As high borrowing rates and the slowdown in major economic activities affect demand for goods and services in the market, investment commitments have shrunken by more than a quarter in the first half of the current fiscal year.

According to the data provided by the Department of Industry (DoI), investment commitments have declined by 26.86 percent in the first six months of the current fiscal year. Domestic and foreign investors have made an investment pledge totaling Rs 139.271 billion in the first six months of FY 2022/23 compared to Rs 190.442 billion in the same period of FY 2021/22.

Similarly, the number of industries registered at DoI also declined during the review period. Only 145 industries were registered in the first five months while this number was 155 during the corresponding period of the last fiscal year.

The DoI data correlates with the recent survey carried out by the Confederation of Nepalese Industry (CNI) which states new investments have halted in almost all sectors with 70 percent of investors postponing their new investment plans due to exorbitantly high interest rates, disruption in money cycle, and a huge drop in market demand for goods and services.

Except for tourism, there has been a decline in new investment pledges in all sectors in the current fiscal year. With the recession affecting almost every kind of economic activity, industrialists who had earlier planned to invest in different sectors, are in 'wait-and-watch' mode, according to the CNI survey. The survey shows that businesses associated with the automobile, footwear, and pharmaceutical sectors have put their investment plans on hold indefinitely.

Similarly, 85.71 percent of industrialists belonging to the agricultural sector have postponed their new investments. In the cement sector, 83.3 percent of industrialists have deferred their investment plans while it is 71.4 percent in the engineering and construction sector. Likewise, 50 percent of businessmen associated with the e-commerce sector have held up their new investments.

According to DoI officials, the decline in industry registration is attributed to the current economic situation of the country where the private sector is grappling with multiple issues ranging from a slowdown in economic activities, and weaker demand to high borrowing rates.

