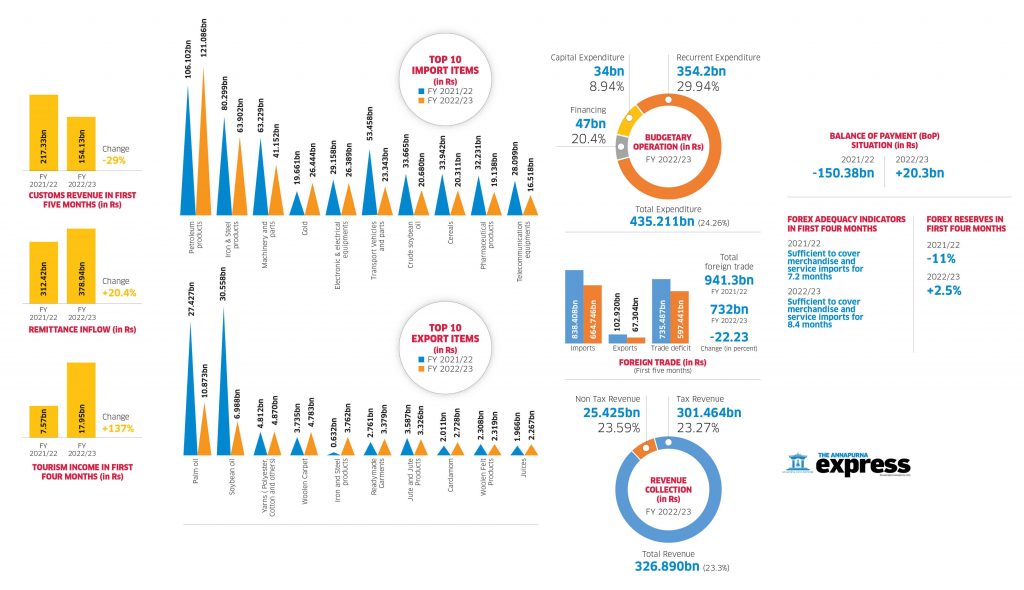

Revenue collection has largely fallen behind the target in the first five months of the current fiscal year as the FCGO data shows the government's revenue collection has a shortfall of Rs 138 billion of the target.

The government had set a target of collecting Rs 464bn in revenue from mid-July to mid-December period, but the collection stood at only Rs 326bn. On the other hand, the overall expenditure stood at Rs 438.79bn.

Improving external sector

While Nepa’s overall economic prospect is still uncertain as the recession has gripped the economy, the recovery in the country’s external sector has given some breathing space to the government. The latest macroeconomic report of Nepal Rastra Bank (NRB) shows some key indicators of the external sector of the economy including balance of payment (BoP), remittance inflow and forex reserves all have increased.

Nepal’s BOP is at a surplus of Rs 20.03bn in the first four months of FY 2022/23, compared to a deficit of Rs 150.38bn in the same period of FY 2021/22.

Meanwhile, the forex reserve increased by 2.5 percent to Rs Rs 1246.27bn in mid-Nov 2022 from Rs 1215.80bn in mid-July 2022. In US dollar terms, the gross forex reserve increased one percent to 9.63bn in mid-Nov from 9.54bn in mid-July this year.

The current forex reserve, according to the central bank, is sufficient to cover the merchandise imports of 9.7 months, and merchandise and services imports of 8.4 months.

Similarly, remittance inflow has increased by 20.4 percent in the first four months against a decline of seven percent in the last fiscal. Nepal has received remittances worth Rs 378.04bn till mid-Nov 2022.

Customs revenue down by 29 percent

With a 20.71 percent decrease in the country’s imports decreasing, the customs revenue has also declined in the first five months of the current fiscal year. The new foreign trade statistics released by the Department of Customs (DoC) on Thursday show the customs revenue has shrunk by 29 percent.

DoC collected revenue worth Rs 154.13bn in the first five months of the current fiscal year compared to Rs 217.33bn in the corresponding period of the last fiscal year. The customs revenue has been affected due to the import restrictions on four-wheelers and motorcycles above 150 cc and mobile handsets costing over $300, that have higher share in government revenue collection.

Trade deficit decreases by 18 percent

The country’s trade deficit has decreased by 18.77 percent in the first five months of the current fiscal year. According to the data released by the Customs Department, the country’s total trade deficit is Rs 597.44bn in the first five months of the current fiscal year compared to Rs 735.48bn during the same period of FY 2021/22. The decline in trade deficit is attributed to the shrunk in the country’s total foreign trade (both exports and imports) which went down by 22.23 percent in the review period.

