CPN (US) sits on the fence

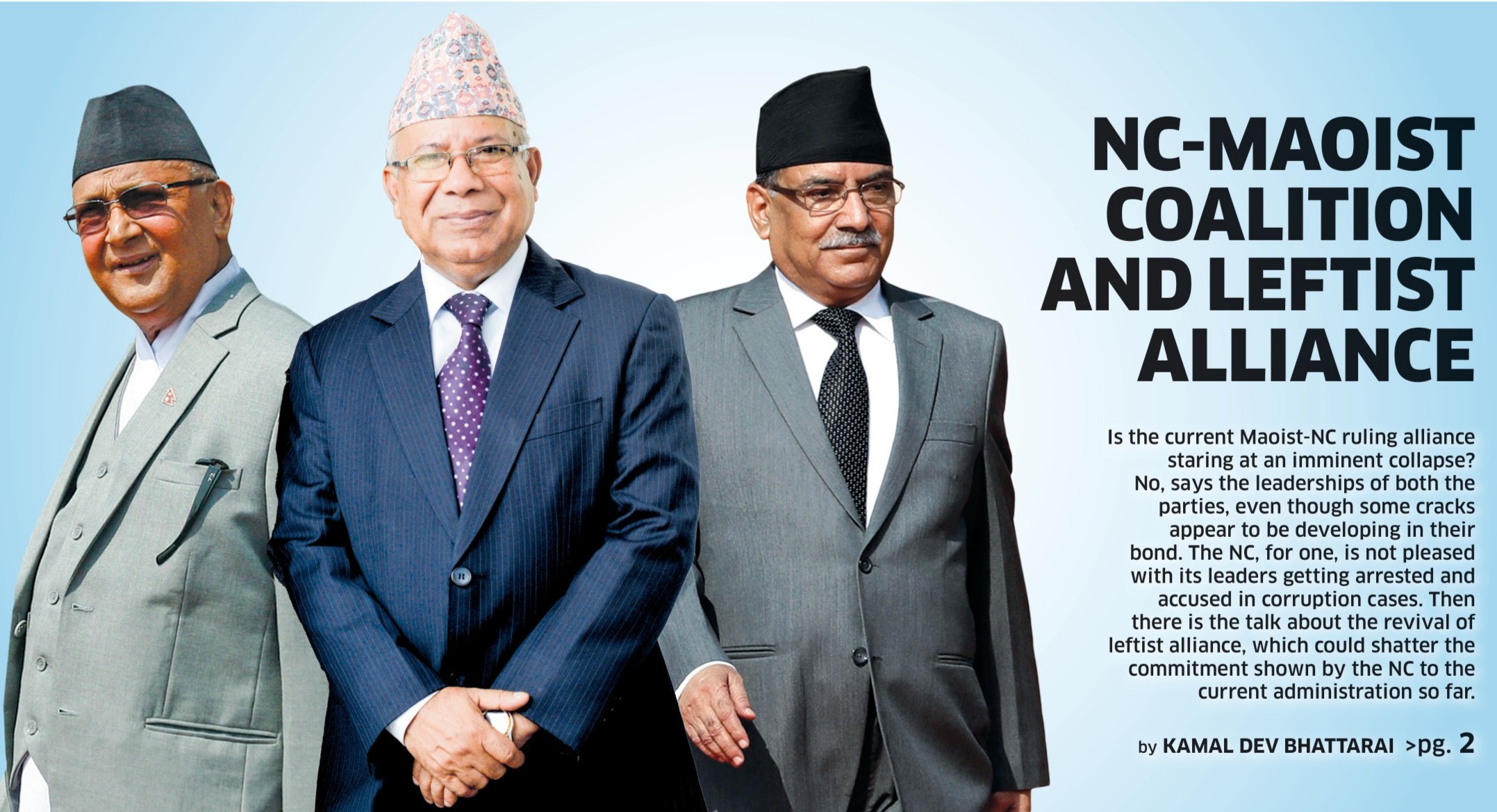

CPN (Unified Socialist) chairperson Madhav Kumar Nepal has said that the party will not rush to take the decision about joining the government. As Prime Minister Pushpa Kamal Dahal prepares to seek the vote of confidence on Jan 10, Nepal is under pressure to make a decision.

PM Dahal on Wednesday urged Nepal to support the government. Nepal, however, said his party has not taken any decision on the issue. The party views the political situation as foggy and is not in a hurry to make a decision. We will wait for the policies and program of the government and decide, Nepal said.

The party has failed to emerge as a national party but has 10 members in the Parliament. Nepal is reportedly unhappy that Dahal joined hands with CPN-UML to form the government. The UML is Nepal's former party, which he left after falling out with its Chairman KP Oli. Dahal has expedited talks with parties to win the floor test, and it is important for him that Nepal's party is behind him.