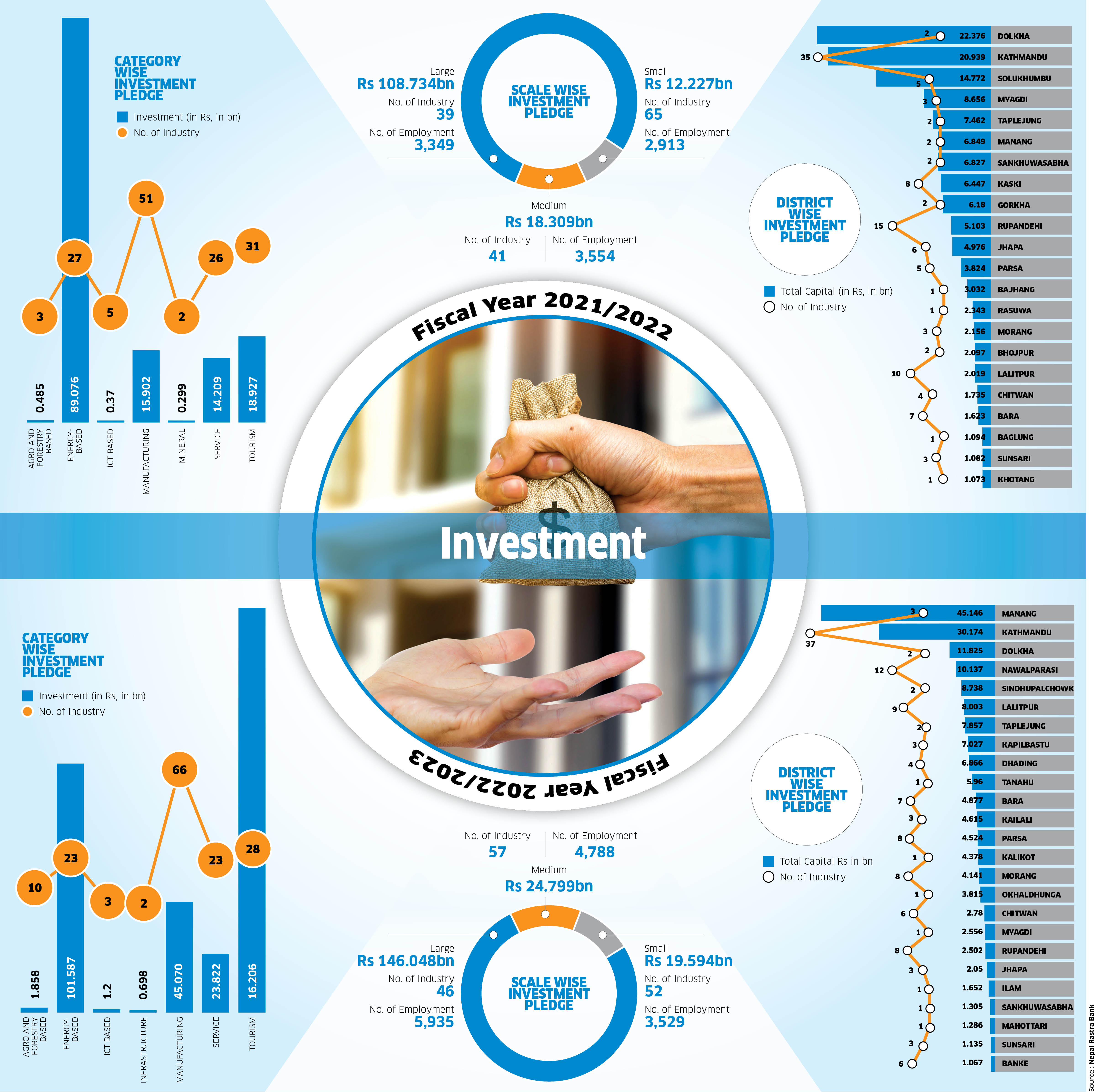

As the tourism sector is gradually coming out of the impact of the Covid-19 pandemic, investment has been seen growing in the hospitality sector. According to the DoI, investment pledges in the tourism sector grew by 16.80 percent. A total of 31 industries with an investment commitment of Rs 18.92 billion were registered at the department in this fiscal year compared to 28 industries pledging Rs 16.20 billion during the same period of the last fiscal year.

There has been a sharp decline in the registration of new industries in the manufacturing sector this year. As of mid-December this year, 51 new manufacturing industries have been registered with investment commitments totaling Rs 15.90 billion. According to DoI data, 66 manufacturing industries pledging investments worth Rs 45.07 billion were registered during the same period of the last fiscal year.

The energy sector has also seen a drop in investment pledges with investment commitments dropping by 12.81 percent. A total of 27 energy sector companies have been registered at the DoI with an investment commitment amounting to Rs 89.07 billion in the first half of the current fiscal year which was Rs 101.58 billion in the corresponding period of the last fiscal year.

District-wise, Dolkha registered the highest investment pledge of Rs 22.376 billion in the first six months of FY 2022/23 followed by Kathmandu at Rs 20.93 billion and Solukhumbu at Rs 14.77 billion.

FDI commitment down by 43.27 percent

Foreign direct investment (FDI) pledges in the country have dropped significantly during the first half of the current fiscal year. The latest statistics of DoI show FDI commitments dropped by 43.27 percent in the first six months of FY 2022/23. FDI commitments totaled Rs 17.30 billion in the review period compared to Rs 30.50 billion in the corresponding period of FY 2021/22.

In the first six months of the current fiscal year, a total of 131 industries having FDI pledges have been registered at the department. Of them, two are large-scale industries, 19 medium-scale, and 110 small enterprises.

Government officials point out the global economic downturn and the tightening of visa rules for foreign investors by the Nepal government for the decline in FDI pledges.

FDI flow to Nepal declined this fiscal mainly due to a slowdown in investment commitment from China. The investors from the northern neighbor have been committing the largest amount of FDI in the last several years to Nepal. With China facing economic problems due to renewed Covid-19 crisis, and supply chain disruptions, investment pledges from the northern neighbor are also affected.

The tighter visa rules that the government enforced in early November 2022 discourage applicants from submitting fake documents to get business visas. DoI decided to recommend business visas for foreign investors only for three months at a time to prevent the misuse of the facility. Officials said that the move has been aimed at discouraging the tendency of prolonging their stay in Nepal.

OVERALL INVESTMENT PLEDGE

(FIRST SIX MONTHS OF FY 2022/23)

| FY |

INVESTMENT ( in bn) |

CHANGE |

| 2022/23 |

139.271 |

-26.86% |

| 2021/22 |

190.442 |

|

FOREIGN DIRECT INVESTMENT

(FIRST SIX MONTHS)

