Who gets the fattest check?

Quick, who are the top-earners of Nepal? If your guess is private bank CEOs, then you are right on the money. The average annual salary package of private bank CEOs, as per Nepal Rastra Bank data, is above Rs 10m. But do you know which bank’s CEO gets the fattest check? While on the subject, how much does the President of Nepal earn, or the prime minister for that matter? Definitely, much less than private bank CEOs but a lot more than an average salary person.

Pratik Ghimire of ApEx reports on the salaries and benefits of top government officials and bank honchos.

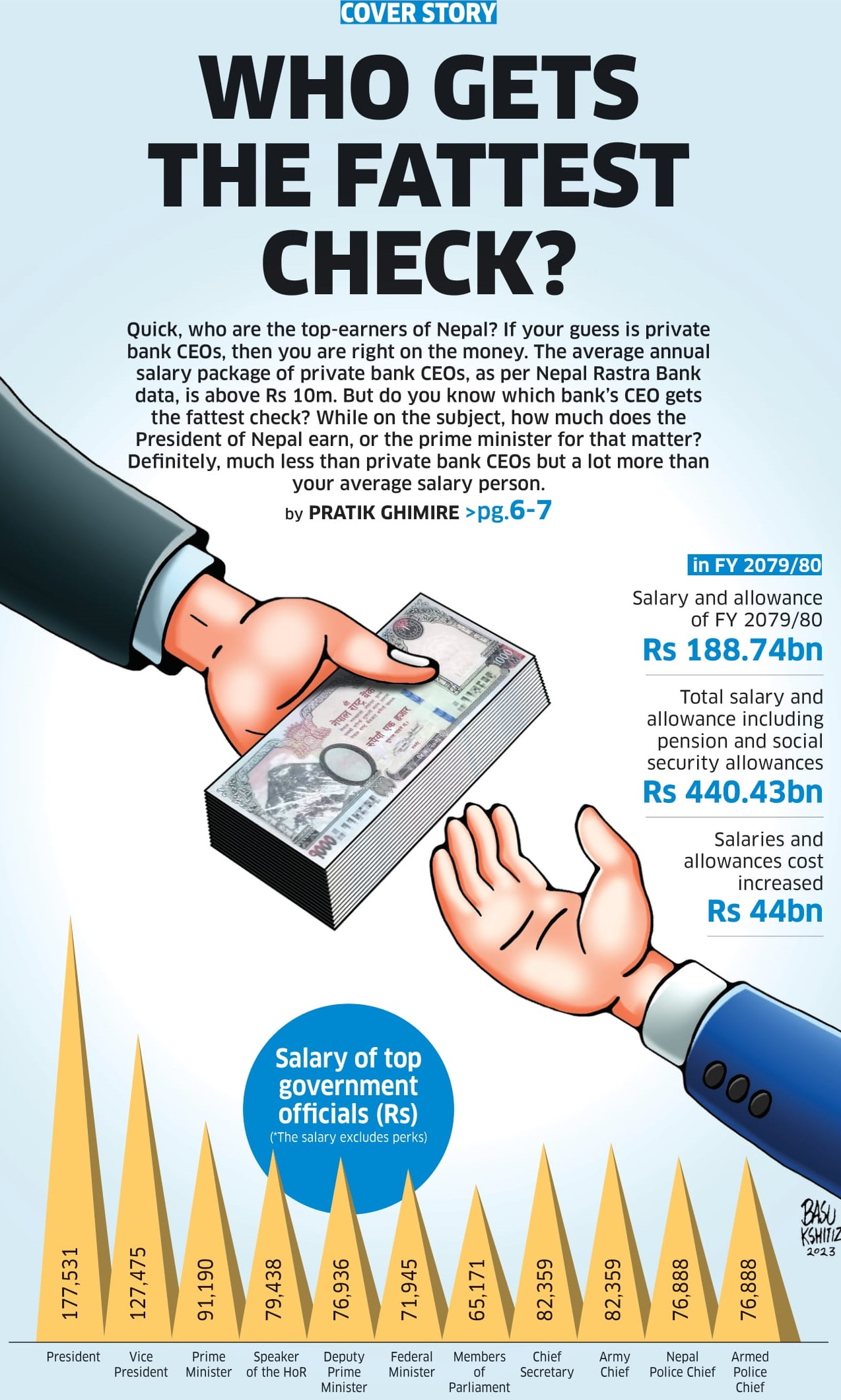

One of the decisions of the first Cabinet meeting of the Pushpa Kamal Dahal-led government was that the prime minister and ministers will not take the 15 percent salary raise for a year in order to maintain austerity in public expenditure. The previous government led by Sher Bahadur Deuba, had increased the civil servants' salary by 15 percent in the federal budget for the fiscal year 2022/23. With the increment the cost of salaries and allowances increased by more than Rs 44bn in the current fiscal year. In line with the decision, Rs 188.74bn was allocated for salary and allowance for the running fiscal year.

Together with pension and social security allowances the allocation stood at Rs Rs 440.43bn against Rs 364.44bn of the previous fiscal year. The president, vice president, prime minister, speaker of the House of Representatives, chairman of the National Assembly, chief ministers, federal ministers, chief secretary, army chief, lawmakers, and chiefs of the Nepal Police and Armed Police Force are among the highest paid government officials in the country. While their salaries are much lower than the CEOs of private banks and companies, those holding top political and executive positions do enjoy other privileges apart from their salaries.

As per latest data, President Bidya Devi Bhandari draws a monthly salary of Rs 177,531 while Vice President Nanda Bahadur Pun takes home Rs 127,475. The prime minister gets a monthly paycheck of Rs 91,190 while the Speaker of the HoR gets Rs 79,438. Similarly, the monthly salary of the deputy prime minister is Rs 76,936 while that of ministers is Rs 71,945. Members of parliament, meanwhile, get Rs 65,171 monthly.