NRB shows flexibility to resolve working capital loans issue

After months of wrangling, Nepal Rastra Bank (NRB) and the private sector are close to a deal to resolve the working capital loans issue. The meetings between the NRB senior officials and the top leadership of the private sector in the last two days indicate both sides are working to find a middle ground to resolve the issue which forced the businessmen to hit the streets. NRB and private sector representatives appeared to have reached an understanding on rescheduling the implementation of working capital loans guidelines which has invited strong backlash from the business community. The central bank enforced the guidelines on October 18 arguing that it seeks to stop the misutilization of money loaned to business firms. NRB Governor Maha Prasad Adhikari on Monday held a discussion with the top leaders of the private sector separately including Federation of Nepalese Chambers of Commerce and Industry (FNCCI) President Shekhar Golchha, Confederation of Nepalese Industries President Vishnu Kumar Agrawal and Nepal Chambers of Commerce President Rajendra Malla. According to businesspersons who were part of the delegations, the central bank has indicated flexibility to address the private sector's demand. After the new coalition government led by Pushpa Kamal Dahal was formed and Bishnu Poudel took charge as the finance minister, NRB governor Adhikari initiated consultations with the umbrella organizations of the private sector. Sources said Governor Adhikari during Monday's meeting with FNCCI President Golchha and CNI President Agrawal put forward a middle point. He asked both business leaders to come up with concrete proposals on working capital loans guidelines by Tuesday. According to an FNCCI source, Golcha and Vice President Anjan Shrestha agreed on the middle point of providing 'two years to the old debtors and implementing guidelines for the new borrowers'. "However, FNCCI has made some changes in its demand after holding discussions with the presidents of the provincial chapters of FNCCI as district chapters have been demanding to adopt flexibility in the implementation of the guidelines in the case of new borrowers as well," the source said. As per the guidelines, a borrower can receive working capital loans up to only 20 percent of their annual turnover if it is less than Rs 20 million. Similarly, a borrower can receive up to 25 percent of the total annual turnover if they have an annual turnover of over Rs 20 million. The NRB is of the view that the main motive behind introducing the working capital guidelines is to deter the firms from diverting the loans for other purposes. Central bank officials believe that due to a diversion of working capital loans for other purposes such as imports, investment in real estate, and the stock market, BFI lending surged contributing to ballooning imports in the past. “Many businesspersons invested the money they borrowed as short-term working capital loans in long-term investments such as real estate and now they are struggling to cash in on those properties to bring the loan exposure to the set limit,” said an NRB official. The private sector has been demanding suspension of the implementation of the guidelines arguing that the arrangements have adversely affected their businesses. FNCCI has termed the guidelines on working capital loans as the 'major obstacle to the business and private sector growth'. Amid continued protests from the private sector, the central bank on November 16 sought advice from the stakeholders to see if there was any problem with implementing the provisions of the guidelines. While issuing the first quarterly review of the monetary policy for FY2022/23, the central bank also promised to make necessary changes based on suggestions. At that time, though NRB said it was ready to make necessary amendments to the guidelines, the central bank, however, remained steadfast about the need for such monetary arrangements. Nonetheless, with the formation of the new government and CPN (UML) leader Bishnu Paudel becoming the new finance minister, NRB has seemingly softened its stance. Observers say that this is due to the pressure of the finance minister who has promised the private sector leaders to resolve the issues business community members are facing at present. A senior NRB official acknowledged that they are now in discussion with the private sector on resolving the working capital loans issue. "At the moment, there have been talks with them (private sector). The issue of rescheduling the working capital loans is also under discussion. But no conclusion has been reached. We have also sought feedback from the banks and financial institutions about the problems in the implementation of the guideline," said the official.

