Narayangarh-Muglin road disrupted yet again

The Narayangarh-Muglin road has been obstructed yet again. Two-way traffic has been disrupted following a landslide at Ichhakamana Rural Municipality-5 in Chitwan on Monday. A driver sustained minor injuries when a landslide hit a truck (Na 6 Kha 710) this morning, police said. Efforts are underway to remove landslide debris. Police Inspector at the Area Police Office, Muglin, Bishal Tamang said that the two-way traffic along the Narayangarh-Muglin road has been disrupted following a mudslide triggered by torrential rainfall. The road section that saw disruption for around 18 hours on Sunday came into reoperation since last evening. Immediately after resumption, the landslide occurred and disrupted the road. It was quickly cleared off to bring the traffic into operation. Daily thousands of vehicles pass through the road. The passengers moving to and from different parts of the country have been hit hard due to frequent disruption of the road. The District Administration Office Chitwan has urged the people to not use the road section until and unless there is an emergency.

Mid-Term Growth Insurance Plan: MetLife offers unique benefits to customers

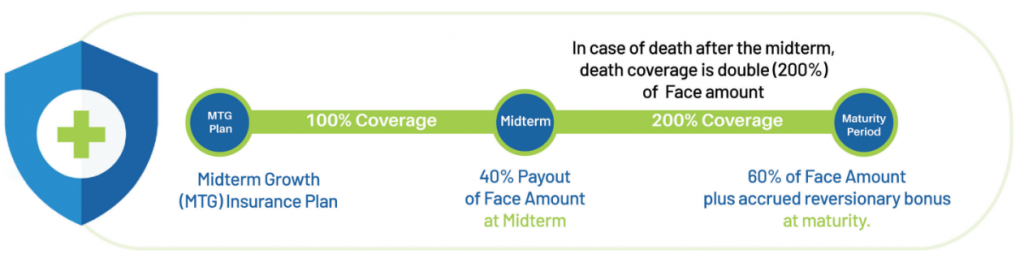

In its ongoing commitment to provide customers and the life insurance industry with innovative insurance plans, MetLife Nepal launched the Mid-Term Growth (MTG) plan on 1 Feb 2023. This unique endowment plan offers customers a high level of insurance protection with the unique benefit of a mid-term payout, along with double protection after the midterm. So for example, if the policy term is 20 years, then the customer can receive a payout after 10 years after which the face value of their death cover will double.

This plan is open to individuals aged between 31 days and 60 years, and is especially relevant for those who have recently started working and embarked on their careers. They can start with a small MTG plan based on their income capacity, which will provide increased life coverage. And a payout of a sum that can be helpful for their financial needs after the midterm. For instance, an employed 30-year-old can enroll in a MetLife MTG plan with a maximum term of 22 years and an insurance amount ranging from Rs 250,000 to Rs 50m.

In addition to the basic plan, applicants can choose additional protection, or “riders,” such as a Personal Accident Rider Benefit, Waiver of Premium Rider Benefit, and Critical Illness Rider Benefit, at a minimal additional cost.

This plan is an anticipated endowment benefit with regular premium payments, where the policy owner participates in profits through reversionary bonuses. This means the policy owners benefit from investment returns. It is a truly unique offering in the Nepali market, as no other plan provides double death coverage and partial survival benefit payment within the same policy. Normally, if customers want to increase their life insurance coverage, they have to add a new policy during the existing tenure. However, MTG provides the best solution by automatically doubling the coverage value after the midpoint with the same premium for the existing policy.

Enrolling in this insurance plan might be a smart move for long-term financial goals. For example, a 30 year old can choose a maximum term of 22 years and after 11 years, the person will receive a payout that can help achieve his dreams, be it funding children’s education or planning for a comfortable retirement. So, this is for protection and long-term saving.

Similarly, with a small plan based on income capacity, policy owners not only can increase life coverage but also the assurance of a payout after the midterm. It can give them confidence knowing that they will have financial support when they need it most.

Hence, the target segment for MTG is professionals who anticipate the need to revise or increase their coverage in a few years’ time. MTG offers this option so customers do not have to purchase additional plans in between.

Furthermore, MetLife provides value-added services to its customers, including a life card facility that offers attractive discounts to cardholders and their dependents for treatment and care at 100+ medical centers across Nepal. With global coverage and 24-hour protection, MetLife policyholders can feel secure even when traveling or residing outside the borders of Nepal.

