With the weak revenue collection, the government is struggling in managing resources while the process of formulation of the federal budget for the next fiscal year is gaining momentum. In the last few months, the government has tried to restart economic activities with a series of measures including lifting the import restrictions and land plotting restrictions, but the efforts have not been reflected in the revenue collection.

With resource management becoming an uphill task, the government has decided to scrap the projects that did not start their work by mid-April. The Finance Ministry has decided not to proceed with the projects that are yet to start preliminary works.

Amid the resources crunch, the government a few months ago introduced austerity measures announcing to curtail expenses in a number of categories. The Finance Ministry has already shortlisted the projects and has sent a circular to the line ministries not to take forward projects that are not in top priority for now.  The data of the nine months of the current fiscal year of the Finance Ministry show revenue collection remains dismal even after the import restrictions were lifted. The federal government’s half of revenue comes from taxing imported goods. The Department of Customs (DoC) and Inland Revenue Department (IRD), the key agencies of the revenue regime, have reported poor revenue collection as of mid-April of this fiscal. DoC managed to collect only Rs 34.76bn in revenue in Chaitra (mid-March to mid-April) against the target of Rs 57.29bn.

The data of the nine months of the current fiscal year of the Finance Ministry show revenue collection remains dismal even after the import restrictions were lifted. The federal government’s half of revenue comes from taxing imported goods. The Department of Customs (DoC) and Inland Revenue Department (IRD), the key agencies of the revenue regime, have reported poor revenue collection as of mid-April of this fiscal. DoC managed to collect only Rs 34.76bn in revenue in Chaitra (mid-March to mid-April) against the target of Rs 57.29bn.

By the end of the third quarter of the current fiscal year, the department has managed to collect only Rs 285bn against the target of Rs 490bn, which is only 58 percent of the target. The story of IRD is also the same. The department has collected Rs 337bn in revenue as of mid-April, which is less than Rs 342.65bn collected during the same period last fiscal year 2021/22.

