Murder-accused lawmaker Laxmi Mahato Koiri suspended

CPN-UML lawmaker Laxmi Mahato Koiri, who has been indicted in a criminal case, has been suspended. Speaker Devraj Ghimire suspended lawmaker Koiri accused of murdering Assistant Sub-Inspector Thaman BK during the Madhes movement today. The Speaker suspended lawmaker Koiri after the Nepal Police headquarters on Sunday sent a letter to the Parliament Secretariat saying that he is accused of a murder and is on the fugitive list of Nepal Police. He was elected as a member of the House of Representatives from Mahottari-1 in the November 20 elections. The Dhanusha District Court had released Koiri on a bail of Rs 100,000. But the Janakpur High Court, overturning the decision of the district court, ordered the police administration to keep him in custody for investigation.

Perils of the banking sector: Rising NPL and declining profit

While the first six months of the current fiscal year 2022/23 were dominated by the consolidation in the banking sector, the next three months were about rising bad loans and problems in loan recovery.

The commercial banks that struggled with a prolonged shortage of loanable funds till mid-January are now flushed with liquidity. As the liquidity eased, banks gradually slashed interest rates, particularly in deposits. However, there has been a sharp rise in non-performing loans (NPLs) of commercial banks as they grapple with the country's economic downturn which has arisen difficulties for financial institutions in the recovery of loans and debt servicing.

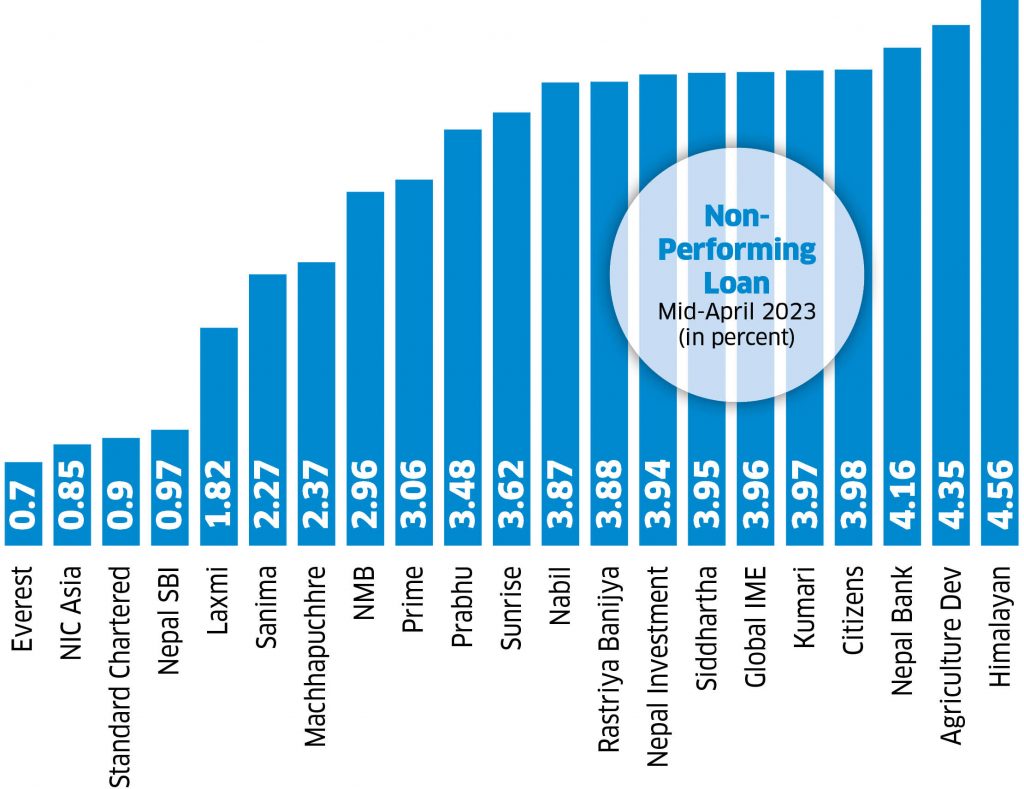

The unaudited financial reports of 21 commercial banks show their NPL has reached 3.03 percent in the third quarter of FY 2022/23, an increase of a whopping 147 percent compared to the same period of the last fiscal year. The NPL of the commercial banks stood at 1.23 percent as of mid-April, 2022.