An Anticipated Endowment Benefit with regular premium payments in which the policy owner will participate in profits via reversionary bonuses.

Survival Benefit

Survival benefit will be paid in two phases as 40 percent of Face Amount (FA) at midterm of the policy term and 60 percent Face Amount (FA) plus accrued reversionary bonuses at maturity.

Death Benefit

If the insured dies between the policy’s inception date and the policy’s midterm, the beneficiary receives 100 percent of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident).

If the insured dies after midterm within the policy term, the beneficiary receives two times (200 percent) of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident). Partial survival benefit paid out as 40 percent of Face Amount (FA) will not be deducted from the death benefit. Incase of Paid-up policy, death benefit shall limit to paid-up value.

In case of child/juvenile, death benefits are payable subject to Graded Death Benefit Endorsement and maximum coverage amount for the child insured shall be Rs 5,000,000.

Special Provisions

Provisions of cash surrenders, policy loan facility and non-forfeiture options of paid-up and automatic premium loan.

Additional Riders

Personal Accident Rider Benefit

This rider pays benefits in case of death, dismemberment, and permanent total disability due to accidents up to the principal sum/face amount.

Issue Age: 18-65

Coverage Expiry Age: 70 years

Waiver of Premium Rider Benefit

Under this benefit, the future premium of base policy is waived in case of permanent total disability due to sickness and accidents.

Issue Age: 18-55 years

Coverage Expiry Age: 60 years

Critical Illness Rider Benefit

This rider pays 100 percent or 50 percent of face amount coverage if diagnosed with seven critical diseases (major cancer, first heart attack, stroke, benign brain tumor, serious coronary artery disease, heart valve surgery, and primary pulmonary hypertension).

Issue Age: 18-54 years

Coverage Expiry Age: 60 years

For more, click here.

Survival Benefit

Survival benefit will be paid in two phases as 40 percent of Face Amount (FA) at midterm of the policy term and 60 percent Face Amount (FA) plus accrued reversionary bonuses at maturity.

Death Benefit

If the insured dies between the policy’s inception date and the policy’s midterm, the beneficiary receives 100 percent of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident).

If the insured dies after midterm within the policy term, the beneficiary receives two times (200 percent) of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident). Partial survival benefit paid out as 40 percent of Face Amount (FA) will not be deducted from the death benefit. Incase of Paid-up policy, death benefit shall limit to paid-up value.

In case of child/juvenile, death benefits are payable subject to Graded Death Benefit Endorsement and maximum coverage amount for the child insured shall be Rs 5,000,000.

Special Provisions

Provisions of cash surrenders, policy loan facility and non-forfeiture options of paid-up and automatic premium loan.

Additional Riders

Personal Accident Rider Benefit

This rider pays benefits in case of death, dismemberment, and permanent total disability due to accidents up to the principal sum/face amount.

Issue Age: 18-65

Coverage Expiry Age: 70 years

Waiver of Premium Rider Benefit

Under this benefit, the future premium of base policy is waived in case of permanent total disability due to sickness and accidents.

Issue Age: 18-55 years

Coverage Expiry Age: 60 years

Critical Illness Rider Benefit

This rider pays 100 percent or 50 percent of face amount coverage if diagnosed with seven critical diseases (major cancer, first heart attack, stroke, benign brain tumor, serious coronary artery disease, heart valve surgery, and primary pulmonary hypertension).

Issue Age: 18-54 years

Coverage Expiry Age: 60 years

For more, click here.

KMC serves 7-day ultimatum to remove temporary structures built inside the premises of Lalita Niwas

The Kathmandu Metropolitan City has given a seven-day ultimatum to remove the temporary structures built inside the premises of Lalita Niwas. The metropolis served the ultimatum by issuing a notice on Sunday. A team of Kathmandu Metropolitan City this afternoon had reached Baluwatar to inspect and fence the disputed land. The Central Investigation Bureau (CIB) of Nepal Police had concluded that fraud and forgery cases should be filed against 400 people for their alleged role in transferring the land at Lalita Niwas in Baluwatar. Police have concluded that 143 ropani land of Lalita Niwas has been transferred to private ownership. The Commission for the Investigation of Abuse of Authority (CIAA) has already filed a case at the Special Court claiming that the 136 ropani government land has been encroached upon.

