Neeraj Singh Manhas: High chances of Nepal slipping into FATF gray list

Neeraj Singh Manhas is the Director of Research in the Indo-Pacific Consortium at Raisina House, New Delhi. He has authored three books and has diverse research interests covering Sino-Indian border issues; China in the Indian Ocean; India-China foreign policy; water security; defense and Indo-Pacific studies. His recently-edited book is “Analyzing the Current Afghan Context” (Routledge 2022). His works have appeared in the Institute for Security & Development Policy (ISDP), Observer Research Foundation (ORF), Lee Kuan Yew School of Public Policy, The Hindu Business Line, The Pioneer, Financial Express, and other online platforms. ApEx spoke with him about the risk of Nepal slipping into the gray list of FATF. Different sources are claiming that Nepal will again be put into the FATF gray list. What are the chances? I think the chances are 90 percent; there is a 10 percent chance that it can be averted, if any technical issue comes up with FATF. APG officials have said they would only incorporate progress made through December 16, 2022 in their mutual evaluation report, as Nepal (the country was on the greylist in 2008-2014) is once again placed in a vulnerable position and is at the risk of being greylisted. This will be quite harmful for Nepal because it has already had to deal with numerous other significant challenges. In the past, several countries’ economies have suffered due to FATF-imposed restrictions. Do you think it will have the same impact on Nepal? In June 2018, Pakistan was placed on a watch list. Numerous sources have proved that Pakistan's economy suffered losses of over $30bn as a result of FATF’s restrictions. Pakistan, which has a friendly relationship with Saudi Arabia and the UAE, benefited from the latter’s bailout packages. The economic position of Nepal is dwindling, and its current status does not appear encouraging even as it seeks international investments. The lives of ordinary people have been affected, and the economy has been severely damaged by an expanding trade imbalance, a rapidly diminishing foreign exchange reserve, and surging inflation. Indeed, Nepal may slip into a serious financial crisis like Pakistan and Sri Lanka if serious action is not taken. India has a potential role in helping Nepal frame new laws for money-laundering syndicates during 2008-2014, when it was on the FATF gray list. Do you think India will save Nepal from the FATF radar? India has always believed in “Vasudhaiva Kutumbakam” (the world is one family). Former PM Atal Bihari Vajpayee once stated: “We can change friends but not our neighbors.” India’s position with its neighboring states has always been humble and helpful. Recently, when Sri Lanka was going through a financial crisis, India provided foreign aid multiple times. India helped Nepal frame new laws for money-laundering from 2008 to 2014, things are a bit more difficult for India this time around. Members of the 39-strong FATF have held discussions, with a majority stating that they may go against Nepal in the upcoming FATF meeting, making things pretty difficult for India. Let’s see what happens until then. China has heavily invested in Nepal in its infrastructure, railways, and FDI; the current Prime Minister also shares close ties with Xi Jinping. Do you think China will have a significant role? China has always helped Nepal fill its infrastructure gaps. As part of China-Nepal BRI Cooperation, both countries signed several MoUs, including Investment and Cooperation on Production Capacity, Human Resource Development Cooperation, and Economic and Technical Cooperation. PM Prachanda is on good terms with Xi Jinping, and everyone is hoping that China will help Nepal in this case. However, China is going through a massive upheaval, what with the Covid-19 pandemic, and mass resentment against their government. It will be interesting to see the Chinese moves vis-a-vis the FATF matter involving Nepal. What significant challenges does Nepal face as it tries to return to track? There are myriad problems facing Nepal, including an economic crisis, lack of better infrastructure, political instability, corruption, brain drain, unemployment, border security, and underutilization of resources. If Nepal slips into the FATF gray list, its challenges will only increase. However, Nepal has identified 15 laws that must be amended to make them compatible with the FATF anti-money laundering case. Some of the significant laws that need amendment are the Assets Laundering Prevention Act-2008, Land Revenue Act-1978, Tourism Act-1978, Securities Act-2007, Human Trafficking and Transportation (Control) Act-2008, Confiscation of Criminal Proceeds Act-2014, Mutual Legal Assistance Act-2014, Organized Crimes Prevention Act-2014, Criminal (Code) Act-2017 and Cooperative Act-2017. In February, when the APG is expected to produce its preliminary report, it will give its opinion. It will prepare its final report, which will determine whether Nepal will be under the International Cooperation Review Group (ICRG) monitoring of the FATF.