While the banks’ bad loans have been gradually increasing from the start of the current fiscal year, the NPL deteriorated sharply in the last three months. Bankers attribute the rise in NPL to the slowing economic activities coupled with higher interest rates, and the declining ability of borrowers to repay debts. According to them, loan recovery and debt servicing have become difficult of late.

Banks and financial institutions (BFIs) have started to make their recovery department active after the problems in loan recovery. Many banks have expanded the recovery department by adding additional human resources.

The third quarter of the current fiscal year also saw BFIs slashing their interest rates. In March, the Nepal Bankers’ Association (NBA) fixed the interest rate on fixed deposits for individual depositors at 11 percent. Under huge pressure from the agitated business community, NBA decided to reduce it to 9.99 percent for individual depositors effective from the new year. Similarly, the interest rate for institutional deposits has come down to 7.99 percent from nine percent earlier. Similarly, interest rates on savings account deposits have been set at a minimum of 5.40 percent to a maximum of 7.40 percent.

While the banks’ bad loans have been gradually increasing from the start of the current fiscal year, the NPL deteriorated sharply in the last three months. Bankers attribute the rise in NPL to the slowing economic activities coupled with higher interest rates, and the declining ability of borrowers to repay debts. According to them, loan recovery and debt servicing have become difficult of late.

Banks and financial institutions (BFIs) have started to make their recovery department active after the problems in loan recovery. Many banks have expanded the recovery department by adding additional human resources.

The third quarter of the current fiscal year also saw BFIs slashing their interest rates. In March, the Nepal Bankers’ Association (NBA) fixed the interest rate on fixed deposits for individual depositors at 11 percent. Under huge pressure from the agitated business community, NBA decided to reduce it to 9.99 percent for individual depositors effective from the new year. Similarly, the interest rate for institutional deposits has come down to 7.99 percent from nine percent earlier. Similarly, interest rates on savings account deposits have been set at a minimum of 5.40 percent to a maximum of 7.40 percent.

The commercial banks’ deposits grew by 10.45 percent to Rs 4,764.65bn by mid-April 2023. At the same time, banks’ lending expanded by only 2.66 percent in the first nine months of the current fiscal year.

