It ain’t no Chinese whisper: Delhi’s a bit worried

The Parliamentary Standing Committee of External Affairs of India has suggested the government to review and enhance its developmental diplomacy in view of the increasing Chinese outreach and presence in its neighborhood, Press Trust of India reports. The ministry report was based on the panel’s observations on the subject ‘Demands for Grants' of the ministry for the year 2022-23, according to the PTI report. It also dealt with aid allocations to India's neighboring countries, including Afghanistan and Nepal. “In view of the increasing Chinese outreach and presence in India's neighborhood, the Committee feels that India needs to review and enhance their developmental diplomacy,” the panel said. It further suggested that “a strategy/vision should be formulated to expand our developmental partnership, particularly capacity building and knowledge sharing, to effectively counter the presence of other regional powers in our neighborhood.” The ministry submitted that the Government of India attaches high priority to the relationship with neighboring countries and has a well-articulated policy of ‘Neighborhood First’. In its reply, the Ministry of External Affairs told the panel that the primary orientation of India's foreign policy remains its immediate neighborhood under the ‘Neighborhood First’ policy.

Tourist arrivals hits three-year high in 2022

In what could be seen as a strong recovery in the Nepali tourism business, tourist arrivals in Nepal rose to a three-year high in 2022. Over 600,000 tourists visited Nepal last year, putting an end to a two-year downward spiral that started in early 2020 when the coronavirus outbreak wreaked havoc across the world. Data from Nepal Tourism Board (NTB) shows that a total of 614,148 international tourists visited Nepal last year, of which 67,932 came in December. While the number of foreign visitors entering Nepal grew by 306.82 percent in 2022 compared to 2021, it is still 48.70 percent lower than in 2019 when 1.19 million arrivals were recorded. According to NTB, the largest number of foreign visitors who came to Nepal in 2022 were from India. A total of 209,105 Indian tourists visited Nepal last year. Similarly, 77,009 came from the US, 44,781 from the UK, 26,874 from Australia, and 25,384 from Bangladesh. With two new international airports—Gautam Buddha Int'l Airport in Bhairahawa and Pokhara Regional International Airport—coming into operation, the tourism sector is buoyant about the footfalls of visitors in the country in 2023. Prime Minister Pushpa Kamal Dahal inaugurated the Pokhara International Airport on Sunday. The Ministry of Culture, Tourism and Civil Aviation has already prepared the strategic framework for the Nepal Tourism Decade 2023-2032 while Nepal Tourism Board has said it is targeting 1 million foreign visitors for 2023. The framework developed by a four-member expert panel led by the former NTB CEO Prachanda Man Shrestha has set ambitious targets of increasing tourist spending to $125 daily from the existing $48, creating 1 million direct jobs in the tourism sector, and increasing the tourism sector's contribution to national GDP to 10 percent. The plan also aims to bring the tourist numbers to pre-pandemic levels by 2024 and increase arrivals in each subsequent year by 15 percent. The NTB CEO Dhananjay Regmi, while addressing the 24th anniversary of the board on Saturday said that the tourism industry is in a revival phase after two disastrous years and the board will focus more in attracting visitors from Asia, mainly from Southeast Asia and the Middle East. For the Nepali tourism industry, the years 2020 and 2021 came as a nightmare. With global travel coming to a grinding halt due to the restrictions enforced by governments across the world, the arrival of tourists fell to record lows resulting in massive financial losses and layoffs in the tourism and hospitality business. In 2020, Nepal’s tourism earnings totaled USD 217 million which was USD 801 million in 2019. The earnings plummeted by 48.2 percent to a meager USD 112.5 million in 2021. Similarly, average expenses per visitor per day plunged to USD 48 in 2021 which was USD 65 in 2020. Tourist Arrivals in Nepal

| 2022 614,148 +306.82 percent 2021 150,962 -34.38 percent 2020 230,085 -80.78 percent 2019 1,197,191 |

| Month Arrivals January 16,975 February 19,766 March 42,006 April 61,589 May 53,608 June 46,957 July 44,462 August 41,304 September 58,314 October 88,582 November 72,653 December 67,932 |

Nepse starts the new year on a positive note

The Nepal Stock Exchange (Nepse) began the new year by continuing the momentum that the index has been on for the last few days after the formation of the new government. The Nepse index surged by 17.26 points on Sunday, the first trading day of the week. The daily turnover at the benchmark index crossed Rs 4 billion, the highest in five months. The last time when daily turnover crossed the Rs 4 billion mark was on August 3, 2022. Despite the increase, volatility was observed in the market on Sunday with the Nepse index touching an intra-day high of 2083.19 points before falling to an intra-day low of 2032.19 points. The index settled at 2046.26 points. After the new government noted in its first meeting that problems in the country's capital market will be resolved in the coming days, the stock market is on an upward swing. In the last five trading days after the Pushpa Kamal Dahal-led government came into power, the benchmark index has surged by 179.08 points. On Sunday's trading, Nabil Bank recorded the highest turnover of Rs 225.7 million while the shares of Api Power Company were the most traded scrips. The share price of 121 companies increased while 87 companies saw their share prices decrease. The Nepse index on December 29 (the last trading day of 2022) surged past the 2000 mark for the first time in four months. The benchmark index had dropped below 2000 points on August 27 amid a bearish run that began over a year ago. The confidence of stock investors seems to have returned after the new government assured that it would address problems in liquidity management and will work to bring down the persistently higher interest rates.