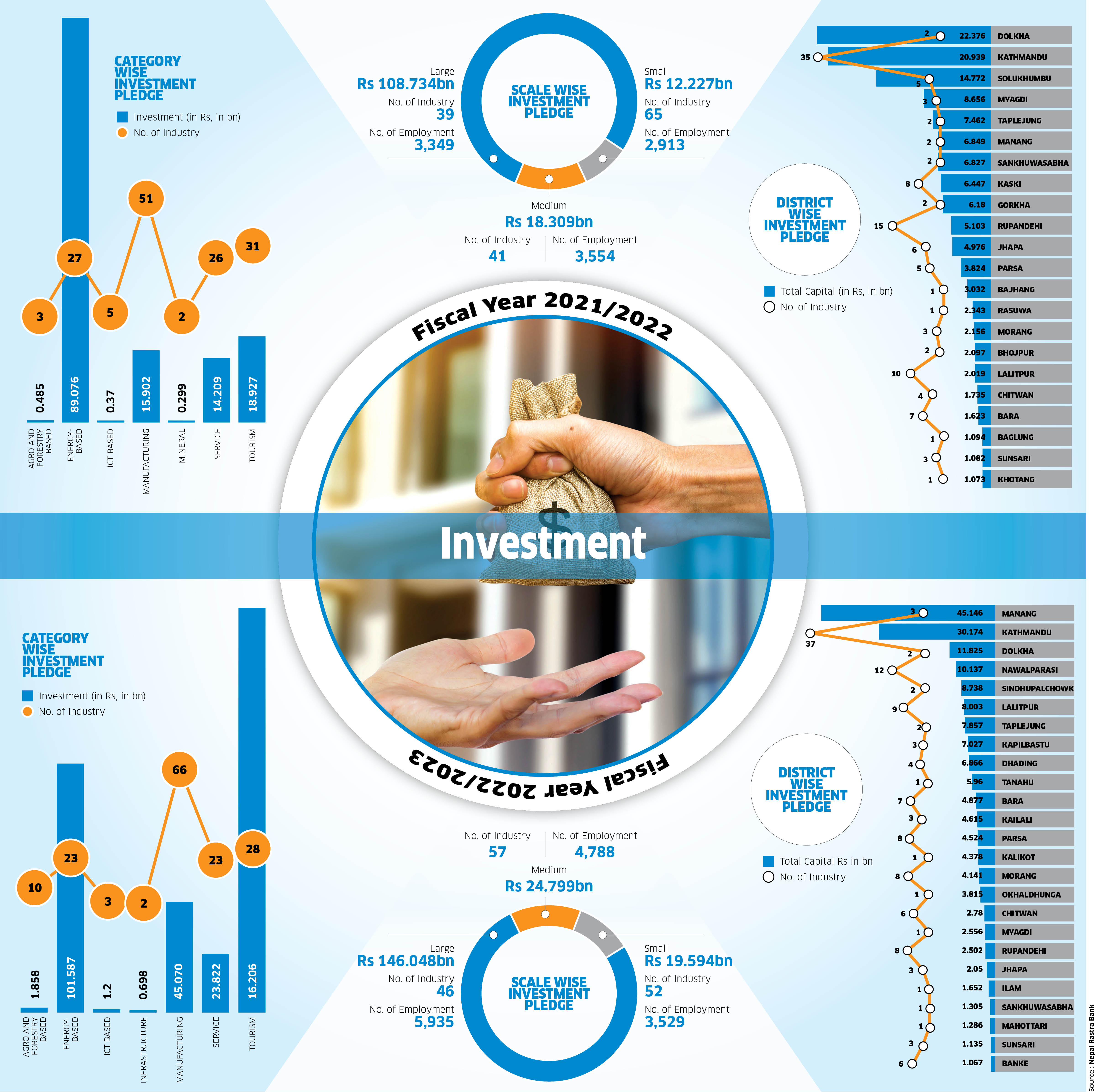

State of investment

As high borrowing rates and the slowdown in major economic activities affect demand for goods and services in the market, investment commitments have shrunken by more than a quarter in the first half of the current fiscal year. According to the data provided by the Department of Industry (DoI), investment commitments have declined by 26.86 percent in the first six months of the current fiscal year. Domestic and foreign investors have made an investment pledge totaling Rs 139.271 billion in the first six months of FY 2022/23 compared to Rs 190.442 billion in the same period of FY 2021/22. Similarly, the number of industries registered at DoI also declined during the review period. Only 145 industries were registered in the first five months while this number was 155 during the corresponding period of the last fiscal year. The DoI data correlates with the recent survey carried out by the Confederation of Nepalese Industry (CNI) which states new investments have halted in almost all sectors with 70 percent of investors postponing their new investment plans due to exorbitantly high interest rates, disruption in money cycle, and a huge drop in market demand for goods and services. Except for tourism, there has been a decline in new investment pledges in all sectors in the current fiscal year. With the recession affecting almost every kind of economic activity, industrialists who had earlier planned to invest in different sectors, are in 'wait-and-watch' mode, according to the CNI survey. The survey shows that businesses associated with the automobile, footwear, and pharmaceutical sectors have put their investment plans on hold indefinitely. Similarly, 85.71 percent of industrialists belonging to the agricultural sector have postponed their new investments. In the cement sector, 83.3 percent of industrialists have deferred their investment plans while it is 71.4 percent in the engineering and construction sector. Likewise, 50 percent of businessmen associated with the e-commerce sector have held up their new investments. According to DoI officials, the decline in industry registration is attributed to the current economic situation of the country where the private sector is grappling with multiple issues ranging from a slowdown in economic activities, and weaker demand to high borrowing rates. As the tourism sector is gradually coming out of the impact of the Covid-19 pandemic, investment has been seen growing in the hospitality sector. According to the DoI, investment pledges in the tourism sector grew by 16.80 percent. A total of 31 industries with an investment commitment of Rs 18.92 billion were registered at the department in this fiscal year compared to 28 industries pledging Rs 16.20 billion during the same period of the last fiscal year. There has been a sharp decline in the registration of new industries in the manufacturing sector this year. As of mid-December this year, 51 new manufacturing industries have been registered with investment commitments totaling Rs 15.90 billion. According to DoI data, 66 manufacturing industries pledging investments worth Rs 45.07 billion were registered during the same period of the last fiscal year. The energy sector has also seen a