. According to the NEA, 500-600 MW of electricity is needed to meet the demand of peak hours. As production capacity drops to 40 percent during the dry season, NEA has to manage the electricity supply by importing from India. The current power cuts, according to NEA are due to lower imports of power from India. According to NEA Spokesperson Suresh Bhattarai, the state-owned power utility has to resort to power cuts as electricity import from India has not happened as demanded by the NEA. "There is a power cut in industrial corridors and large industries during peak hours," said Bhattarai, "Such power cut is especially in big industries and industrial hubs." Bhattarai said that the NEA has been in touch with Indian authorities to resolve the current crisis. Suyesh Pyakurel, President of the Chamber of Industries Morang, said that industries in Sunsari-Morang Industrial Corridor have been forced to close the industries due to the power cut. "While the NEA has been giving prior information about the power cut, industries have been suffering due to disruption in power supply," he said. Power cuts at manufacturing plants have caused a drop in production besides damaging expensive equipment, say industrialists. They demand that NEA needs to announce load shedding formally as the power utility has failed to maintain an adequate supply of electricity in the country. As Nepal is likely to face power shortage for some more years, especially during the dry season, the NEA should formally announce the load shedding by setting a routine, they say. "We all know, there is a power shortage every winter. We cannot ask for electricity in such a scenario. It would be better if NEA announces load shedding formally during the winter season, said Pyakurel, adding, "While we have been given prior information about the power cuts for the next day. But there is also no guarantee that there will be a power supply after that. If that is guaranteed, we would have made our schedule accordingly to operate industries."

China resumes outbound group tours excluding Nepal from the list of ‘relevant countries’

When China announced the reopening of outbound travel for its citizens, travel trade entrepreneurs in Nepal were quite hopeful of welcoming a good number of Chinese guests in 2023. However, their hope has been dashed for the moment as China failed to include Nepal in its list of the countries where its citizens can travel starting from February 6. "From February 6, 2023, travel agencies and online companies across the country, on a pilot basis, are resuming the organization of outbound group tours and the air ticket plus hotel service for Chinese citizens to relevant countries," reads a press statement issued by the Chinese Ministry for Culture and Tourism on January 20. China has included 20 countries in the first phase where Chinese travelers can travel. The northern neighbor included Thailand, Indonesia, Cambodia, Sri Lanka, Maldives, Malaysia, the Philippines, Singapore, Laos, United Arab Emirates, Egypt, Kenya, South Africa, Russia, Switzerland, Hungary, New Zealand, Fiji, Cuba, and Argentina as an outbound destination for Chinese citizens to travel as the pilot destinations, as per the circular issued by the Chinese Ministry of Culture and Tourism. The disappearance of Nepal from the list, according to Nepali travel trade entrepreneurs, could affect the government's target of welcoming 1 million tourists in 2023. Before the pandemic-related travel restrictions began in early 2020 in Nepal and across the world, China was the second largest source market for Nepal after India as the country welcomed 169,543 tourists from the northern neighbor. A total of 1.19 million foreign tourists visited Nepal in 2019 before the pandemic disrupted global tourism. “We were expecting that Nepal would be included in China’s list of outbound destinations for Chinese citizens from the beginning which unfortunately could not happen,” said Bishwesh Shrestha, owner of C&K Travels which specializes in Chinese tourists. “We are also planning to launch a publicity campaign in China, but we will do it later once Nepal is also included in the list.” Travel trade entrepreneurs say Nepali authorities should proactively lobby with China to include Nepali in the list. "We should have taken a diplomatic approach as countries like Thailand have been requesting China to include their countries on the list," said a tour operator. Tour operators say they expect Nepal to be included in the next list of 'relevant countries' hopefully as early as possible. According to them, a significant contribution of Chinese tourists would be required if Nepal wants to meet the target of 1 million in 2023. Tour operators specializing in Chinese tourists say they are getting a lot of inquiries from the northern neighbor currently. "In fact, FITs (free independent travelers) have already started coming to Nepal," said Shrestha, adding, "But, group travelers from the northern neighbor have not happened yet." During its 24th anniversary, the Nepal Tourism Board (NTB) announced to attract at least one million foreign tourists in 2023. In 2022, tourist arrivals reached over 600,000 without any significant contribution from China. Nepal welcomed only 9,595 Chinese tourists in 2022. Tour operators say they are receiving increasing inquiries from major source markets of late. Binayak Shah, First Vice President of Hotel Association Nepal (HAN), in early January had said that the initial trends in tourism are encouraging. “The inquiries we’ve been receiving from international visitors of late have given new hope,” said Shah. When it comes to Chinese tourists, besides China opening the door for its citizens to visit Nepal, their arrivals will also depend on how quickly flights between the two countries are normalized, according to tour operators. There is still some uncertainty as to when other Chinese airlines would resume their flights to Nepal. While China Southern and Air China are now operating their flights to Kathmandu, other airlines, namely China Eastern and Sichuan Air are yet to resume their Kathmandu flights. “With the normalization of flights with China, we can welcome at least 100,000 Chinese tourists in 2023,” said Shrestha. According to tour operators, the fact that many countries still have some kind of reservations about letting Chinese tourists enter their countries could bring a large number of Chinese tourists to Nepal. “If there will be normalization of flights from China as that of the pre-Covid period, we could welcome more than 100,000 Chinese tourists in 2023,” said Shrestha. With China reopening outbound travel for Chinese Citizens, Himalaya Airlines has recently resumed its Kathmandu-Beijing direct flight after a hiatus of 32 months. The Kathmandu-Beijing flight was suspended in March 2020 after the Covid-19 pandemic swept the globe. Himalaya's Airbus 319 departed from Tribhuvan International Airport on January 17 to Beijing Daxing International Airport. According to the airliner, the January 17 flight was a reoperation flight and the regular flights will begin in February. The resumption of direct flights between Kathmandu and Beijing is expected to help increase the frequency of Chinese tourist arrivals in Nepal this year.