China’s BRI claim over Pokhara airport shows desperation

In 2016, Nepal took $215m in soft loan from China’s Export-Import Bank to construct the Pokhara Regional International Airport. The following year in May, Nepal officially joined China’s Belt and Road Initiative (BRI), a flagship project of Chinese President Xi Jinping. Since the signing of the BRI, China has been urging Nepal to select and propose specific infrastructure projects to be developed under the program. Initially, Nepal had proposed 36 projects, but they were later scaled down to nine. Now, both countries are holding talks to finalize the BRI implementation plan, which is expected to get a boost under Prime Minister Pushpa Kamal Dahal. On Aug 10 last year, former foreign minister Narayan Khadka and his Chinese counterpart Wang Yi pledged to conclude the implementation plan for BRI cooperation, and convene a meeting of the Joint Commission later that same year. However, the meeting could not take place, as Nepal was due to hold elections to the federal parliament and provincial elections on Nov 20. Prime Minister Dahal of CPN (Maoist Center) is expected to accord priority to China’s BRI projects, unlike his predecessor Sher Bahadur Deuba of Nepali Congress, which is largely seen as ‘pro-West’. While Dahal will certainly try to make some progress on the BRI projects in order to appease Beijing, he is unlikely to accept loans under the program, which comes with lots of strings attached. Even if he were to warm up to the loan agreements, the move is likely to face fierce opposition from the NC. Beijing is buoyed by Dahal’s appointment, but it will be folly of the Xi government to expect unquestionable cooperation from him. It must take a lesson from the latest controversy over Pokhara Regional International Airport. A tweet by the Chinese embassy on the eve of the airport’s inauguration had Nepal in a tizzy. The tweet mentioned that the airport construction was a flagship project of Nepal-China BRI cooperation, but officials and observers claim it is not. Foreign policy expert Rupak Sapkota insists that the airport project is not a specific project under the BRI, and that China was trying to give a message that it is a flagship project in Nepal, which is a part of a broader BRI map. “There is no clarity whether the BRI is more about the infrastructure projects or a central piece of China’s international engagement,” he says. “I think China will come up with a concrete concept this year, which happens to be the 10th anniversary of the BRI launch.” The construction of the new airport in Pokhara was contracted to China CAMC Engineering Co, and the loan for the project also came from China’s EXIM Bank. But the important thing to remember here is that the loan agreement was signed before Nepal became a part of the BRI. However, Wang Xin, charge d’affaires at the Chinese embassy in Kathmandu, has clearly said that the new airport is the bright name card of the China-Nepal joint project under the BRI. Sapkota is of the view that the governments from both countries should address the latest controversy and clear the confusion, if any. Former foreign minister Prakash Sharan Mahat, who signed the BRI agreement on behalf of the Nepal government, also says that Pokhara airport does not fall under the BRI. “The agreement for the airport construction loan was signed in 2016, whereas I signed the BRI agreement in 2017,” he says. “China has no basis to make such a claim.” This is not the first time China has claimed that cooperation under the BRI has already made progress in Nepal. Addressing a program titled Sino-Nepal BRI Framework Agreement: Shared Future for Trans-Himalayan Region on Sept 9, 2021, former Chinese ambassador Hou Yanqi had said: “A series of important consensus have been reached on the cooperation under the BRI, as well as the construction of the trans-Himalayan Multi-Dimensional Connectivity Network.” In reality, there had been no such “important consensus”. Observers say China is desperate to implement the BRI projects in Nepal, as the previous government under Deuba had made it clear that Nepal would not take any loans under the BRI. “By projecting Pokhara airport project as part of the BRI, Beijing is simply trying to show the world that the flagship program is gaining ground in Nepal,” says a senior government official. “Since the US is lumping together all its assistance programs as part of its Indo-Pacific Strategy, China is doing the same with the BRI.” Geopolitical analyst Chandra Dev Bhatta says Beijing’s rash and rushed approach will not only disrepute the BRI, but also create a trust deficit between Nepal and China. “It appears that China is using us to serve its broader strategic interests,” says Bhatta. Eight facts:

- Chinese President Xi Jinping launched BRI in 2013

- Nepal signed agreement with China to take loan to construct Pokhara Regional International Airport in 2016

- Nepal agreed to become a party to BRI in 2017

- Second BRI summit listed Trans-Himalayan Connectivity as a key BRI project in 2019

- Nepal presented nine potential projects that could be developed under the BRI; it does not include Pokhara airport

- BRI implementation plan is currently under deliberation

- Pokhara airport was not a joint project of two countries; China was just a lender and Nepal have to pay