The Deuba-led government had decided to increase the salaries and other perks and benefits of the country’s five top officials, including the president and prime minister, as per the recommendation of the committee led by the then Secretary of the Prime Minister's Office, Lakshman Aryal. The committee's report titled 'Report on Salary, Facilities of Special Officers-2079' had proposed increasing the monthly salary of the president to Rs 250,000, the vice president to Rs 150,000, the prime minister to Rs 110,000, the speaker to 95,000 and the chairman of the National Assembly to Rs 95,000 per month. The committee had made the recommendation based on the salary increment rates of government employees in the years 2020, 2021, and 2022.

How much do the highest-paid bank CEOs get?  Banking has always been the most preferred sector for job seekers in Nepal, as it offers lucrative pay and allowance packages compared to other lines of work. The salary index that Nepal Rastra Bank (NRB) publishes every month also shows salary growth of bank employees is higher than those working in other sectors. As per the recent macroeconomic report published by the NRB, the salary index of bank and financial institute (BFI) employees increased by 25.04 percent in the first five months of the current fiscal year compared to the same period of the last fiscal year.

Banking has always been the most preferred sector for job seekers in Nepal, as it offers lucrative pay and allowance packages compared to other lines of work. The salary index that Nepal Rastra Bank (NRB) publishes every month also shows salary growth of bank employees is higher than those working in other sectors. As per the recent macroeconomic report published by the NRB, the salary index of bank and financial institute (BFI) employees increased by 25.04 percent in the first five months of the current fiscal year compared to the same period of the last fiscal year.

Apart from the monthly salary, the BFI employees also receive benefits such as accrued leave allowances, allowances, bonuses, social security benefits, and insurance facilities. They can also get loans to buy houses and cars at low-interest rates. That is why the remunerations of bank CEOs always attract a lot of public interest. The available data shows that bank CEOs are among the highest-earning professionals in the country. As per the NRB rule, a CEO can work in the same bank for two consecutive terms (eight years) only. After that, a 'cooling period' of six months is applicable if he/she wants to join another bank.