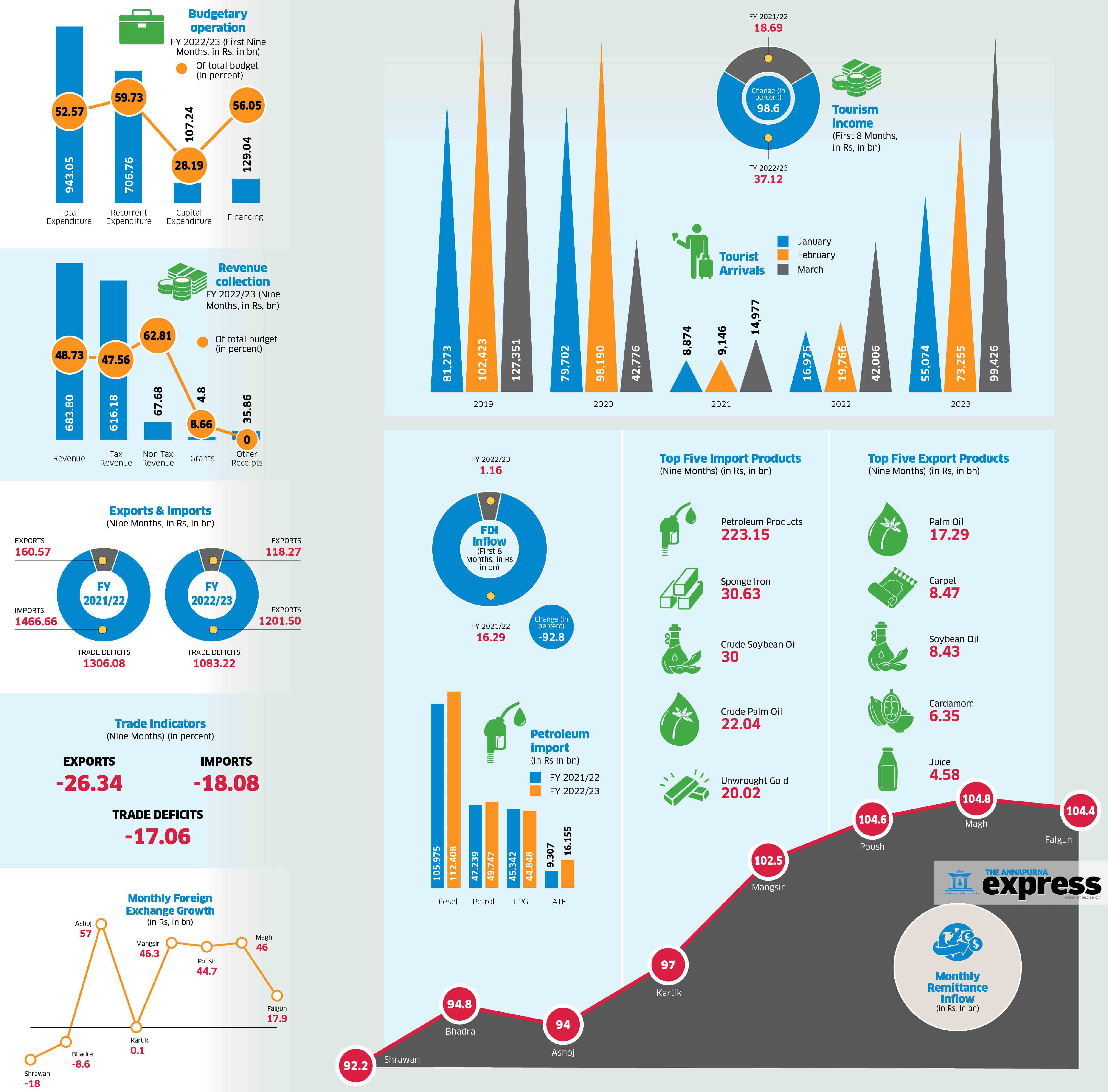

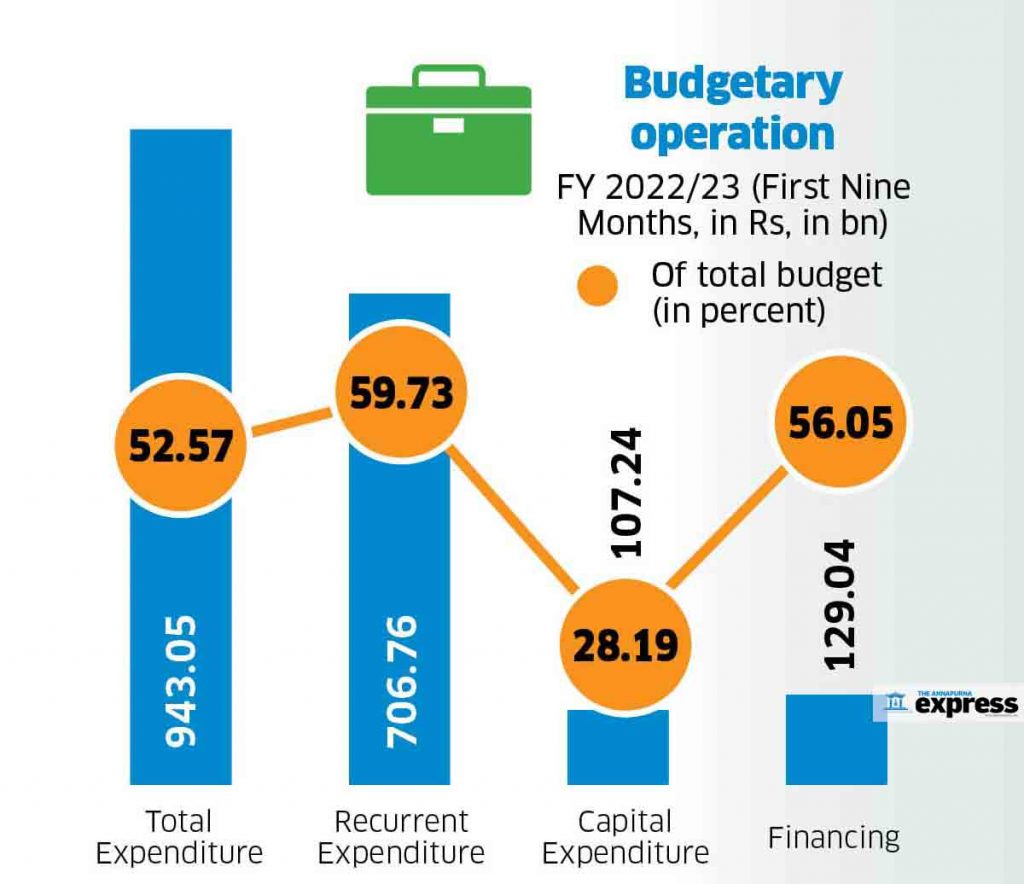

With DoC and IRD posting dismal results, the overall revenue of the federal government in the nine months of the current fiscal year has declined by 13.36 percent. The government’s revenue collection stood at Rs 683.20bn as of mid-April compared to Rs 789.26bn collected during the same period last fiscal year 2021/22, according to the Financial Comptroller General Office (FCGO).  The collected revenue has not been enough even to meet the recurrent expenditure of the government which stood at Rs 706.76bn as of mid-April. The total expenditure of the government stood at Rs 943.05bn.