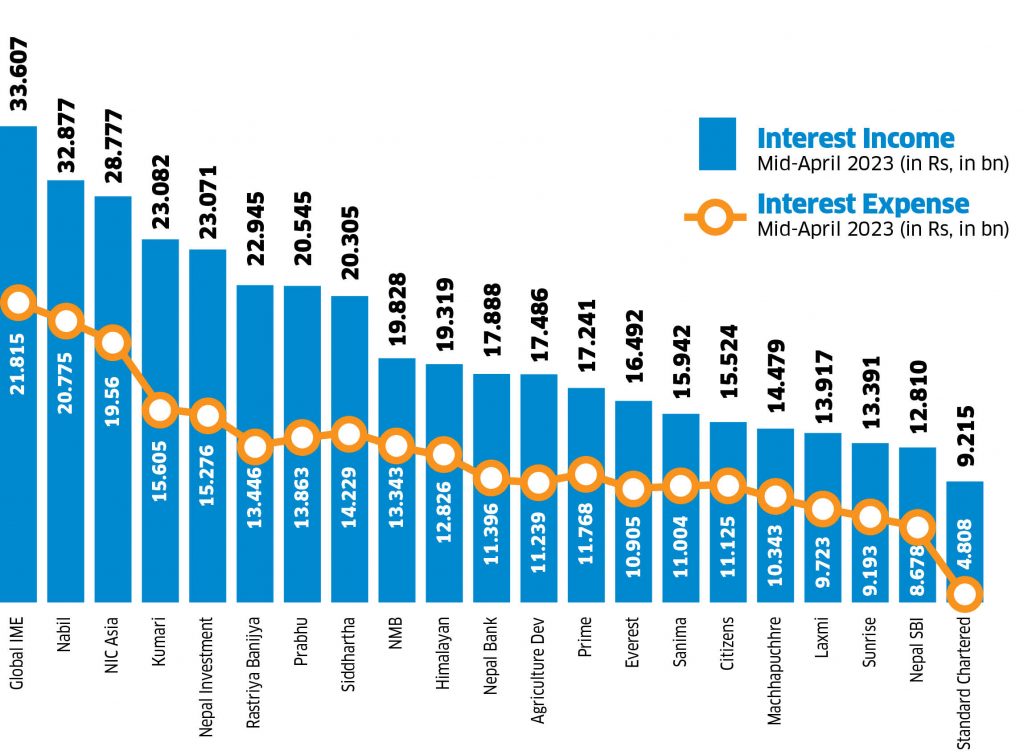

While banks’ interest income grew by 31.60 percent, their interest expenses expanded by much higher during this period. As banks have to pay higher interest rates for deposits amid a prolonged liquidity crunch, their interest expense surged by 34.98 percent. This has affected the bank’s net interest income which grew by 25.43 percent.

Banks saw their net fee income and net trading income shrinking in the first nine months of the current fiscal. The net fee income decreased by 5.03 percent while net trading income shrunk by 36.74 percent during this period.

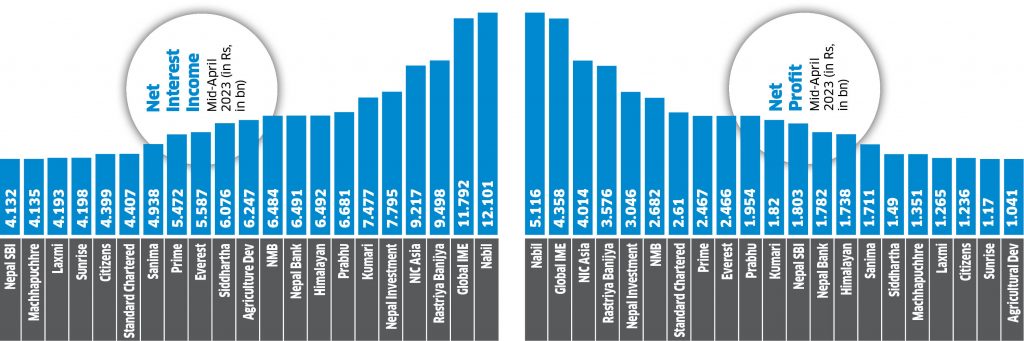

14 banks’ net profit rise

Despite the problems, the third quarter reports of 21 commercial banks show 14 have increased their profits compared to the same period of the last fiscal year. Similarly, seven banks have reported a decline in profit.

Sunrise Bank, Citizens Bank International, Siddhartha Bank, Prime Commercial Bank, Machhapuchchhre Bank, Agricultural Development Bank, and Nepal Bank have reported a decline in their profits.

The commercial banks’ deposits grew by 10.45 percent to Rs 4,764.65bn by mid-April 2023. At the same time, banks’ lending expanded by only 2.66 percent in the first nine months of the current fiscal year.

While banks’ interest income grew by 31.60 percent, their interest expenses expanded by much higher during this period. As banks have to pay higher interest rates for deposits amid a prolonged liquidity crunch, their interest expense surged by 34.98 percent. This has affected the bank’s net interest income which grew by 25.43 percent.

Banks saw their net fee income and net trading income shrinking in the first nine months of the current fiscal. The net fee income decreased by 5.03 percent while net trading income shrunk by 36.74 percent during this period.

14 banks’ net profit rise

Despite the problems, the third quarter reports of 21 commercial banks show 14 have increased their profits compared to the same period of the last fiscal year. Similarly, seven banks have reported a decline in profit.

Sunrise Bank, Citizens Bank International, Siddhartha Bank, Prime Commercial Bank, Machhapuchchhre Bank, Agricultural Development Bank, and Nepal Bank have reported a decline in their profits.