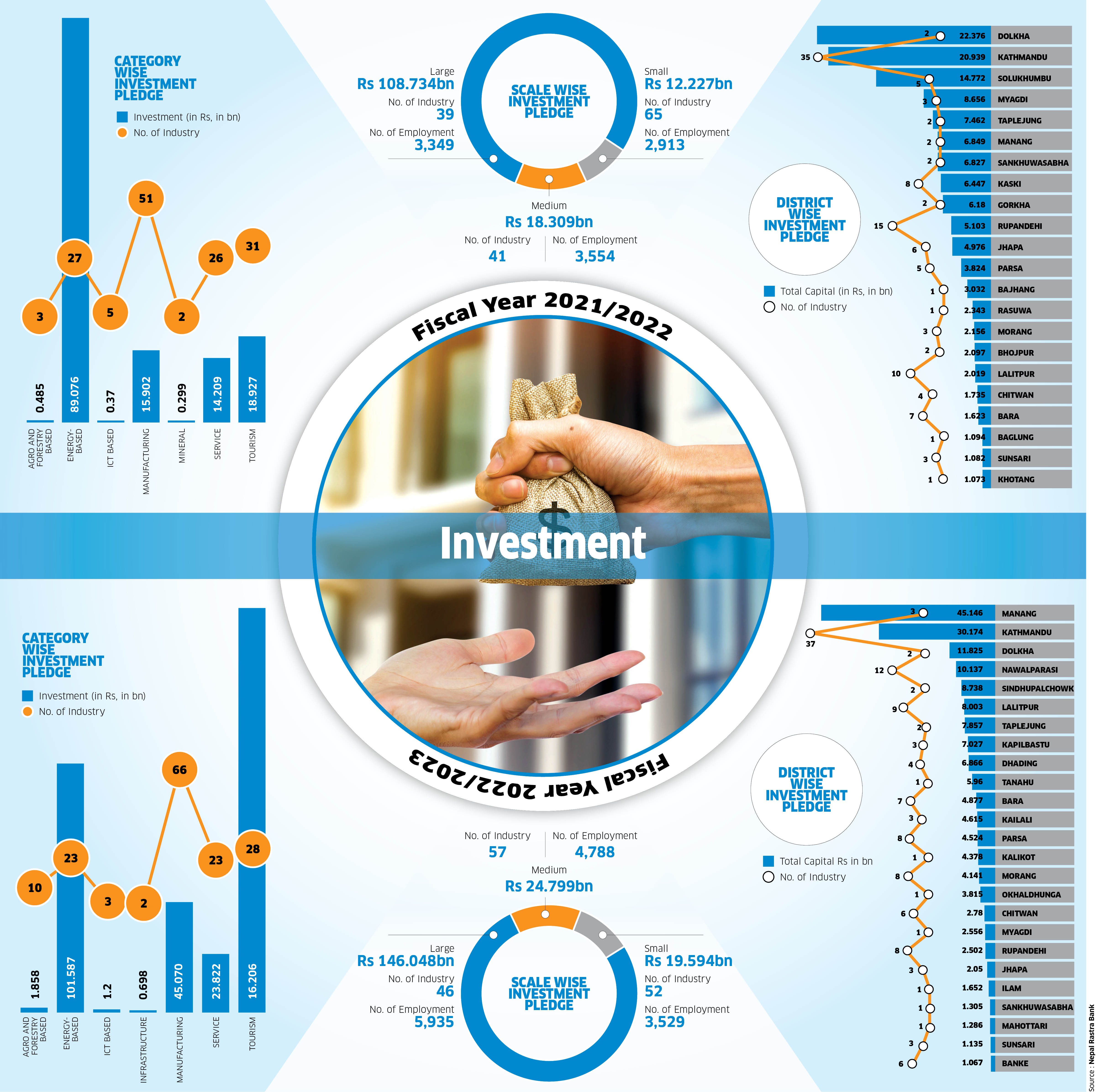

State of investment

As high borrowing rates and the slowdown in major economic activities affect demand for goods and services in the market, investment commitments have shrunken by more than a quarter in the first half of the current fiscal year. According to the data provided by the Department of Industry (DoI), investment commitments have declined by 26.86 percent in the first six months of the current fiscal year. Domestic and foreign investors have made an investment pledge totaling Rs 139.271 billion in the first six months of FY 2022/23 compared to Rs 190.442 billion in the same period of FY 2021/22. Similarly, the number of industries registered at DoI also declined during the review period. Only 145 industries were registered in the first five months while this number was 155 during the corresponding period of the last fiscal year. The DoI data correlates with the recent survey carried out by the Confederation of Nepalese Industry (CNI) which states new investments have halted in almost all sectors with 70 percent of investors postponing their new investment plans due to exorbitantly high interest rates, disruption in money cycle, and a huge drop in market demand for goods and services. Except for tourism, there has been a decline in new investment pledges in all sectors in the current fiscal year. With the recession affecting almost every kind of economic activity, industrialists who had earlier planned to invest in different sectors, are in 'wait-and-watch' mode, according to the CNI survey. The survey shows that businesses associated with the automobile, footwear, and pharmaceutical sectors have put their investment plans on hold indefinitely. Similarly, 85.71 percent of industrialists belonging to the agricultural sector have postponed their new investments. In the cement sector, 83.3 percent of industrialists have deferred their investment plans while it is 71.4 percent in the engineering and construction sector. Likewise, 50 percent of businessmen associated with the e-commerce sector have held up their new investments. According to DoI officials, the decline in industry registration is attributed to the current economic situation of the country where the private sector is grappling with multiple issues ranging from a slowdown in economic activities, and weaker demand to high borrowing rates. As the tourism sector is gradually coming out of the impact of the Covid-19 pandemic, investment has been seen growing in the hospitality sector. According to the DoI, investment pledges in the tourism sector grew by 16.80 percent. A total of 31 industries with an investment commitment of Rs 18.92 billion were registered at the department in this fiscal year compared to 28 industries pledging Rs 16.20 billion during the same period of the last fiscal year. There has been a sharp decline in the