The collected revenue has not been enough even to meet the recurrent expenditure of the government which stood at Rs 706.76bn as of mid-April. The total expenditure of the government stood at Rs 943.05bn.

Continuous improvement in the external sector

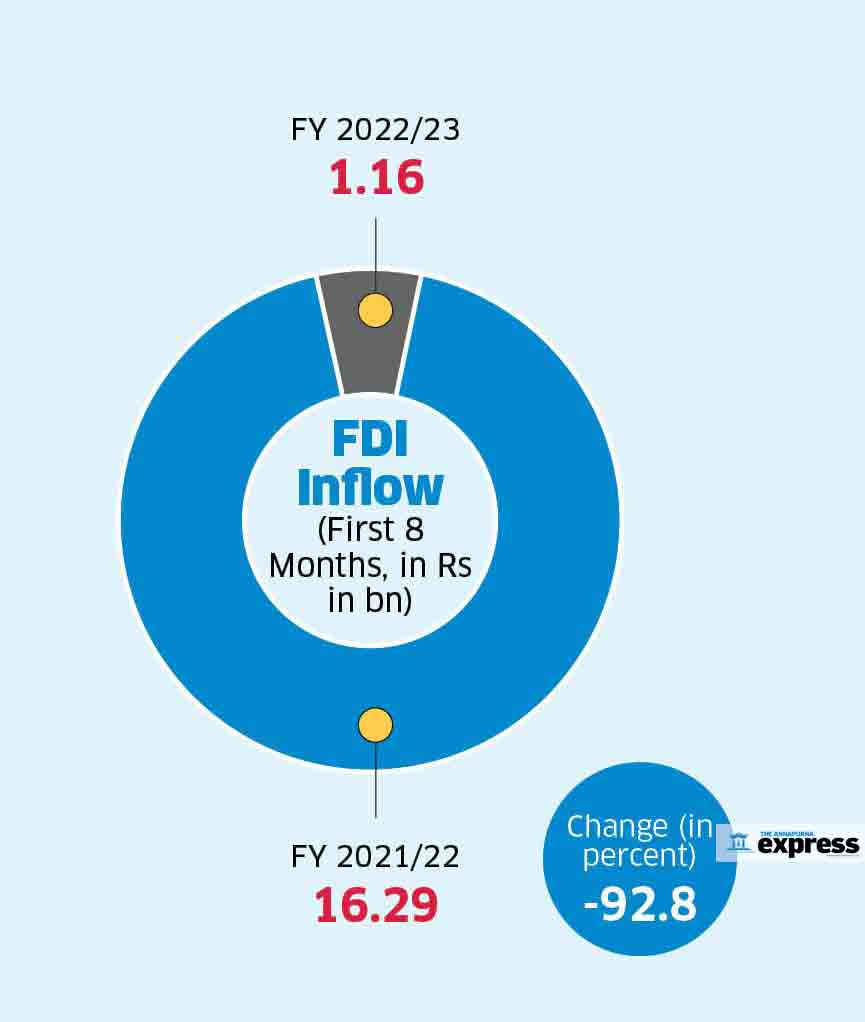

With noticeable improvements in the country’s forex reserves, balance of payment (BOP), tourism income and remittance inflow, the recovery in the country’s external sector has continued. The country’s BOP is at a surplus of Rs 148.10bn in the eight months of FY 2022/23 compared to a deficit of Rs 258.64bn in the same period of FY 2021/22.