The remunerations of CEOs of government-owned banks are less than their private bank peers. The annual salary and allowances of the CEOs of government-owned Rastriya Banijya Bank (RBB), Nepal Bank Limited, and Agricultural Development Banks are around Rs 5m. Krishna Bahadur Adhikari, CEO of Nepal Bank, received Rs 5.4m in the last fiscal year. The annual salary package of Kiran Kumar Shrestha, CEO of RBB, was Rs 6.6m in FY 2021/22. Among the commercial banks, the annual remuneration packages of the CEOs of Prabhu Bank, Standard Chartered Bank Nepal, and Nepal Investment Bank Limited (NIBL) are the highest.

Each of the CEOs received annual remuneration of above Rs 30m in the last fiscal year. The average annual salary package of CEOs of private banks is above Rs 10m. In FY 2021/22, Prabhu Bank CEO Ashok Sherchan received an annual pay package of Rs 40.03m, the highest among the bank CEOs to date. In FY 2021/22, NIC Asia CEO Roshan Kumar Neupane's annual package was Rs 23.4m. NIC Asia paid Rs 18m as salary and allowances, and Rs 5.2m as a bonus to Neupane in the last fiscal year. Similarly, Siddhartha Bank paid Rs 28m to its CEO in FY 2021/22.

Himalayan Bank paid Rs 21.1m as a salary and allowance to its CEO Ashoke SJB Rana in the last fiscal year. The bank paid Rs 10.6m as salary and Rs 9.5m as allowances to Rana. Prime Commercial Bank paid annual remuneration of Rs 21m to its CEO Narayan Das Manandhar. Of the total remuneration paid to him, Rs 18m was salary and Rs 8.5m was allowance and Rs 1.4m was Dashain allowance.

Laxmi Bank CEO Ajay Bikram Shah was paid Rs 13.2m as annual remuneration in the last fiscal year. NMB Bank paid Rs 23.4m annual pay package to its CEO Sunil KC in FY 2021/22. Of the total remuneration, Rs 8.5m was allowance and Rs 5m was bonus. Nepal Investment Bank Limited (NIBL) paid an annual salary package of Rs 30.6m to its CEO Jyoti Prakash Pandey in FY 2021/22. Of the total package, Rs 16m was salary, Rs 10.7m was allowance and Rs 2.2m was Dashain allowance.

NRB Governor receives Rs 5m in remuneration

Maha Prasad Adhikari, governor of Nepal Rastra Bank, received Rs 4.90m in remuneration in the last fiscal year, of which Rs 1.41m was salary and Rs 305,000 was meeting allowance of the board of directors of the central bank. Similarly, the governor received Rs 3.18m in other allowances and facilities.

Meanwhile, NRB deputy governors Neelam Dhungana and Bam Bahadur Mishra have received Rs 4.26m and Rs 4.22m in remunerations, respectively, in the last fiscal year. As per data published by NRB, both deputy governors received Rs 1.26m in salary. Dhungana's BOD meeting allowance totaled Rs 273,000, while it was Rs 296,000 for Mishra. Meanwhile, Rs 2.71m was paid to Dhungana in other allowances and facilities which was Rs 2.63m for Mishra.

Banks paid Rs 47.17bn in salary and allowances; Rs 10.67bn paid as a bonus

The NRB data shows commercial banks' employees' expenses increased by 10.15 percent in the last fiscal year. The commercial banks operating in the country paid Rs 47.17bn as salary and allowances to their employees in FY 2021/22. Such salary and expenses stood at Rs 42.82bn in FY 2020/21. Similarly, banks also paid Rs 10.67bn as bonuses to their employees in the last fiscal year.

Merger in Insurance Sector: Prime Life, Union Life, and Gurans Life sign final merger deal