registration of new industries in the manufacturing sector this year. As of mid-December this year, 51 new manufacturing industries have been registered with investment commitments totaling Rs 15.90 billion. According to DoI data, 66 manufacturing industries pledging investments worth Rs 45.07 billion were registered during the same period of the last fiscal year. The energy sector has also seen a drop in investment pledges with investment commitments dropping by 12.81 percent. A total of 27 energy sector companies have been registered at the DoI with an investment commitment amounting to Rs 89.07 billion in the first half of the current fiscal year which was Rs 101.58 billion in the corresponding period of the last fiscal year. District-wise, Dolkha registered the highest investment pledge of Rs 22.376 billion in the first six months of FY 2022/23 followed by Kathmandu at Rs 20.93 billion and Solukhumbu at Rs 14.77 billion. FDI commitment down by 43.27 percent Foreign direct investment (FDI) pledges in the country have dropped significantly during the first half of the current fiscal year. The latest statistics of DoI show FDI commitments dropped by 43.27 percent in the first six months of FY 2022/23. FDI commitments totaled Rs 17.30 billion in the review period compared to Rs 30.50 billion in the corresponding period of FY 2021/22. In the first six months of the current fiscal year, a total of 131 industries having FDI pledges have been registered at the department. Of them, two are large-scale industries, 19 medium-scale, and 110 small enterprises. Government officials point out the global economic downturn and the tightening of visa rules for foreign investors by the Nepal government for the decline in FDI pledges. FDI flow to Nepal declined this fiscal mainly due to a slowdown in investment commitment from China. The investors from the northern neighbor have been committing the largest amount of FDI in the last several years to Nepal. With China facing economic problems due to renewed Covid-19 crisis, and supply chain disruptions, investment pledges from the northern neighbor are also affected. The tighter visa rules that the government enforced in early November 2022 discourage applicants from submitting fake documents to get business visas. DoI decided to recommend business visas for foreign investors only for three months at a time to prevent the misuse of the facility. Officials said that the move has been aimed at discouraging the tendency of prolonging their stay in Nepal. OVERALL INVESTMENT PLEDGE (FIRST SIX MONTHS OF FY 2022/23)

| FY | INVESTMENT ( in bn) | CHANGE |

| 2022/23 | 139.271 | -26.86% |

| 2021/22 | 190.442 |

| FY | FDI (in bn) | CHANGE |

| 2022/23 | 17.30 | -43.27 percent |

| 2021/22 | 30.50 |

FIRST SIX MONTHS, FY 2022/23

CATEGORY WISE INVESTMENT PLEDGE

|

FIRST SIX MONTHS, FY 2021/22

CATEGORY-WISE INVESTMENT PLEDGE

|