9,590 employees recommended action for not submitting property details

A total of 9,590 employees in the federal and provincial governments did not submit their property details in the fiscal year 2078/9 BS. The National Vigilance Center has already handed a report to the Commission for the Investigation of Abuse of Authority (CIAA), recommending action against those employees. The CIAA has been recommended for taking a fine of Rs 5,000 each against them in accordance with the Provision Relating to Statement of Property (Clause 50), Corruption Prevention Act- 2002, according to Centre's information officer and Under-secretary Hari Prasad Sharma. Of them, 3,453 are from the civil service, 113 from Nepal Police, 1,158 are teachers and 1,902 are those appointed towards political appointment and on the contract. Similarly, 1027 employees of province level and 1,917 of local levels did not submit their property details.

Nepse plunges by 53. 70 points on Sunday

The Nepal Stock Exchange (NEPSE) plunged by 53. 70 points to close at 2,097.29 points on Sunday. Similarly, the sensitive index dropped by 12. 23 points to close at 390. 52 points. A total of 11,323,183-unit shares of 286 companies were traded for Rs 5. 08 billion. Meanwhile, BPW Laghubitta Bittiya Sanstha Limited was the top gainer today with its price surging by 10. 00 percent. Likewise, Shrijanshil Laghubitta Bittiya Sanstha Limited was the top loser with its price dropped by 9. 32 percent. At the end of the day, the total market capitalization stood at Rs 3. 07 trillion.

Bill to amend some Nepal Acts tabled in HoR

A Bill to amend some Nepal Acts- 2080 BS has been tabled in the House of Representatives. The Bill originated in the National Assembly was presented in the lower house session today by its secretary Padam Prasad Pandey.

476,000 tourists visit Nepal in six months

A total of 476, 000 foreign tourists visited Nepal in the six months (January to June) of the current fiscal year 2022/23, according to the Nepal Tourism Board. The total number of visiting tourists in 2019 from January to June was 536,058. The number was a 97.79 percent surge than that in 2022 during the same period, and 16.93 percent decrease than that in 2019. However, in the following years, the tourism industry was marred by COVID-19 that broke out in 2019, with the number of visiting tourists decreasing. During the same period, the influx of visiting tourists dropped to 220,815 in 2020, 58,058 in 2021, and 240,901 in 2022.

Suryatara Cement not in touch with IBN

When Investment Board Nepal (IBN) in March 2022, approved the investment proposal of Suryatara Cement Industry for setting up a cement factory in Surkhet, it was supposed to be the first cement plant in Karnali Province. However, even after 15 months of approval, Suryatara Cement has not shown any signs of going ahead with a Rs 14.27bn project. A few months ago, there was also a plan to sign a memorandum of understanding (MoU) between the company and the IBN. However, the IBN officials said the company has not come in contact with the board. It has been almost 15 months since the investment was approved. However, the industry has not come in contact, said a senior official at the IBN. The company on 31 March 2022, had received approval for investing Rs 14.27bn from the IBN. According to the IBN, after signing a MoU, the IBN, and Suryatara will have to sign the project implementation agreement. For this purpose, the company has to complete the financial closure. As per the rules, the company is required to sign the project implementation agreement with the board within two years of the approval of the investment. After selling stakes in Samrat Cement to Binod Chaudhary, Mukunda Timilsina, the main promoter of Suryatara Cement, planned for establishing a cement plant in Panchpuri Municipality of Surkhet, which was going to be the single largest investment in industry in Karnali Province. The company has aimed to bring the plant into operation within two years of starting the construction of infrastructure. Promoter Timilsina acknowledged that they are not in contact with the board. “Since the government did not guarantee the access road and electricity supply to the project site, we have not taken the project ahead,” said Timilsina. According to Timilsina, the then Finance Minister Janardan Sharma had promised to provide electricity and an access road for the project. “That commitment has not been honored by the government,” he said. It has been estimated that about 20 MW of electricity will be required to run the plant; for which a 26-kilometer-long 132 KV transmission line needs to be built from Lamki Chuha in Kailali. Suryatara received approval for investment from IBN to operate a cement plant in Surkhet as a domestic investment. According to the company, Nepali banks have already committed to invest in the project and loans will be sought at the ratio of 80 percent of the total investment. The production capacity of the proposed cement plant has been estimated at 3,000 tons (60,000 sacks) daily. The company has planned to supply the cement to districts in Karnali and Sudurpaschim provinces. Suryatara has already purchased nearly 40 bighas of land to set up the cement plant. Similarly, it has been confirmed that limestone will be brought to Barahtal of Surkhet for the processing of the raw material.