Gold price drops by Rs 400 per tola on Tuesday

The price of gold has dropped by Rs 400 per tola in the domestic market on Tuesday. According to the Federation of Nepal Gold and Silver Dealers’ Association, the yellow bullion is being traded at Rs 103, 500 per tola today. It was traded at Rs 103, 900 per tola on Monday. Meanwhile, tejabi gold is being traded at Rs 103, 000 per tola today. Similarly, the price of silver has dropped by Rs 15 and is being traded at Rs 1, 365 per tola.

Nepal, India to discuss new cross-border transmission lines

Nepal and India will hold discussions on developing new cross-border transmission lines as the two countries have moved in the direction of creating a common electricity market in South Asia. The topic will be discussed in the upcoming meetings of the joint secretary-level Joint Working Group and secretary-level Joint Steering Committee to be held in India. “A few potential cross-border lines have been identified and there will be a discussion on which will be developed during the next bilateral meeting,” said a senior official at Ministry of Energy, Water Resources and Irrigation. The Nepal Electricity Authority (NEA) has proposed to develop a 400KV transmission line connecting Inaruwa of Nepal and Purnia of Bihar, India. Similarly, the 400kV New Lamki (Dodohara)-Bareli Cross Border Transmission Line has also been planned with the NEA preparing a comprehensive design of this project. Currently, the 400KV Dhalkebar-Muzaffarpur Cross-border transmission line is the only high-capacity power line for power trade between the two countries which can transmit around 1,000MW of electricity at a time. Nepal and India have already moved ahead to develop the New Butwal-Gorakhpur Transmission Line which will have a capacity of transporting power as much as 3,500MW. NEA and the Power Grid Corporation of India have established a joint venture company in India to construct this transmission line in the Indian territory. The Millennium Challenge Account (MCA) Nepal, a special purpose vehicle established to carry out the MCC Compact project, will build the 18 kilometers section of this cross-border line from the New Butwal substation to the Nepal-India border. MCA Nepal has already invited tenders from interested contractors for the purpose. The Arun III Hydropower Project, which is being developed by an Indian company SJVN Limited, is also building its own dedicated cross-border transmission line between Nepal and India to export electricity generated by the project. With more electricity that will be generated by various power projects across the country coming to the national grid in the current and next fiscal years, there is an urgent need to initiate the construction of more cross-border transmission lines between Nepal and India. The two countries are going to discuss a new cross-border line at a time when there is a growing concern in Nepal that the lack of cross-border transmission infrastructure could be a hindrance to realizing the potential of power exports. During the wet season in 2022, Nepal suffered spillage of power as domestic consumption slumped while there was approval for exporting power from India. According to NEA, over 700MW is expected to be added to the national grid in the current fiscal 2022/23 while over 550MW is expected to be added in the next fiscal year 2023/24. Officials say it has become necessary to export more power in the upcoming days to prevent the wastage of surplus power. The state-owned power utility body sold electricity worth Rs11.16 billion to India beginning June last year until it stopped the exports in the third week of December last year owing to a decline in production during the dry season. NEA has set a target of selling power worth Rs 16 billion in the current fiscal year 2022/23 after resuming export in June next year. The then Energy Minister Pampha Bhusal told the previous House of Representatives in June last year that there was a possibility of exporting more than Rs 70 billion worth of electricity to India in the next five years. India has allowed Nepal to sell 452.6MW of power generated by eight hydropower projects in India’s energy market. But during the last meeting of the Joint Working Group and Joint Steering Committee in February 2022, India had agreed to increase the volume of power to be exported through Dhalkebar-Muzaffarpur Transmission once the 400kV Hetauda-Dhalkebar-Inaruwa Transmission Line is completed in 2023. A joint technical team was also supposed to study the possibility of developing a cross-border line between Nepal and the West Bengal State of India as per the agreement reached during the last bilateral meeting in February last year.