drop in investment pledges with investment commitments dropping by 12.81 percent. A total of 27 energy sector companies have been registered at the DoI with an investment commitment amounting to Rs 89.07 billion in the first half of the current fiscal year which was Rs 101.58 billion in the corresponding period of the last fiscal year. District-wise, Dolkha registered the highest investment pledge of Rs 22.376 billion in the first six months of FY 2022/23 followed by Kathmandu at Rs 20.93 billion and Solukhumbu at Rs 14.77 billion. FDI commitment down by 43.27 percent Foreign direct investment (FDI) pledges in the country have dropped significantly during the first half of the current fiscal year. The latest statistics of DoI show FDI commitments dropped by 43.27 percent in the first six months of FY 2022/23. FDI commitments totaled Rs 17.30 billion in the review period compared to Rs 30.50 billion in the corresponding period of FY 2021/22. In the first six months of the current fiscal year, a total of 131 industries having FDI pledges have been registered at the department. Of them, two are large-scale industries, 19 medium-scale, and 110 small enterprises. Government officials point out the global economic downturn and the tightening of visa rules for foreign investors by the Nepal government for the decline in FDI pledges. FDI flow to Nepal declined this fiscal mainly due to a slowdown in investment commitment from China. The investors from the northern neighbor have been committing the largest amount of FDI in the last several years to Nepal. With China facing economic problems due to renewed Covid-19 crisis, and supply chain disruptions, investment pledges from the northern neighbor are also affected. The tighter visa rules that the government enforced in early November 2022 discourage applicants from submitting fake documents to get business visas. DoI decided to recommend business visas for foreign investors only for three months at a time to prevent the misuse of the facility. Officials said that the move has been aimed at discouraging the tendency of prolonging their stay in Nepal. OVERALL INVESTMENT PLEDGE (FIRST SIX MONTHS OF FY 2022/23)

| FY | INVESTMENT ( in bn) | CHANGE |

| 2022/23 | 139.271 | -26.86% |

| 2021/22 | 190.442 |

| FY | FDI (in bn) | CHANGE |

| 2022/23 | 17.30 | -43.27 percent |

| 2021/22 | 30.50 |

FIRST SIX MONTHS, FY 2022/23

CATEGORY WISE INVESTMENT PLEDGE

|

FIRST SIX MONTHS, FY 2021/22

CATEGORY-WISE INVESTMENT PLEDGE

|

Submit everyday report of aircrafts: Minister Kiranti tells NAC Chair Adhikari

Minister for Culture, Tourism and Civil Aviation Sudan Kiranti directed Chairman of the Nepal Airlines Corporation Yuva Raj Adhikari to fly aircrafts on time. Inspecting the office of the Nepal Airlines Corporation on Monday, Minister Kiranti directed Chairman Adhikari to fly aircrafts on time. Saying that even a second matter, Minister Kiranti directed Adhikari not to defame Nepali time. He also directed the Chairman to submit the everyday report of the NAC’s aircrafts. Minister Kirant said that he would not go home without checking the report of the aircrafts. He also directed Adhikari to submit a financial plan to improve the NAC and to make arrangements to book tickets online within a month.