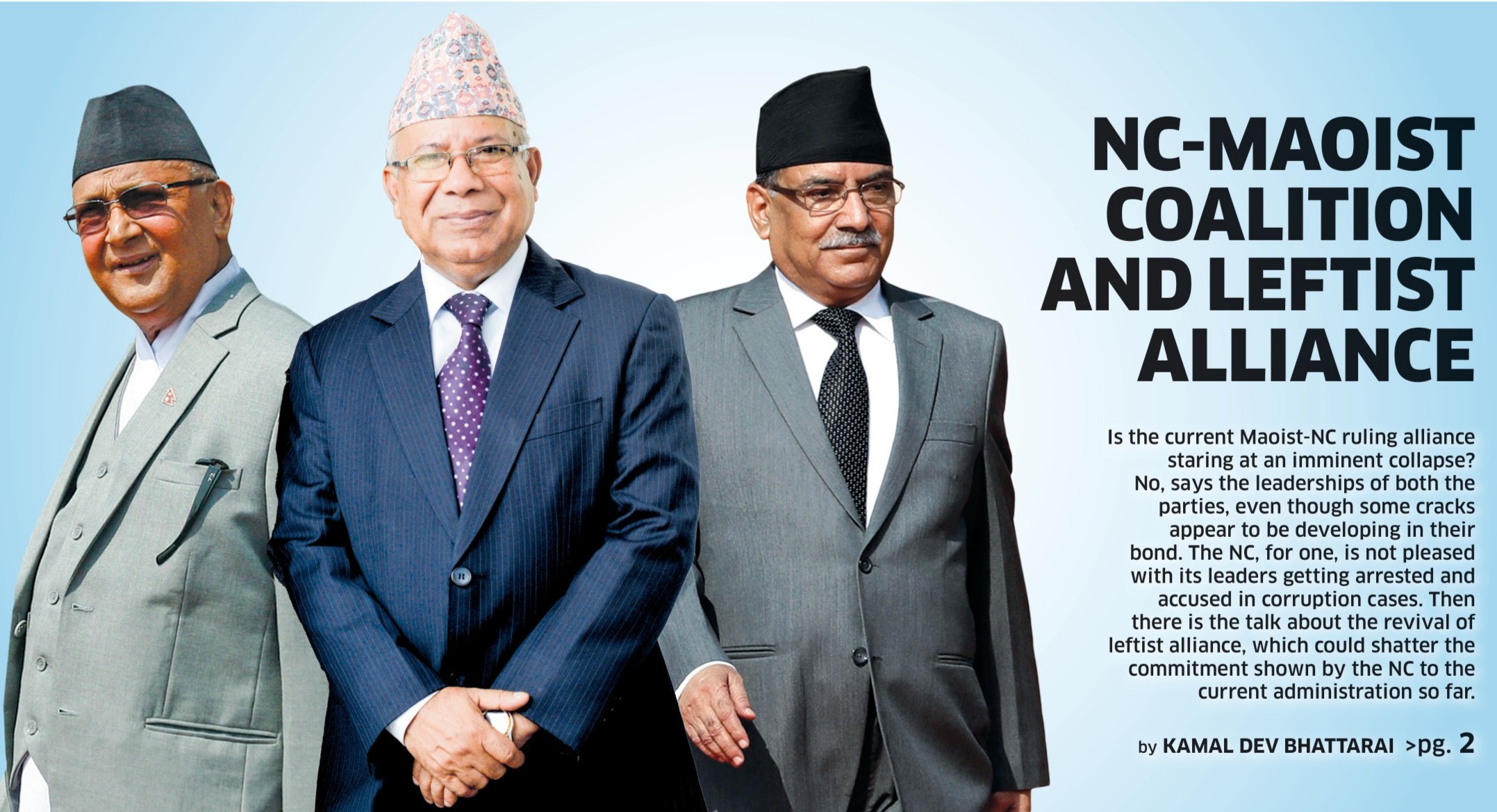

Dahal may be the prime minister, but it’s Oli who runs the show

After the power-sharing negotiation between the Nepali Congress and CPN (Maoist Center) fell through on Dec 25, Maoist leader Puspha Kamal Dahal stormed out of the prime minister’s official residence in Baluwatar. Dahal drove straight to the Balkot residence of CPN-UML Chairman KP Oli, where other Maoist leaders were already present. Within a matter of few hours the UML and Maoists worked out a power-sharing deal, thwarting NC leader Sher Bahadur Deuba’s bid to retain his prime ministerial seat. “Balkot meeting agrees to make Dahal new prime minister” read the headlines of most online news outlets. Deuba, whose parties won the most number of parliament seats (89) in the Nov 20 general election, was suddenly on the back foot. The third-placed Maoist party, which secured just 32 slots in the House of Representatives, had outmaneuvered the grand old party. The last minute Maoist-UML alliance was supported by five other fringe political parties, effectively sidelining the NC not just from the center but provinces as well. While Dahal certainly outdid Deuba, the real winner here was Oli. In recent years, the former prime minister and UML kingpin has solidified his position as one of the most powerful leaders in Nepal’s political history. He is both loved and reviled for his political cunning and nationalist attitude. In 2018, the merger between the UML and Maoist saw the formation of Nepal Communist Party (NCP), which propelled Oli’s status as one of the most powerful prime ministers as well as the leader of the largest communist party. The UML-Maoist union, however, only lasted for just a little over two years. The party broke up after Oli began to display authoritarian bent both inside the party and in government. The party division didn’t just cause intense rivalry between Oli and Dahal, but also led to the departure of former UML senior leaders Madhav Kumar Nepal and Jhala Nath Khanal, who went on to form their own party. With the party fractured, Oli found himself leading a minority government. In order to hold on to power, he made two unsuccessful attempts to dissolve the parliament, but the Supreme Court intervened and dismissed him from the prime minister’s office. The NC led five-party coalition, which included the Maoists, went on to form a government, while the UML occupied the opposition aisle. For the Nov 20 election, the NC-led coalition forged an electoral alliance against the UML, which was contesting as a single party in most of the constituencies. Despite facing the five-party alliance alone, the UML managed to win 78 seats in parliament, just 11 fewer than the NC and 46 more than the Maoists. More importantly, the NC-led alliance failed to secure enough seats to even form a simple majority. And when Deuba refused to cede the prime minister’s office to Dahal as part of the power-sharing deal, the NC-led alliance disintegrated and the UML was thrust into the role of a kingmaker. The