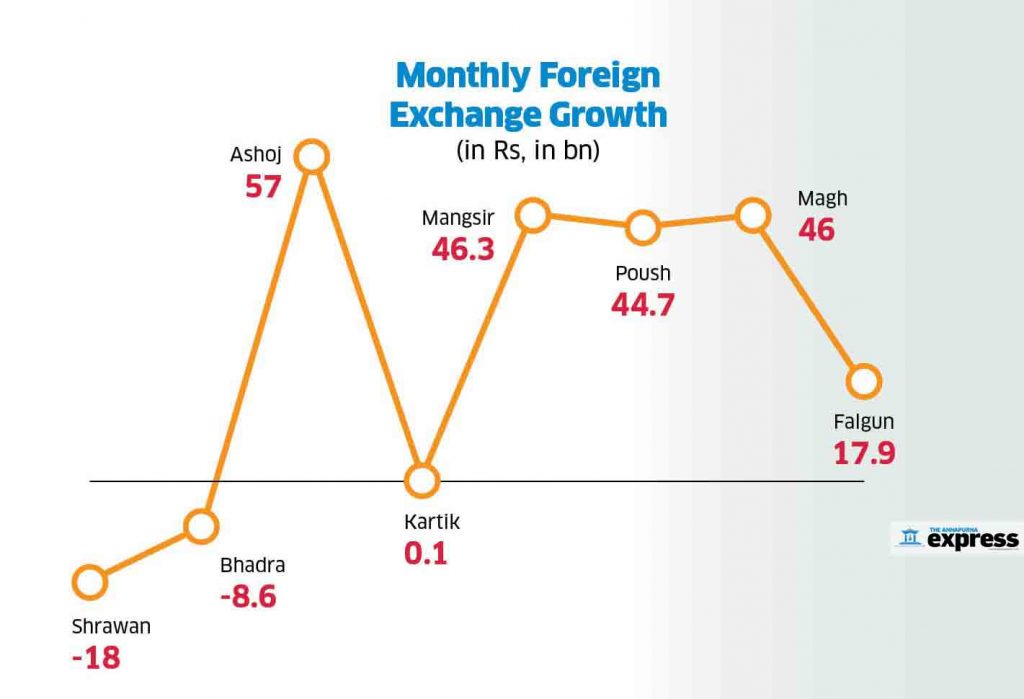

In US Dollar terms, the BOP is at a surplus of 1.12bn in the current fiscal year compared to a deficit of 2.17bn in the same period of the last fiscal year.  The country’s forex reserves increased by 15.2 percent in the review period. Nepal’s forex reserves stood at Rs 1,401.21bn in mid-March 2023 (Falgun) from Rs 1,215.80bn in mid-July 2022. In US dollar terms, the gross foreign exchange reserves increased by 12.1 percent to Rs 10.69bn in mid-March 2023 from Rs 9.54bn in mid-July 2022.

The country’s forex reserves increased by 15.2 percent in the review period. Nepal’s forex reserves stood at Rs 1,401.21bn in mid-March 2023 (Falgun) from Rs 1,215.80bn in mid-July 2022. In US dollar terms, the gross foreign exchange reserves increased by 12.1 percent to Rs 10.69bn in mid-March 2023 from Rs 9.54bn in mid-July 2022.

The central bank said that the foreign exchange reserves of the banking sector are sufficient to cover merchandise imports for 10.8 months, and merchandise and services imports for 9.4 months. Similarly, remittance inflows have increased by 25.3 percent to Rs 794.32bn in the review period. The inflow of remittances had decreased by 1.3 percent in the same period of the last fiscal year.

Imports start to surge  After the easing of the import restrictions, the country’s imports have started to surge again. Nepal imported goods worth Rs 143.123bn in Chaitra (mid-March to mid-April), the highest on a month-to-month basis, in the current fiscal year. The country imported goods worth Rs 139.22bn in Falgun (mid-February to mid-March), an increase of 10 percent compared to Magh (mid-January to mid-February).

After the easing of the import restrictions, the country’s imports have started to surge again. Nepal imported goods worth Rs 143.123bn in Chaitra (mid-March to mid-April), the highest on a month-to-month basis, in the current fiscal year. The country imported goods worth Rs 139.22bn in Falgun (mid-February to mid-March), an increase of 10 percent compared to Magh (mid-January to mid-February).