Dr Min Bahadur Shrestha appointed Vice-Chairman of NPC

Dr Min Bahadur Shrestha has been appointed as the Vice-Chairman of the National Planning Commission. A Cabinet meeting held recently decided to appoint Shrestha as the Vice-Chairman of the National Planning Commission. Prime Minister Pushpa Kamal Dahal administered oath of office and secrecy to Shrestha amid a function organized at the Office of Prime Minister and Council Ministers in Singhadurbar. Shrestha held the responsibility as the Vice-Chairman of the National Planning Commission in 2016 also when Dahal was the Prime Minister.

Fold4 and Flip4 hit the Nepali market

The latest flagship models from the Korean handset maker Samsung arrived in the Nepali market. The Galaxy Z Fold4 and Galaxy Z Flip4 both have been launched in the local market in the third week of January. Both phones were introduced to Nepal six months after they were launched in the global market as the Nepal government restricted imports of mobile handsets costing over USD 300 in April last year. With the government lifting the import restrictions in early December, importers have been gradually bringing flagship models of different brands to the market. The Galaxy Z Fold4 and Z Flip4 are Samsung's fourth-generation foldable smartphones. While the design of the Fold4 looks very similar to its predecessor Fold3, there are a few small changes. Compared to Fold3, Fold4 is slightly lighter, the hinge is slimmer and the bezels are narrower. Fold4 weighs 263 grams while Fold3 is 271 grams. Fold4 comes up with a 6.2-inch exterior display and a 7.6-inch interior display. The interior one is a Foldable Dynamic AMOLED 2X panel with a 120Hz adaptive fast refresh rate & QXGA+ (2176 x 1812p) resolution. While the exterior is an HD+ 2316 x 904p Dynamic AMOLED 2X, 120Hz display protected by Corning Gorilla Glass Victus+. Further, the phone has an aluminum frame and the back panel also gets Gorilla Glass Victus+ protection. There is a side-mounted fingerprint scanner embedded in the power key. The Fold4 is powered by the latest flagship Qualcomm Snapdragon 8+ Gen 1 chipset. Built on TSMC 4nm, the chipset has three CPU clusters comprised of a single powerful Arm Cortex-X2 flagship-core, three performance and efficiency balanced Arm Cortex-A710 big-cores, and four power-efficient Arm Cortex-A510 little-cores. While the Fold4 comes with 12GB RAM and 256GB/512GB/1TB internal storage, only the 256GB variant is available in Nepal. The Fold4 is available for Rs 244,999 for the 12/256GB variant. The phone has a triple-camera setup on the back that includes a 50MP main camera, a 12MP ultra-wide camera, and a 10MP telephoto camera with 3x optical zoom and 30x digital zoom. The Fold4 has a 4400mAh battery and supports 25W fast charging and 15W fast wireless charging. Galaxy Z Flip4 builds on the success of Samsung’s iconic form factor, adding key features, including an upgraded camera experience, a larger battery, and expanded customization while maintaining its ultra-compact design. Galaxy Z Flip4 sports a compact clamshell design and offers unique smartphone experiences. The innovative form factor allows the users to do more without even unfolding the phone, including answering calls and replying to texts. With an upgraded camera equipped with a 65 percent brighter sensor, Galaxy Z Flip4 comes with Samsung’s flagship Nightography feature ensuring your photos and videos are crisper and more stable through the day or night. The Z Flip4 comes with the latest Snapdragon 8+ Gen1 processor and a 10 percent higher battery capacity at 3700mAh. With a slimmer hinge, straightened edges, contrasting hazed back glass, and glossy metal frames, the design is sleeker and the most refined one yet. The Samsung Galaxy Z Flip4 has been priced at Rs 1,44,999 for the 8/256GB variant in the local market.