The banks’ quarterly report shows one bank’s profit crossed the Rs 5bn mark, the profits of two banks have crossed Rs 4bn while two earned above Rs 3bn in profit in the current fiscal year.

Nabil Bank records the highest profit

Nabil Bank has topped the chart as the bank’s profit grew by 52.63 percent in the first nine months of the current fiscal year. The bank earned Rs 5.11bn in profit, which is the highest among the banks in the third quarter of the current fiscal year.

Global IME Bank is second on the list with a profit of Rs 4.35bn, an increment of 16.96 percent followed by the NIC Asia Bank which has reported a profit of Rs 4.01bn.

In terms of growth, Everest Bank has the highest profit growth at 62.63 percent. The bank recorded a profit of Rs 2.46bn in the first nine months of this fiscal compared to Rs 1.51bn in the last fiscal. Standard Chartered Bank’s profit also grew by 60.24 percent to Rs 2.61bn.

Himalayan Bank posts highest NPL

The profits of banks have also been affected by the increment in bad loans as they have to keep aside large amounts of money for the provisioning of bad loans. Provisioning is a practice where banks are required to maintain a certain amount in reserve when loans are not recovered.

Among the commercial banks, the NPLs of three banks crossed four percent. Himalayan Bank has the highest NPL of 4.56 percent, followed by the Agricultural Development Bank with 4.35 percent, and Nepal Bank with 4.16 percent.

Four banks have managed to keep their NPL below one percent. Nepal SBI Bank, Standard Chartered Bank Nepal, NIC Asia Bank, and Everest Bank have less than 1 percent NPL. SBI’s NPL stood at 0.97 percent, Standard Chartered’s at 0.90 percent, NIC Asia’s at 0.85 percent, and Everest’s at 0.70 percent.

Provisioning surged by 324.27 percent

As NPLs surged sharply, the loan loss provisions of banks also increased. The amount for provisioning has increased by 324.27 percent. Banks have set aside Rs 31.32bn for loan loss provisions till mid-April 2023 compared to Rs 7.38bn during the same period of the last fiscal year. The total provisioning amount of banks increased by Rs 23.94bn in the last 12 months.

Kumari Bank and Nabil Bank have set aside above Rs 3bn each for provisioning purposes in the third quarter.

The banks’ quarterly report shows one bank’s profit crossed the Rs 5bn mark, the profits of two banks have crossed Rs 4bn while two earned above Rs 3bn in profit in the current fiscal year.

Nabil Bank records the highest profit

Nabil Bank has topped the chart as the bank’s profit grew by 52.63 percent in the first nine months of the current fiscal year. The bank earned Rs 5.11bn in profit, which is the highest among the banks in the third quarter of the current fiscal year.

Global IME Bank is second on the list with a profit of Rs 4.35bn, an increment of 16.96 percent followed by the NIC Asia Bank which has reported a profit of Rs 4.01bn.

In terms of growth, Everest Bank has the highest profit growth at 62.63 percent. The bank recorded a profit of Rs 2.46bn in the first nine months of this fiscal compared to Rs 1.51bn in the last fiscal. Standard Chartered Bank’s profit also grew by 60.24 percent to Rs 2.61bn.

Himalayan Bank posts highest NPL

The profits of banks have also been affected by the increment in bad loans as they have to keep aside large amounts of money for the provisioning of bad loans. Provisioning is a practice where banks are required to maintain a certain amount in reserve when loans are not recovered.

Among the commercial banks, the NPLs of three banks crossed four percent. Himalayan Bank has the highest NPL of 4.56 percent, followed by the Agricultural Development Bank with 4.35 percent, and Nepal Bank with 4.16 percent.

Four banks have managed to keep their NPL below one percent. Nepal SBI Bank, Standard Chartered Bank Nepal, NIC Asia Bank, and Everest Bank have less than 1 percent NPL. SBI’s NPL stood at 0.97 percent, Standard Chartered’s at 0.90 percent, NIC Asia’s at 0.85 percent, and Everest’s at 0.70 percent.