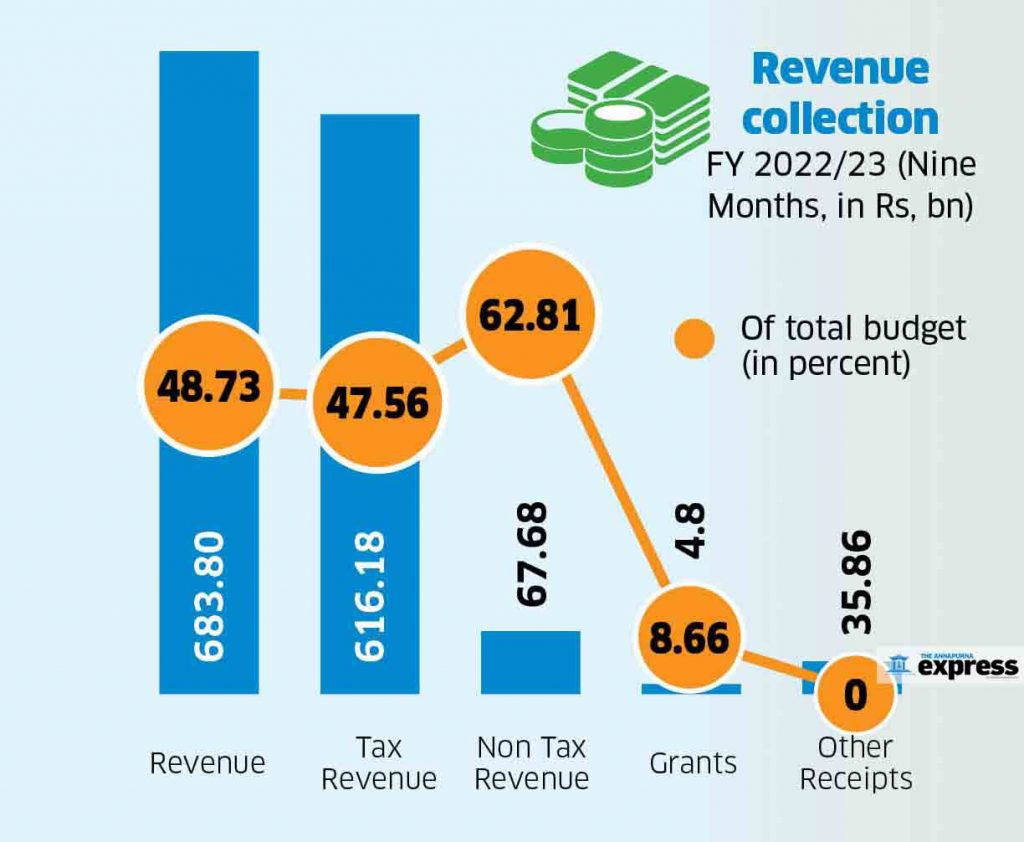

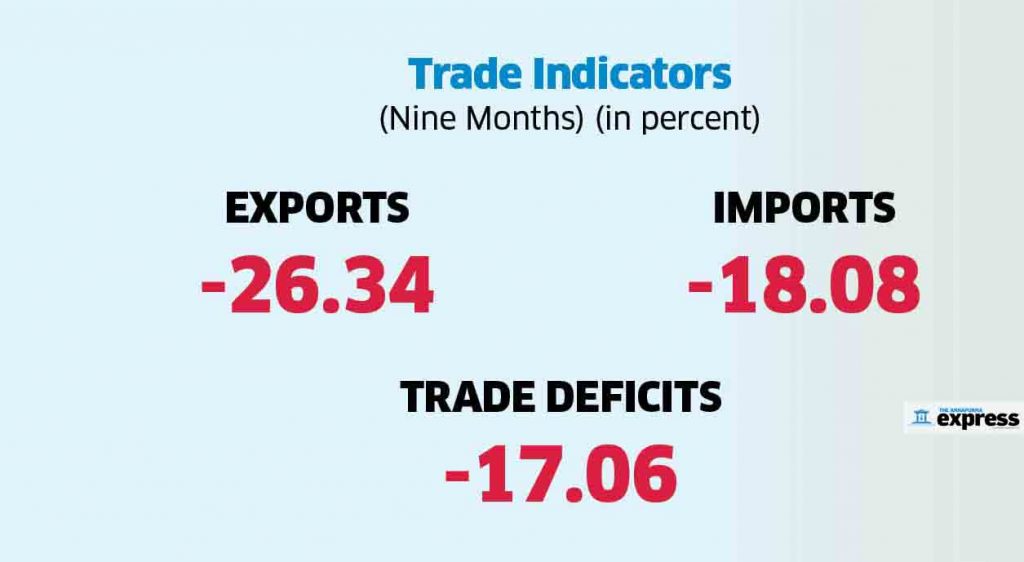

Nepal had imported goods worth Rs 142.31bn in Bhadra (mid-August-mid-September), the second highest on a month-to-month basis in FY 2022/23. However, the country’s total imports in the first nine months of the current fiscal year are lower than the last fiscal year. According to DoC, goods worth Rs 1,201.508bn were imported in the current fiscal year compared to Rs 1,466.662bn during the same period of the last fiscal year. The imports during the first nine months of this fiscal have declined by 18.08 percent.