- Nepal built this airport, just contract was awarded to Chinese company

Living on the margins amidst a harsh winter

Rajendra Sada of Mujeliya in Janakpur-14 is struggling to keep his family of 12 warm this winter. He only has three beddings and two blankets to share among them. "We can't afford jackets and blankets like others. How will we be able to brave the winter chill? We simply don’t know," Sada said. "Our children are shivering, but there is nothing we can do. We are poor. The state is not taking care of us." “We don’t even have firewood. We are burning hay borrowed from our landlords to keep ourselves warm," Sada, the senior-most member in the Mujeliya neighborhood, said. Sada and his family are not alone in their struggles to keep warm this winter. Approximately 50 other families from the disadvantaged Chamar Dom and Musahar communities live in the same densely-populated settlement. Many of these families lack proper beddings and have been forced to sleep on hay mats and use hay as blankets. "We use hay to prepare meals as well, because we don't have money to buy firewood," Sada said. The harsh realities of poverty have made it difficult for these families to meet their basic needs and stay warm during the cold winter months. The dense fog and chilly winds of the Tarai plains have made life difficult for many families this winter. In the Musahari settlement of Balwa-1 in Mahottari district, approximately 60 families are struggling to keep warm. Only a handful of households in the settlement have quilts, and even fewer have blankets. Those who lack proper bedding have been forced to use hay to cover themselves at night. The cold and wet conditions, combined with a lack of proper winter gear, have made it difficult for these families to withstand the winter weather. Marani Devi Sada and Pulakit Sada, both residents of the Musahari settlement in Balwa-1, Mahottari district, are feeling the effects of poverty and neglect this winter. "We have nothing in our hut," Marani Devi said. "We cover ourselves with hay mats at night." Pulakit echoed her sentiments: "This small hut cannot protect us from the biting chill." Nothing coming from local governments Despite the formation of local governments, these families have not seen any benefits and have not received any assistance, such as blankets, to help them weather the cold. "We hear news of governments distributing blankets, but are yet to receive any," Marani Devi said. "Nobody cares for us." The Musahar community, a marginalized and economically disadvantaged group, has been living in the Musahari settlement in Balwa-1, Mahottari district for a long time. However, their living conditions are far from ideal. Many lack proper shelters and warm clothing to protect them from the cold. "We get to eat only when we get work. Otherwise, we sleep on empty stomachs," said Mukhiya Sada. Shivo Sada, another member of the community, explained that local people often have to rely on hay, which they receive in exchange for harvesting the paddy of landlords. "If the sun shines a little, we go to the mango orchard to collect twigs. We can't afford to buy firewood as it's very expensive," she said. The combination of poverty, lack of resources, and a lack of support from the government has made it difficult for these families to survive the winter months. The Musahar community in Dharmaban of Janakpur-1 is facing a particularly difficult winter. Savishakti Sada and her family have been living under the open sky, relying on fire to keep themselves warm. "Floods in June washed away our hut," she said. "We are making do with just a tarpaulin." Lila Mestar, another member of the community, reported that many of the poor people in the area are struggling to stay warm with only hay to cover themselves. "We haven't received any relief from anyone so far," she said. "A lot of people came to solicit our votes in the election, but now that the election is over, nobody seems concerned about our plight." Mestar added that if the government provided blankets, it would at least give them some comfort during the cold winter nights. The chill has significantly disrupted the daily lives of people in the Tarai districts. In towns such as Birgunj, Kalaiya, and Gaur, there has been a decrease in the movement of people due to extreme cold. The cold weather has had a disproportionate impact on certain groups, with children, elderly individuals and daily wage laborers being particularly vulnerable. These groups have been suffering from various cold-related illnesses like colds, pneumonia, diarrhea and headache. Birgunj experienced a minimum temperature of 10 degrees Celsius on Monday evening. The weather has remained cold for the past week. With temperatures falling, local governments of Bara and Parsa have announced closure of community schools. Schools shut A harsh winter has made it difficult to maintain a suitable teaching environment in these schools. Birgunj Metropolitan City as well as Pokhariya, Jagarnathpur, Jirabhavani, and Sakhuwa Prasauni rural municipalities of Parsa, and Kalaiya Municipality have declared a holiday until Friday. A grim poverty, human capital scenario Of the seven provinces of Nepal, Madhes is the second poorest province, if government data on multidimensional poverty are any indication. Records at the Province Policy and Planning Commission of the Madhesh Pradesh Government show that multidimensional poverty in the province is at a staggering 47.9 percent, which is far higher than the national average of 28.6 percent. In terms of economic poverty also, the province is not faring well. With economic poverty at 27.7 percent, a bit higher than the national average of 25.2 percent, Madhesh stands as the third poorest province of Nepal. Out of the province’s eight districts, Rautahat is the most multidimensionally poor district with a score of 46.43 percent, per the commission’s data. Mahottari comes second with a score of 44.75 percent, followed by Sarlahi (43.86 percent), Siraha (42.62 percent), Dhanusha (41 percent), Bara (40.09 percent), Saptari (38.34 percent) and Parsa (36.37 percent). In terms of human development also, the province is lagging far behind. While the whole of Nepal has a human development index of 0.49 percent, Madhesh’s HDI stands at a paltry 0.421 percent. Vice-chair of the Province Policy and Planning Commission of the Madhesh province government, Bhogendra Jha, says: These data show Madhesh lagging far behind. “With the objective of reducing economic poverty, the provincial government has formulated policies. But progress has fallen short of our target.” Keeping these indicators in mind, the commission aims to bring down economic poverty to 21 percent. This goal features in the base paper of the provincial commission’s five-year plan. HDI in Madhes districts District HDI Parsa 0.464 Saptari 0.437 Siraha 0.408 Sarlahi 0.402 Dhanusha 0.401 Mahottari 0.388 Rautahat 0.386 Bara 0.386