NRB hikes paid-up capital of digital payment companies

Nepal Rastra Bank (NRB) has increased the paid-up capital of entities involved in the digital payment business. Issuing a new licensing policy on Thursday, the central bank has increased the paid-up capital for payment service providers (PSPs) and payment system operators (PSOs). As per the new arrangement, the paid-up capital of PSPs operating devices other than payment cards has been fixed at Rs 50 million. The paid-up capital of PSPs operating payment cards and other devices has been fixed at Rs 250 million. Similarly, the paid-up capital of PSOs has been fixed at Rs 400 million, while PSOs handling payment transactions outside Nepal through payment instruments issued in the country have to raise their paid-up capital to Rs 800 million. NRB has set a deadline of 2028 for the existing PSPs and PSOs to meet the new paid-up capital requirement. The companies that have already obtained licenses from the central bank, have to maintain the paid-up capital as prescribed by the NRB by mid-July 2028," says the policy. According to NRB, the provisions regarding minimum paid-up capital will not be applicable to banks and financial institutions that operate payment services, and institutions established abroad and operating payment-related activities in Nepal. Industry insiders said the central bank, by increasing paid-up capital is looking for a commitment from the promoters of PSPs and PSOs as the majority of companies' business has not grown as expected when licenses were issued. "This move by the central bank will consolidate the payment industry. Those who've been struggling in business or will struggle to meet the new paid-up capital requirements, have now the option to go for a merger," said Suman Pokharel, Vice President of IME Group which operates IME Pay, one of Nepal's leading mobile wallets. The central bank has also opened doors for foreign investors to invest in domestic payment service providers and payment system operators. In the new licensing policy, the central bank has provisioned that companies that have submitted applications for a license to operate payment-related services or those who already have a license can bring in investment from foreign firms and companies with the approval of the NRB. "Such foreign investment should not exceed percent of the paid-up capital of the licensed organization," said the NRB. Earlier, there was no arrangement for foreign investment in domestic PSPs. Operators of such companies have been seeking NRB approval to bring foreign investments. NRB has also paved the way for mergers and acquisitions of payment-related entities. Now, entities dealing with payment may merge/merge with each other or acquire one other institution based on the central bank policy. Currently, there are 10 PSOs and 27 PSPs currently operating in Nepal. Of the 10, three are international companies. The central bank has given permission to Visa Worldwide of Singapore, Mastercard of Singapore, and Union Pay International of China to operate as PSOs. Digital payment in Nepal has grown multifold, particularly after the start of the Covid-19 pandemic in early 2020. According to NRB statistics, Nepal has now more than 20 million mobile wallet users, of which 10.6 million are e-wallet users. Similarly, there are 1.9 million internet banking users in the country.

Nagarik Unmukti Party decides to give vote of confidence to Dahal; But to stay in opposition’s bench

Nagarik Unmukti Party has decided to give a vote of confidence to Prime Minister Pushpa Kamal Dahal. A meeting of the party held on Tuesday made the decision to this effect, Chief Whip Ganga Ram Chaudhary said. He, however, said that the party has decided to stay in the opposition bench in the Parliament despite giving the vote of confidence. Chaudhary said that the party will not participate in the government until the release of Resham Chaudhary, serving life imprisonment for his involvement in the 2015 Tikapur incident, and will play as a role of opposition. The coalition government had addressed the demands of the Nagarik Unmukti Party through the Common Minimum Program (CMP) unveiled on Monday. Chaudhary said that the party had reached the decision to give a vote of confidence by welcoming the same.

US bans some imports from N Korea, claiming slave labor

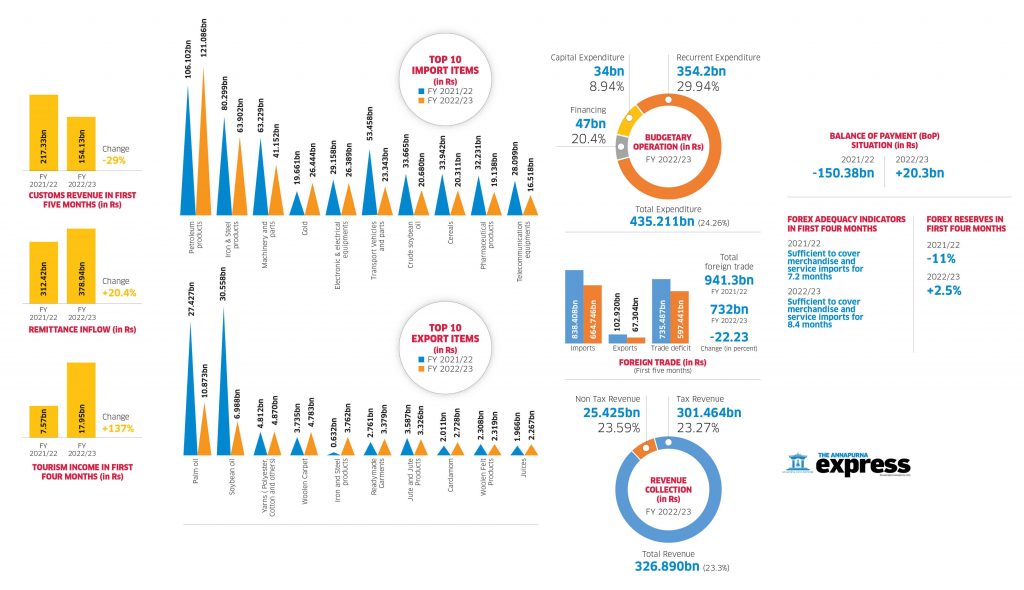

State of the economy: Recovery hope rises with improvements in external sector

After a tumultuous year that gave rise to fears that Nepal is going the 'Sri Lanka way', the good news is the country's external sector has improved noticeably over the last two months. But the bad news is, the government is struggling to meet the revenue collection target along with expediting capital expenditure.