Trade deficit decreased by 18 percent  The country’s trade deficit has decreased by 17.06 percent in the nine months of the current fiscal year. According to DoC, the country’s total trade deficit has been limited to Rs 1,083.22bn in the nine months of FY 2022/23 compared to Rs 1,306.08bn during the same period of FY 2021/22.

The country’s trade deficit has decreased by 17.06 percent in the nine months of the current fiscal year. According to DoC, the country’s total trade deficit has been limited to Rs 1,083.22bn in the nine months of FY 2022/23 compared to Rs 1,306.08bn during the same period of FY 2021/22.

The trade deficit declined this fiscal as the country’s total foreign trade shrunk by 18.89 percent during the review period. Both imports and exports have decreased in the current fiscal year.

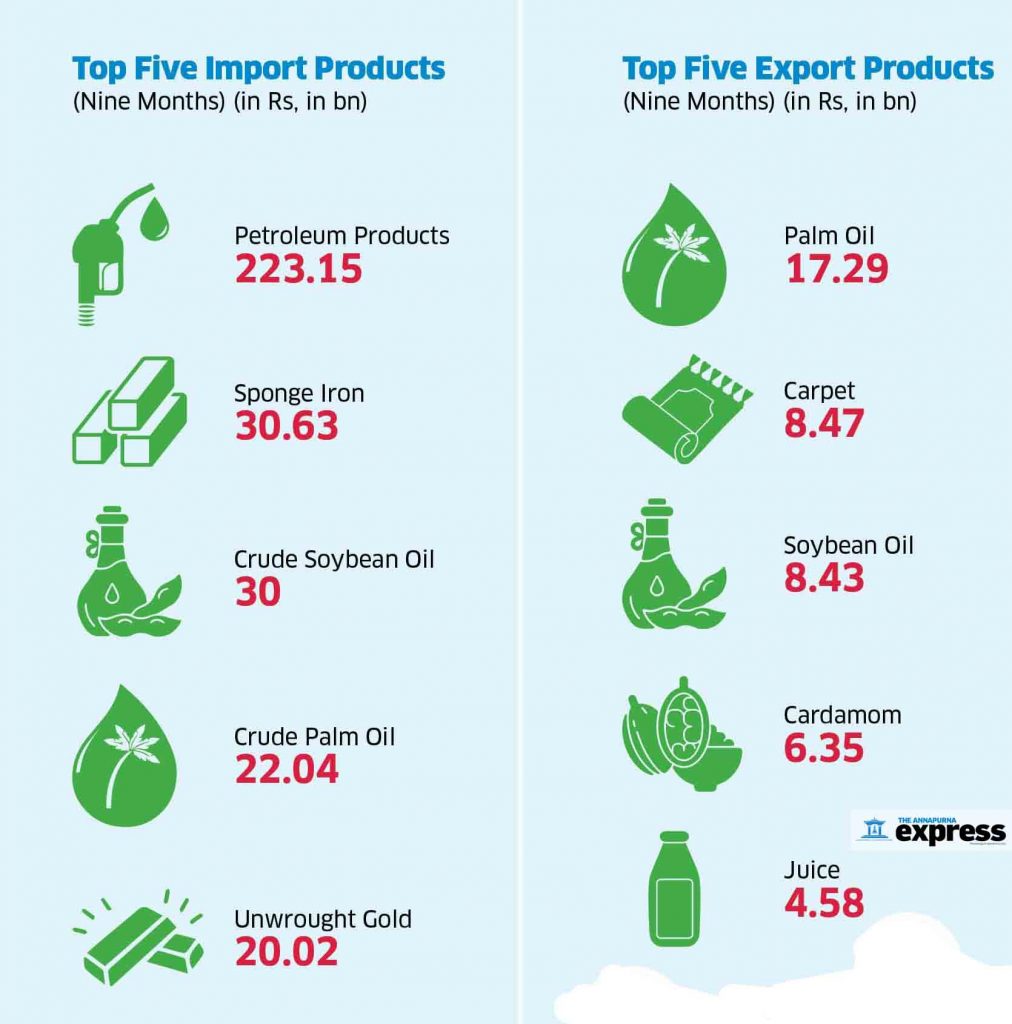

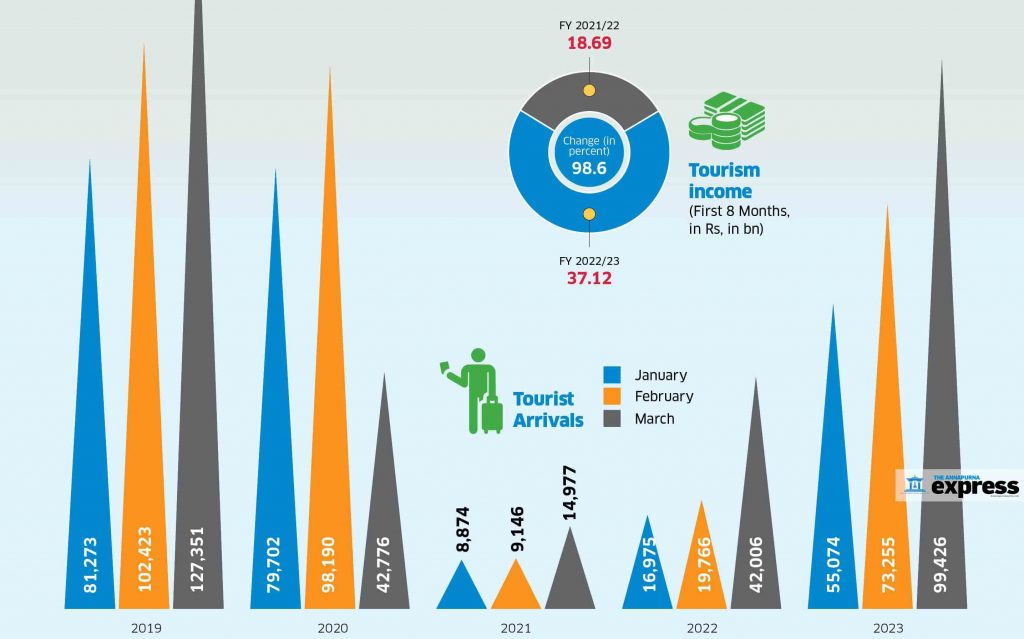

Tourist arrivals hit a four-year high in March  Continuing the upward momentum in 2023, the arrival of tourists in March hit a four-year high signaling that tourism in Nepal has largely recovered from the impacts of the Covid-19 pandemic. The latest statistics of the Nepal Tourism Board (NTB) show tourist footfalls in March 2023 stood at 99,426, the highest since March 2019.

Continuing the upward momentum in 2023, the arrival of tourists in March hit a four-year high signaling that tourism in Nepal has largely recovered from the impacts of the Covid-19 pandemic. The latest statistics of the Nepal Tourism Board (NTB) show tourist footfalls in March 2023 stood at 99,426, the highest since March 2019.