Provisioning surged by 324.27 percent

As NPLs surged sharply, the loan loss provisions of banks also increased. The amount for provisioning has increased by 324.27 percent. Banks have set aside Rs 31.32bn for loan loss provisions till mid-April 2023 compared to Rs 7.38bn during the same period of the last fiscal year. The total provisioning amount of banks increased by Rs 23.94bn in the last 12 months.

Kumari Bank and Nabil Bank have set aside above Rs 3bn each for provisioning purposes in the third quarter.

9 feared buried in Darchula avalanche

At least nine people were missing and feared buried in an avalanche that occurred at Bolin in Byas Rural Municipality-1 of Darchula district on Tuesday. It has been suspected that the people who had gone to pick yarsagumba caterpillar fungus (Cordyceps sinensis) were affected by the avalanche that took place at around 3 pm today, the District Police Office, Darchula said. A team of 30 security personnel under the command of DSP has gone to the incident area. Details about the incident are awaited, police said.

RSP President Lamichhane’s driver dies during treatment

Rastriya Swatantra Party (RSP) President Rabi Lamichhne’s driver Sambhu Thapa, who was critically injured after falling off a house roof in Chitwan, died on Tuesday. He breathed his last during the course of treatment at the Medicity Hospital in Lalitpur, a hospital source said. Thapa sustained serious injuries after falling off the top floor of Lamichhane’s three-storey house in Bharatpur on April 17 in the run-up to the by-election. Though Thapa was treated at the College of Medical Science in Bharatpur, he was airlifted to Kathmandu for further treatment on a Nepal Army helicopter on April 18.

Lumbini Province CM Chaudhary secures vote of confidence

Lumbini Province Chief Minister Dilli Bahadur Chaudhary secured a vote of confidence on Tuesday. Chief Minister Chaudhary got the vote of confidence in the 10th meeting of the first session of Lumbini Province Assembly today. Speaker Tularam Gharti Magar announced that a total of 53 votes were cast in favor of Chaudhary while 29 cast votes against him. Similarly, four lawmakers remained neutral. CM Chaudhary had presented a proposal for vote of confidence in the Province Assembly as per the Article 188 (1) of the Constitution and Rule 145 (4) of the Lumbini Province Assembly Regulations-2079. Twenty-seven members from the Nepali Congress, nine from the CPN (Maoist Centre), four from Nagarik Unmukti Party, three from Janata Samajbadi Party, Loktantrik Samajbadi Party and Janamant Party each, one from CPN (Unified Socialist) and Rastriya Janamorcha each and one independent member cast their votes in favor of Chaudhary. There are 29 members from the CPN-UML and four from the Rastriya Prajatantra Party. Chaudhary was elected to the post of Chief Minister on April 27 as per the Article 168 (2) of the Constitution.

'Sankata Ko Dhun' premiered

Bhakundo.np, a local media company, premiered a short documentary named “SANKATA KO DHUN” at Te Bahal, Kathmandu, the place that hosts Sankata Club, Nepal’s top division football club. Amid the presence of football fans and stakeholders, the Bhakundo team premiered the documentary. The documentary is about the fans of Sankata Club. Speaking after the premiere, the CEO of Bhakundo Media & Management Pvt Ltd, Gaurav Phuyal said, "This is a first step. We have tried a new thing that has not been done before in Nepali sports."

Nepse plunges by 4. 27 points on Tuesday

The Nepal Stock Exchange (NEPSE) plunged by 4. 27 points to close at 1,866.40 points on Tuesday. Similarly, the sensitive index dropped by 1. 12 points to close at 357. 02 points. A total of 2,336,625-unit shares of 271 companies were traded for Rs 692 billion. Meanwhile, Aatmanirbhar Labhubitta Bittiya Sanstha Limited was the top gainer today with its price surging by 8. 20 percent. Likewise, Swet-Ganga Hydropwer and Construction Limited was the top loser with its price dropped by 4. 70 percent. At the end of the day, the total market capitalization stood at Rs 2. 71 trillion.