Top 10 import items

With the slowdown in economic activities and the overall market demand as a persistently high inflation rate and a squeeze in liquidity in the financial put a dent in the pockets of consumers, the imports of industrial materials, electronic and electrical equipment, vehicles, cereals, telecom equipment, and pharmaceutical products have declined in this fiscal.

Top 10 export items

The exports of edible oils, basically refined palm oil and soybean oil, have taken a beating in this fiscal year. The good news is exports of iron and steel have surged by a whopping 494.7 percent.

BoP Surplus of Rs 20.03bn

The country’s balance of payment (BoP) is at a surplus of Rs 20.03bn in the first four months of the current fiscal year.

Slight improvement in forex reserves

Nepal’s forex reserves increased by 2.5 percent in the first four months of the current fiscal year.

Remittance inflow surged by 20.4 percent

Remittance inflow has increased by 20.4 percent to Rs 378.04 billion in the first four months of the current fiscal year.

Tourism income up by 137 percent

With the fast recovery in footfalls of international visitors in the country, earnings from tourism reached Rs 17.95bn in the first four months of FY 2022/23, compared to Rs 7.57bn during the same period of FY 2021/22.

Inflation still at higher side

The consumer inflation is at 8.08 percent till mid-Nov. Food and beverage inflation stood at 7.38 percent whereas non-food and service inflation rose to 8.63 percent. Under the food and beverage category, the price of restaurants & hotels has increased by 15.97 percent, tobacco products by 11.81 percent, milk products and eggs by 9.33 percent, cereal grains & their products by 9.19 percent, and alcoholic drinks by 8.84 percent.

Customs revenue down by 29 percent

With a 20.71 percent decrease in the country’s imports decreasing, the customs revenue has also declined in the first five months of the current fiscal year. The new foreign trade statistics released by the Department of Customs (DoC) on Thursday show the customs revenue has shrunk by 29 percent.

DoC collected revenue worth Rs 154.13bn in the first five months of the current fiscal year compared to Rs 217.33bn in the corresponding period of the last fiscal year. The customs revenue has been affected due to the import restrictions on four-wheelers and motorcycles above 150 cc and mobile handsets costing over $300, that have higher share in government revenue collection.

Trade deficit decreases by 18 percent

The country’s trade deficit has decreased by 18.77 percent in the first five months of the current fiscal year. According to the data released by the Customs Department, the country’s total trade deficit is Rs 597.44bn in the first five months of the current fiscal year compared to Rs 735.48bn during the same period of FY 2021/22. The decline in trade deficit is attributed to the shrunk in the country’s total foreign trade (both exports and imports) which went down by 22.23 percent in the review period.

Top 10 import items

With the slowdown in economic activities and the overall market demand as a persistently high inflation rate and a squeeze in liquidity in the financial put a dent in the pockets of consumers, the imports of industrial materials, electronic and electrical equipment, vehicles, cereals, telecom equipment, and pharmaceutical products have declined in this fiscal.

Top 10 export items

The exports of edible oils, basically refined palm oil and soybean oil, have taken a beating in this fiscal year. The good news is exports of iron and steel have surged by a whopping 494.7 percent.

BoP Surplus of Rs 20.03bn

The country’s balance of payment (BoP) is at a surplus of Rs 20.03bn in the first four months of the current fiscal year.

Slight improvement in forex reserves

Nepal’s forex reserves increased by 2.5 percent in the first four months of the current fiscal year.

Remittance inflow surged by 20.4 percent

Remittance inflow has increased by 20.4 percent to Rs 378.04 billion in the first four months of the current fiscal year.

Tourism income up by 137 percent

With the fast recovery in footfalls of international visitors in the country, earnings from tourism reached Rs 17.95bn in the first four months of FY 2022/23, compared to Rs 7.57bn during the same period of FY 2021/22.

Inflation still at higher side

The consumer inflation is at 8.08 percent till mid-Nov. Food and beverage inflation stood at 7.38 percent whereas non-food and service inflation rose to 8.63 percent. Under the food and beverage category, the price of restaurants & hotels has increased by 15.97 percent, tobacco products by 11.81 percent, milk products and eggs by 9.33 percent, cereal grains & their products by 9.19 percent, and alcoholic drinks by 8.84 percent.