According to NTB, Nepal welcomed 42,006 tourists in March 2022, 14,977 tourists in March 2021, and 42,776 tourists in March 2020. According to NTB, 227,755 tourists visited Nepal in the first three months of 2023. Tourist arrivals have surged by 35 percent in March compared to February. Nepal welcomed 55,074 international visitors in January, 73,255 in February, and 99,426 in March.

Tourism income up by 98.6 percent

With international travel coming back to normalcy, Nepal’s tourism earnings have also recovered significantly. According to Nepal Rastra Bank, Nepal earned Rs 37.12bn in the eight months of FY 2022/23 compared to Rs 18.69bn during the same period of FY 2021/22. The country's tourism earnings nosedived in FY 2019/20, and FY 2020/21 due to restrictions on international travel as countries imposed various lockdowns to contain the spread of the Covid-19 pandemic.

Forex reserves surged by 15.2 percent  The country's forex reserves increased by 15.2 percent in the eight months of the current fiscal year. According to the NRB report, Nepal’s forex reserves stood at Rs 1401.21bn in mid-March, 2023 (Falgun) from Rs 1215.80bn in mid-July 2022. In US dollar terms, the gross foreign exchange reserves increased by 12.1 percent to Rs 10.69bn in mid-March 2023 from Rs 9.54bn in mid-July 2022.