Gold price increases by Rs 300 per tola on Monday

The price of gold has increased by Rs 300 per tola in the domestic market on Monday. According to the Federation of Nepal Gold and Silver Dealers’ Association, the precious yellow metal is being traded at Rs 105, 300 per tola today. The gold was traded at Rs 105, 000 per tola on Sunday. Meanwhile, tejabi gold is being traded at Rs 104, 800 per tola. Similarly, the price of silver has increased by Rs 5 and is being traded at Rs 1,380 per tola today.

NC decides to file candidacy for the post of President

Nepali Congress has decided to register candidacy for the post of President. A meeting of the office bearers and former office bearers held at party President Sher Bahadur Deuba’s residence in Dhumbarahi on Monday decided to file candidacy by seeking support from all the parties. Congress spokesperson Prakash Sharan Mahat said that the Nepali Congress will file candidacy for the post of President. “We will register our candidacy by seeking support from all the parties. Conspiracies are being hatched to not hold the election on March 13. We will not accept it,” he said. Similarly, the Nepali Congress has demanded that the election be held on time. According to the provision, the presidential election should be held on February 12.

FinMin asks World Bank to increase its budgetary support

Deputy Prime Minister and Finance Minister Bishnu Prasad Paudel asked the World Bank to increase its aid to Nepal in the form of budget support which Nepal can utilize in its priority areas. During a meeting with the World Bank’s Country Director for Nepal Faris Hadad-Zervos on January 19, DPM Paudel sought an increment in budgetary support. The share of budgetary support in total aid to Nepal has been increasing in recent years. The government's International Development Cooperation Policy (DPC)-2019 has highlighted that budget support is the country’s most preferred official development assistance modality. “This is because budget support inherently ensures coherence with the principle of country ownership. It is predictable, allows for better development planning, lowers fragmentation, and leads to more effective use of pooled resources,” states the Finance Ministry in its Development Cooperation Report 2020-21. “It is also flexible, allows for greater responsiveness to development needs, reduces transaction costs associated with managing various implementation channels, and helps build government capacity, contributing to more sustainable results.” According to a senior official of the Finance Ministry, the government expects to receive around Rs 36 billion in Development Policy Credit (DPC), a lending facility as budgetary support, from the World Bank in the current fiscal year 2022/23. “We have already received around Rs 13 billion from the World Bank,” the official said. In recent years, the Washington DC-based multilateral agency has been increasing its support to Nepal under DPC. The latest DPC that the World Bank approved is USD 100 million for helping to improve the enabling environment for Nepal’s green, climate-resilient, and inclusive development pathway. This is the first in a programmatic series of three DPCs on Green, Resilient and Inclusive Development (GRID). In June 2020, the government and the World Bank Board signed the USD 100 million credit line to improve the financial viability and governance of the energy sector and recover from the COVID-19 crisis. It was the second installment of DPC in the energy sector. The first installment of USD 100 million was approved in September 2018. The global lender started Financial Sector Stability Development Policy Credit in 2013. The World Bank said that it introduced the DPC series to promote policy reforms for strengthening institutions and their governance in the medium term. They have been an important financing instrument in this regard. After the evaluation of the liquidity crisis of 2011, the first DPC was approved, according to a 2013 World Bank report. The DPF series enabled the deepening of policy dialogue and supported the momentum for key policy reforms (e.g. modernized legal/regulatory framework for crisis management and bank resolution and consolidation of the financial system), the international donor agency said in its country assistance strategy for 2019-2023. According to the Finance Ministry official, another multilateral lender, Asian Development Bank is also providing budgetary support to Nepal. “We are supposed to receive $175 million under budgetary support in the current fiscal year,” the official said. The International Monetary Fund’s USD 395.9 million Extended Credit Facility is also the budgetary support to Nepal with the country receiving USD 110 million in the last fiscal year. However, citing the import restriction policy of Nepal among others, IMF has been withholding the release of further installments so far. As Nepal seeks more resources to fulfill its financing needs, the share of budgetary support has increased in the past decade. According to the Development Cooperation Report 2020-21, the share of budget support stood at 30.27 percent of the total disbursed official development assistance in the fiscal year 2020/21. As much as USD 509.99 million was disbursed as budget support in that fiscal year. In FY 2019/20, the share of budget support was 36.52 percent. In the earlier years, the share of the budget support was lower with 15 percent being disturbed as budget support in FY 2018/19, according to the Development Cooperation Report 2018-19.