The government has spent only 24.26 percent of the budget in the first five months of the current fiscal year. According to the Financial Comptroller General Office (FCGO), which tracks the budgetary operation, the government’s spending stood at Rs 435.21bn till mid-Dec with capital expenditure totaling just Rs 33.99bn, a meager nine percent of the money allocated in the federal budget, in the review period.

In this context, the most worrying part for the government has been a sharp decline in revenue collection. Such is the slump that current revenue collection is not sufficient even to meet growing recurrent expenditure.

Revenue collection has largely fallen behind the target in the first five months of the current fiscal year as the FCGO data shows the government's revenue collection has a shortfall of Rs 138 billion of the target.

The government had set a target of collecting Rs 464bn in revenue from mid-July to mid-December period, but the collection stood at only Rs 326bn. On the other hand, the overall expenditure stood at Rs 438.79bn.

Improving external sector

While Nepa’s overall economic prospect is still uncertain as the recession has gripped the economy, the recovery in the country’s external sector has given some breathing space to the government. The latest macroeconomic report of Nepal Rastra Bank (NRB) shows some key indicators of the external sector of the economy including balance of payment (BoP), remittance inflow and forex reserves all have increased.

Nepal’s BOP is at a surplus of Rs 20.03bn in the first four months of FY 2022/23, compared to a deficit of Rs 150.38bn in the same period of FY 2021/22.

Meanwhile, the forex reserve increased by 2.5 percent to Rs Rs 1246.27bn in mid-Nov 2022 from Rs 1215.80bn in mid-July 2022. In US dollar terms, the gross forex reserve increased one percent to 9.63bn in mid-Nov from 9.54bn in mid-July this year.

The current forex reserve, according to the central bank, is sufficient to cover the merchandise imports of 9.7 months, and merchandise and services imports of 8.4 months.

Similarly, remittance inflow has increased by 20.4 percent in the first four months against a decline of seven percent in the last fiscal. Nepal has received remittances worth Rs 378.04bn till mid-Nov 2022.

Customs revenue down by 29 percent

With a 20.71 percent decrease in the country’s imports decreasing, the customs revenue has also declined in the first five months of the current fiscal year. The new foreign trade statistics released by the Department of Customs (DoC) on Thursday show the customs revenue has shrunk by 29 percent.

DoC collected revenue worth Rs 154.13bn in the first five months of the current fiscal year compared to Rs 217.33bn in the corresponding period of the last fiscal year. The customs revenue has been affected due to the import restrictions on four-wheelers and motorcycles above 150 cc and mobile handsets costing over $300, that have higher share in government revenue collection.

Trade deficit decreases by 18 percent

The country’s trade deficit has decreased by 18.77 percent in the first five months of the current fiscal year. According to the data released by the Customs Department, the country’s total trade deficit is Rs 597.44bn in the first five months of the current fiscal year compared to Rs 735.48bn during the same period of FY 2021/22. The decline in trade deficit is attributed to the shrunk in the country’s total foreign trade (both exports and imports) which went down by 22.23 percent in the review period.

Top 10 import items

With the slowdown in economic activities and the overall market demand as a persistently high inflation rate and a squeeze in liquidity in the financial put a dent in the pockets of consumers, the imports of industrial materials, electronic and electrical equipment, vehicles, cereals, telecom equipment, and pharmaceutical products have declined in this fiscal.

Top 10 export items

The exports of edible oils, basically refined palm oil and soybean oil, have taken a beating in this fiscal year. The good news is exports of iron and steel have surged by a whopping 494.7 percent.

BoP Surplus of Rs 20.03bn

The country’s balance of payment (BoP) is at a surplus of Rs 20.03bn in the first four months of the current fiscal year.

Slight improvement in forex reserves

Nepal’s forex reserves increased by 2.5 percent in the first four months of the current fiscal year.

Remittance inflow surged by 20.4 percent

Remittance inflow has increased by 20.4 percent to Rs 378.04 billion in the first four months of the current fiscal year.

Tourism income up by 137 percent

With the fast recovery in footfalls of international visitors in the country, earnings from tourism reached Rs 17.95bn in the first four months of FY 2022/23, compared to Rs 7.57bn during the same period of FY 2021/22.