| FY |

FDI (in bn) |

CHANGE |

| 2022/23 |

17.30 |

-43.27 percent |

| 2021/22 |

30.50 |

|

FIRST SIX MONTHS, FY 2022/23

CATEGORY WISE INVESTMENT PLEDGE

| CATEGORY |

NO. OF INDUSTRY |

Investment ( in Rs billion) |

NO. OF EMPLOYMENT |

| AGRO AND FORESTRY BASED |

3 |

0.485 |

223 |

| ENERGY-BASED |

27 |

89.076 |

1,739 |

| ICT BASED |

5 |

0.37 |

267 |

| MANUFACTURING |

51 |

15.902 |

3,291 |

| MINERAL |

2 |

0.299 |

101 |

| SERVICE |

26 |

14.209 |

1,273 |

| TOURISM |

31 |

18.927 |

2,922 |

| TOTAL |

145 |

139.271 |

9,816 |

SCALE WISE INVESTMENT PLEDGE

| SCALE |

NO. OF INDUSTRY |

Investment ( in Rs bn) |

NO. OF EMPLOYMENT |

| LARGE |

39 |

108.734 |

3,349 |

| MEDIUM |

41 |

18.309 |

3,554 |

| SMALL |

65 |

12.227 |

2,913 |

| TOTAL |

145 |

139.271 |

9,816 |

DISTRICT WISE INVESTMENT PLEDGE

| DISTRICT |

NO. OF INDUSTRY |

Investment ( in Rs bn) |

NO. OF EMPLOYMENT |

| DOLKHA |

2 |

22.376 |

100 |

| KATHMANDU |

35 |

20.939 |

2,210 |

| SOLUKHUMBU |

5 |

14.772 |

441 |

| MYAGDI |

3 |

8.656 |

369 |

| TAPLEJUNG |

2 |

7.462 |

92 |

| MANANG |

2 |

6.849 |

84 |

| SANKHUWASABHA |

2 |

6.827 |

118 |

| KASKI |

8 |

6.447 |

407 |

| GORKHA |

2 |

6.180 |

90 |

| RUPANDEHI |

15 |

5.103 |

1,294 |

| JHAPA |

6 |

4.976 |

694 |

| PARSA |

5 |

3.824 |

576 |

| BAJHANG |

1 |

3.032 |

18 |

| RASUWA |

1 |

2.343 |

40 |

| MORANG |

3 |

2.156 |

317 |

| BHOJPUR |

2 |

2.097 |

66 |

| LALITPUR |

10 |

2.019 |

477 |

| CHITWAN |

4 |

1.735 |

284 |

| BARA |

7 |

1.623 |

292 |

| BAGLUNG |

1 |

1.094 |

17 |

| SUNSARI |

3 |

1.082 |

144 |

| KHOTANG |

1 |

1.073 |

33 |

|

…………………………………………………………………………………………………………………

FIRST SIX MONTHS, FY 2021/22

CATEGORY-WISE INVESTMENT PLEDGE

| CATEGORY |

NO. OF INDUSTRY |

Investment ( in Rs bn) |

NO. OF EMPLOYMENT |

| AGRO AND FORESTRY BASED |

10 |

1.858 |

446 |

| ENERGY BASED |

23 |

101.587 |

872 |

| INFORMATION TECHNOLOGY BASED |

3 |

1.2 |

347 |

| INFRASTRUCTURE |

2 |

0.698 |

117 |

| MANUFACTURING |

66 |

45.070 |

8,192 |

| SERVICE |

23 |

23.822 |

2,060 |

| TOURISM |

28 |

16.206 |

2,218 |

| TOTAL |

155 |

190,442.39 |

14,252 |

SCALE-WISE INVESTMENT PLEDGE

| SCALE |

NO. OF INDUSTRY |

Investment ( in Rs bn) |

NO. OF EMPLOYMENT |

| LARGE |

46 |

146.048 |

5,935 |

| MEDIUM |

57 |

24.799 |

4,788 |

| SMALL |

52 |

19.594 |

3,529 |

| TOTAL |

155 |

190.442 |

14,252 |

DISTRICT-WISE INVESTMENT PLEDGE

| DISTRICT |

NO. OF INDUSTRY |

TOTAL CAPITAL

(Rs in m) |

NO. OF EMPLOYMENT |

| MANANG |

3 |

45.146 |

168 |

| KATHMANDU |

37 |

30.174 |

3,082 |

| DOLKHA |

2 |

11.825 |

71 |

| NAWALPARASI |

12 |

10.137 |

1,738 |

| SINDHUPALCHOWK |

2 |

8.738 |

102 |

| LALITPUR |

9 |

8.003 |

1,096 |

| TAPLEJUNG |

2 |

7.857 |

95 |

| KAPILBASTU |

3 |

7.027 |

397 |

| DHADING |

4 |

6.866 |

310 |

| TANAHU |

1 |

5.960 |

64 |

| BARA |

7 |

4.877 |

547 |

| KAILALI |

3 |

4.615 |

837 |

| PARSA |

8 |

4.524 |

564 |

| KALIKOT |

1 |

4.378 |

45 |

| MORANG |

8 |

4.141 |

626 |

| OKHALDHUNGA |

1 |

3.815 |

53 |

| CHITWAN |

6 |

2.780 |

457 |

| MYAGDI |

1 |

2.556 |

25 |

| RUPANDEHI |

8 |

2.502 |

897 |

| JHAPA |

3 |

2.050 |

308 |

| ILAM |

1 |

1.652 |

25 |

| SANKHUWASABHA |

1 |

1.305 |

23 |

| MAHOTTARI |

1 |

1.286 |

200 |

| SUNSARI |

3 |

1.135 |

152 |

| BANKE |

6 |

1.067 |

452 |

|