The country's forex reserves increased by 15.2 percent in the eight months of the current fiscal year. According to the NRB report, Nepal’s forex reserves stood at Rs 1401.21bn in mid-March, 2023 (Falgun) from Rs 1215.80bn in mid-July 2022. In US dollar terms, the gross foreign exchange reserves increased by 12.1 percent to Rs 10.69bn in mid-March 2023 from Rs 9.54bn in mid-July 2022.

NRB in the report said the foreign exchange reserves of the banking sector are sufficient to cover merchandise imports for 10.9 months, and merchandise and services imports for 9.4 months.

Remittance inflow surged by 25.3 percent  NRB has said that remittance inflow has increased by 25.3 percent to Rs 794.32bn in the eight months of the current fiscal year. Remittance had decreased by 1.3 percent in the same period of the last fiscal.

NRB has said that remittance inflow has increased by 25.3 percent to Rs 794.32bn in the eight months of the current fiscal year. Remittance had decreased by 1.3 percent in the same period of the last fiscal.

In US Dollar terms, remittance inflows increased by 14.8 percent to 6.09bn in the review period against a decrease of 2.6 percent in the same period of the previous year.

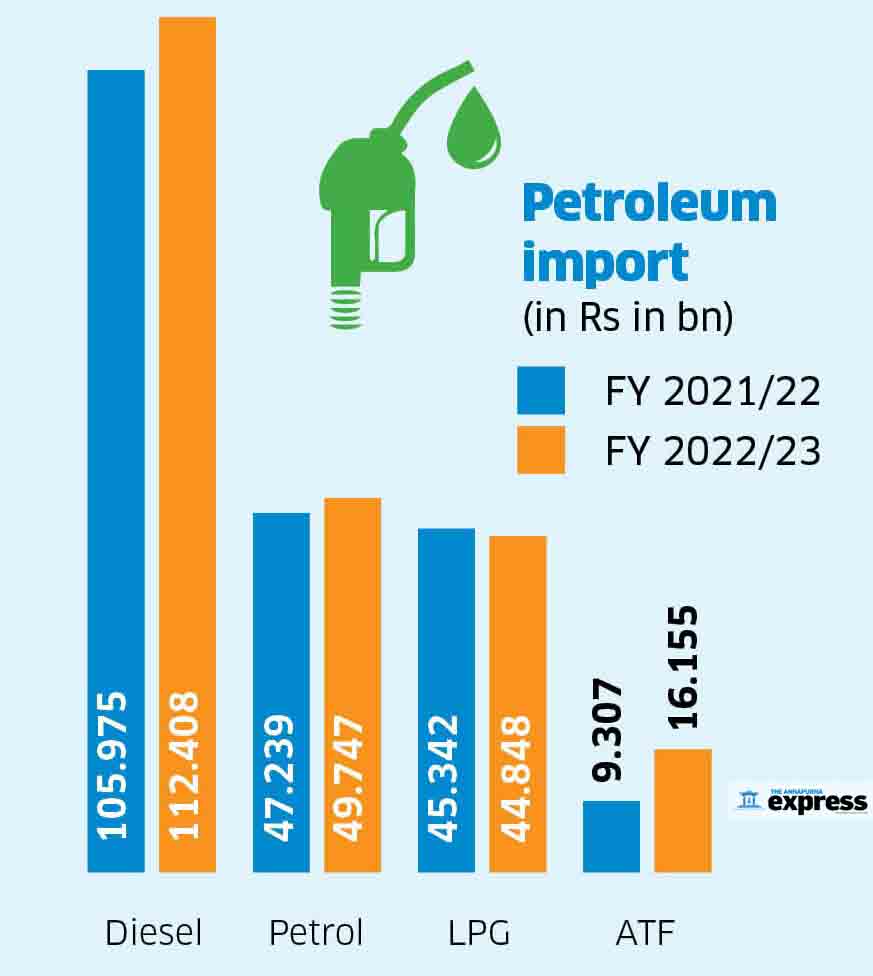

Petroleum products imports decline in quantity

The quantity of all petroleum products (diesel, petrol, LPG, and ATF) has declined in the nine months of FY 2022/23. The quantity of diesel imports decreased by 26.85 percent in the review period compared to the same period of FY 2021/22. However, the import value has increased by 6.07 percent.

Similarly, the quantity of petrol imports also declined by 9.25 percent but the import value increased by 5.30 percent. This is mainly because of the surge in fuel prices caused by the Ukraine-Russia war.