Inflation still at higher side

The consumer inflation is at 8.08 percent till mid-Nov. Food and beverage inflation stood at 7.38 percent whereas non-food and service inflation rose to 8.63 percent. Under the food and beverage category, the price of restaurants & hotels has increased by 15.97 percent, tobacco products by 11.81 percent, milk products and eggs by 9.33 percent, cereal grains & their products by 9.19 percent, and alcoholic drinks by 8.84 percent.

Customs revenue down by 29 percent

With a 20.71 percent decrease in the country’s imports decreasing, the customs revenue has also declined in the first five months of the current fiscal year. The new foreign trade statistics released by the Department of Customs (DoC) on Thursday show the customs revenue has shrunk by 29 percent.

DoC collected revenue worth Rs 154.13bn in the first five months of the current fiscal year compared to Rs 217.33bn in the corresponding period of the last fiscal year. The customs revenue has been affected due to the import restrictions on four-wheelers and motorcycles above 150 cc and mobile handsets costing over $300, that have higher share in government revenue collection.

Trade deficit decreases by 18 percent

The country’s trade deficit has decreased by 18.77 percent in the first five months of the current fiscal year. According to the data released by the Customs Department, the country’s total trade deficit is Rs 597.44bn in the first five months of the current fiscal year compared to Rs 735.48bn during the same period of FY 2021/22. The decline in trade deficit is attributed to the shrunk in the country’s total foreign trade (both exports and imports) which went down by 22.23 percent in the review period.

Top 10 import items

With the slowdown in economic activities and the overall market demand as a persistently high inflation rate and a squeeze in liquidity in the financial put a dent in the pockets of consumers, the imports of industrial materials, electronic and electrical equipment, vehicles, cereals, telecom equipment, and pharmaceutical products have declined in this fiscal.

Top 10 export items

The exports of edible oils, basically refined palm oil and soybean oil, have taken a beating in this fiscal year. The good news is exports of iron and steel have surged by a whopping 494.7 percent.

BoP Surplus of Rs 20.03bn

The country’s balance of payment (BoP) is at a surplus of Rs 20.03bn in the first four months of the current fiscal year.

Slight improvement in forex reserves

Nepal’s forex reserves increased by 2.5 percent in the first four months of the current fiscal year.

Remittance inflow surged by 20.4 percent

Remittance inflow has increased by 20.4 percent to Rs 378.04 billion in the first four months of the current fiscal year.

Tourism income up by 137 percent

With the fast recovery in footfalls of international visitors in the country, earnings from tourism reached Rs 17.95bn in the first four months of FY 2022/23, compared to Rs 7.57bn during the same period of FY 2021/22.

Inflation still at higher side

The consumer inflation is at 8.08 percent till mid-Nov. Food and beverage inflation stood at 7.38 percent whereas non-food and service inflation rose to 8.63 percent. Under the food and beverage category, the price of restaurants & hotels has increased by 15.97 percent, tobacco products by 11.81 percent, milk products and eggs by 9.33 percent, cereal grains & their products by 9.19 percent, and alcoholic drinks by 8.84 percent.

Govt to address demands of Nagarik Unmukti Party, Janamat Party through CMP

The government is going to implement the agreements signed during the Tarai Madhes Movement. Unveiling the Common Minimum Program (CMP) of the government on Monday, Deputy Prime Minister and Finance Minister Bishnu Poudel said that the government will soon implement the agreements signed with the agitating groups. “The cases will be scrapped and arrested leaders and cadres will be released as per the agreements signed between the government and protesters during the Tarai Madhes Movement,” the program said. The CK Raut-led Janamat party and Resham Chaudhary’s Nagarik Unmukti Party had put forward this agenda as a condition to participate in the government. The both parties had also announced that they would not participate in the government until their demands are met. A leader of the ruling coalition said that the process to release the leaders and cadres of Janatmat Party and Nagarik Unmukti Party will be started soon. Earlier on Sunday, Janamat Party and Nagarik Unmukti Party had reached a 12-point agreement for functional unity. The two parties had decided to mount pressure on the government to release Resham Chaudhary among others convicted in the Kailai carnage.

Nepse surges by 47. 15 points on Monday

The Nepal Stock Exchange (NEPSE) gained 47. 15 points to close at 2,211. 76 points on Monday. Similarly, the sensitive index surged by 8. 68 point to close at 419. 91 points A total of 14,676,206 unit shares of 257 companies were traded for Rs 5. 31 billion. Meanwhile, Barun Hydropower Co. Ltd, Khanikhola Hydropower Co. Ltd, Chhyangdi Hydropower Ltd, Joshi Hydropower Development Company Ltd and Himalaya Urja Bikas Company Ltd were the top gainers today, with their price surging by 10. 00 percent. Likewise, Swabhimaan Laghubitta Bittiya Sanstha Limited was the top loser as its price fell by 3. 57 percent. At the end of the day, total market capitalization stood at Rs 3. 19 trillion.