Like the banking sector, the drive for consolidation is also gaining momentum in the insurance sector. While the first two weeks of 2023 were dominated by mergers and acquisitions in the banking sector, the third week saw two merger agreements - one initial agreement and the other final agreement - being signed between insurers. On Sunday, Union Life Insurance Company, and Gurans Life Insurance Company signed a final merger agreement to form Himalayan Life Insurance Company Limited. The final agreement was signed by Sulav Agarwal on behalf of Union Life, Piyush Raj Aryal on behalf of Prime Life, and Vivek Dugar on behalf of Gurans Life. These three companies had inked a preliminary memorandum of understanding (MoU) for the merger on May 12, 2022. The three parties signed the final MoU after the completion of the due diligence audit (DDA) report agreeing on a swap ratio of 1:1:1. Himalayan Life Insurance, which will be formed after the merger, will have paid-up capital of Rs 7.69 billion. It has been agreed that Sulav Agrawal, the current Chairman of Union Life, will be the Chairman of Himalayan Life. Similarly, Manoj Lal Karn, the current CEO of Union Life, will lead the new entity as the CEO. Bipin Kumar Lal, CEO of Gurans Life and Nirmal Dahal, CEO of Prime Life will take the roles of Senior Deputy CEOs in Himalayan Life. The final merger deal between the three life insurers followed the signing of the initial agreement for the merger between two non-life insurance companies- Ajod Insurance and United Insurance - on January 11. The Ajod-United merger initiative has come after Ajod's unsuccessful merger attempt with Prabhu Insurance. United and Ajod agreed on a swap ratio of 100:90. The name of the entity formed after the merger will be United Ajod Insurance. Earlier, Ajod and Prabhu Insurance signed a merger agreement in the last week of July 2022. However, the proposed merger did not materialize as both companies could not agree on the swap ratio. With the Nepal Insurance Authority pushing for a consolidation drive by raising the minimum paid-up capital requirements for both life and non-life insurers, insurance companies have ratcheted their merger initiatives. The authority has increased the paid-up capital of non-life insurance companies to Rs 2 billion while it is Rs 5 billion for life insurance companies. The Nepali insurance sector has already seen two successful mergers in 2022. In July, Himalayan General Insurance and Everest Insurance merged to form Himalayan Everest Insurance Co. Ltd. Similarly, in October, Sanima General Insurance and General Insurance Company merged to form Sanima GIC Insurance Ltd.

Global IME becomes the largest Nepali bank

Global IME Bank Limited has become Nepal's largest bank with the highest paid-up capital. With the successful completion of a merger, Global IME Bank and Bank of Kathmandu (BoK) began unified business on Monday as Global IME Bank. Post-merger, the bank has become the largest bank in the country in terms of total capital, paid-up capital, and business size. Prime Minister Pushpa Kamal Dahal inaugurated the integrated business of the Global IME-BoK on Monday amid a function held in the capital. Global IME has been forefront when it comes to consolidation in the banking sector. As of now, the bank has merged 21 banks and financial institutions into it. Of them, five are commercial banks, 10 are development banks, and six are finance companies. Addressing the inauguration of integrated business, Global IME Bank Chairman Chandra Prasad Dhakal said that the bank has been at the forefront when it comes to the implementation of Nepal Rastra Bank's merger policy. "Global IME Bank's success in the merger has encouraged other banks and financial institutions to merge," said Dhakal. According to him, Global IME holds about 10 percent of the total market share in the Nepali banking sector post-merger. Stating that Global IME's ability to bear risks has also increased, Dhakal said, "I believe this merger will ease the difficulty of having to participate in many banks to raise investment in big projects." After the merger, the total capital of the bank has reached Rs 57 billion, while the paid-up capital is Rs 35.77 billion. The bank's total deposits and extension of loans stand at Rs 412 billion and Rs 377 billion, respectively. Speaking on the occasion, NRB Governor Maha Prasad Adhikari said that financial intermediation costs are decreasing as banks become bigger and stronger due to the mergers. "Banks now should remain self-regulated as they have become larger after the mergers," he said Adhikari. The central bank's board meeting on December 29 had given the final approval for the merger between Global IME Bank and Bank of Kathmandu. The central bank had directed both banks to come up with a new name, arguing that the proposed name 'Global IME BOK Limited' did not have the word 'bank' in it. Hence, both banks agreed to go with the name Global IME Bank post-merger. After the merger, the Chairman of the merged entity is Chandra Prasad Dhakal while Ratna Raj Bajracharya, current CEO of Global IME has continued in the post. The Global IME Bank, post-merger, will have a total of 365 branch offices, 367 ATMs, 286 branchless banking services, 61 extended branch offices, and three contact offices located abroad. Its customer base has increased to 4 million, making it the biggest in terms of customer size, well ahead of NIC Asia Bank which has 3.2 million customers.