Ramesh Kshitij on building companionship through poetry

Ramesh Kshitij is a Nepali poet, lyricist, and writer who is known for his poetry collections. ‘Arko Saanjh Parkhera Saanjhma’, ‘Ghar Farkiraheko Manis’ and ‘Parbat Parbatma Batuwa Gham’ are some of his notable works. He has also written lyrics for several songs sung by some renowned singers of Nepal, and has published a song collection called ‘Aafai Aafno Sathi Bhaye’. Babita Shrestha from ApEx talked to Kshitij about his interest in poetry, literature, and writing. How did you start writing? I was born in Salyan but raised in Dang. As a child, I loved reading books, listening to music and the radio. I also experimented with various writing techniques and took part in literature-related activities at school. So writing came naturally to me. But it’s the environment that I grew up in that made me realize that. The society I lived in had a diverse tradition and a rich cultural heritage and that gave me a lot of ideas on what to write. I think what piqued my interest in literature was my hometown’s rich cultural and natural heritage. What do you mostly work on? I’ve spent most of my time working on poems but recently I’ve also been focusing on story manuscripts. I prefer to write pastoral, philosophical, and spiritual poems with symbols and imagery. I often concentrate on life’s philosophy and my perspective on the world itself. I’ve worked on subjects closely related to society, religion, and philosophical thoughts. Additionally, I enjoy reading contemporary poems as well as classics by Lekhnath Paudyal (poet) and other prominent senior writers. That has also had an influence on what and how I write. How would you describe your poetry? Poetry is different from other forms of literature. It resembles originality, opinion, art, creativity and symbolism. When you write in your own style, poems become attractive. My poetry is more allegorical, according to critics who have read them. I release a new collection every ten years. I don’t write often, but when I do, I attempt to incorporate all the personal, societal, and nationwide issues I’ve witnessed in that decade. I like to explore the meaning of life from as many angles as possible. What’s the role of poetry in contemporary society? Poetry plays a significant role in our society. For many, it can work like meditation. It can provide a sense of inner peace. Now, in our world, the rise of digital technology is making us over reliant on machines. The world is plagued with isolation and loneliness. For instance, in the early days people used to live in communal houses but now there are many nuclear families. The advancement of AI has deteriorated creativity. I think in today’s alienating society, poetry can be a useful companion. Is there anything you want your readers to know about your work? The world of poetry is vast. Individual feelings aren’t always at play. Sometimes a poet will discover other poets in his own work. If I’m writing on philosophy, I might express my personal viewpoint or write in accordance with how society around me is evolving. It automatically makes me happier when I discover that my work has been a friend to even one of my readers. It’s a feeling of content I get when my work motivates them to be more positive about their surroundings. To my reader, I want to make a promise that I will uphold this relevance all the way till the end and grant them the companionship they seek through my work. What recommendation do you have for someone who is aspiring to be a poet? I’d like to share some things that can assist them with discovering their writing abilities rather than making recommendations. I believe it will be beneficial for writers if they study relevant literature in which they are interested in. For me, they were ‘Tarun Tapasi’ by Lekhnath Paudyal, ‘Living with the Himalayan Masters,’ by Swami Rama, and ‘Yogi ko Aatmakatha’ by Paramahansa Yogananda. They are great writings that I think everyone should read. Keep writing with no boundaries because it will help you discover your inner self. Be persistent in your efforts. We all face obstacles, so keep calm and think about the efforts you’ve been putting in. When you recall your work decades later, the struggle and dedication will all seem worthwhile. Kshitij’s picks Tarun Tapasi by Lekhnath Paudyal Tarun Tapasi by Lekhnath Paudyal was published in 1953. The epic is divided into 19 cantos and is written in shikharini chhanda. Living with the Himalayan Masters by Swami Rama In this autobiographical book, Swami Rama talks about his journey through the Himalayan passes and meeting with various sages and yogis of different sects and branches. Yogi ko Aatmakatha by Paramahansa Yogananda This book is an autobiography of Paramahansa Yogananda published in 1946. It’s about his life and his encounters with spiritual figures of the Eastern and the Western world.