UML is the centerpiece of the latest coalition government and Oli the show-runner. Political analyst Dambar Khatiwada says the political power of Baluwatar has shifted to Balkot. He adds Oli has already started to influence what decisions are made in Baluwatar. The rekindling of Oli-Dahal relationship, given their past feuds, was unexpected. For now, there seems to be no friction between the two. But some observers say it is just a matter of time when their egos will clash. As a prime minister, Dahal has all executive powers and wants to act independently without pressure or influence from the coalition partners, mainly the UML. But since it was Oli who made Dahal’s prime ministerial ambition come true, Oli will obviously want to exercise or influence the executive decisions. Oli has already been appointed the head of a cross-party mechanism formed to support and guide the government. Khatiwada says Oli has already established himself as the “de facto” prime minister of the current coalition. Oli also holds the responsibility of drafting the government’s common minimum program, which means Prime Minister Dahal will have to act as per guidance of the Oli-led committee. Besides, two key coalition partners—Rastriya Swatantra Party and Rastriya Prajatantra Party—are also closer to Oli than Dahal. A senior UML leader says Oli’s decision was key to RSP leader Rabi Lamichhane’s appointment as the Home Minister. Ahead of the election, Oli was highly critical of Lamichhane, a former TV host, and his party. But now he seems to have made peace with Lamichhane. After taking charge of the Home Ministry, Lamichhane has been meeting Oli on a regular basis. Khatiwada says this means the new home minister is more loyal to Oli than Prime Minister Dahal. As for the RPP, the UML was already close with the party and had even forged an electoral alliance in some constituencies in the Nov 20 election. The UML, RSP and RPP also have similar views on issues of federalism, citizenship, and the demands raised by Madhesi and Janajati communities. Observers say this brings the three parties closer, and, as a result, Prime Minister Dahal will come under pressure to work as per Oli’s plan. The prime minister’s work will also be made difficult by the fact that the UML candidates will be occupying the posts of the parliament speaker and the president. There is no doubt that these two key positions will be given to Oli’s close aides. This will afford Oli sufficient space to wield executive power from outside. Moreover, the UML arguably has the greatest organizational strength than any other political parties, which means Oli will have a significant influence on bureaucracy. UML leader Mahesh Basnet says the UML has a pivotal role in the Maoist-led government. He also hinted at the possible merger between the UML and Maoists under Oli’s initiative. But if past is any prologue, Oli and Dahal are sure to clash with each other, whether they are in the same party, in different ones, or for that matter, in the same coalition government.