The exchange of any two currencies is carried out based on two types of rates—pegged rate (fixed exchange rate) and floating rate (converted exchange rate). The currency exchange rate is determined and managed by the central bank of each country. The exchange rate is generally determined based on demand and supply.

The exchange rate of Nepali currency, which is pegged to the Indian currency, has fallen as the Indian currency has been taking one hit after another following the Covid-19 outbreak and the Russia-Ukraine war.

Nepal has an import-based economy, so the devaluation of the domestic currency against the US dollar will also impact the imports of foreign goods.

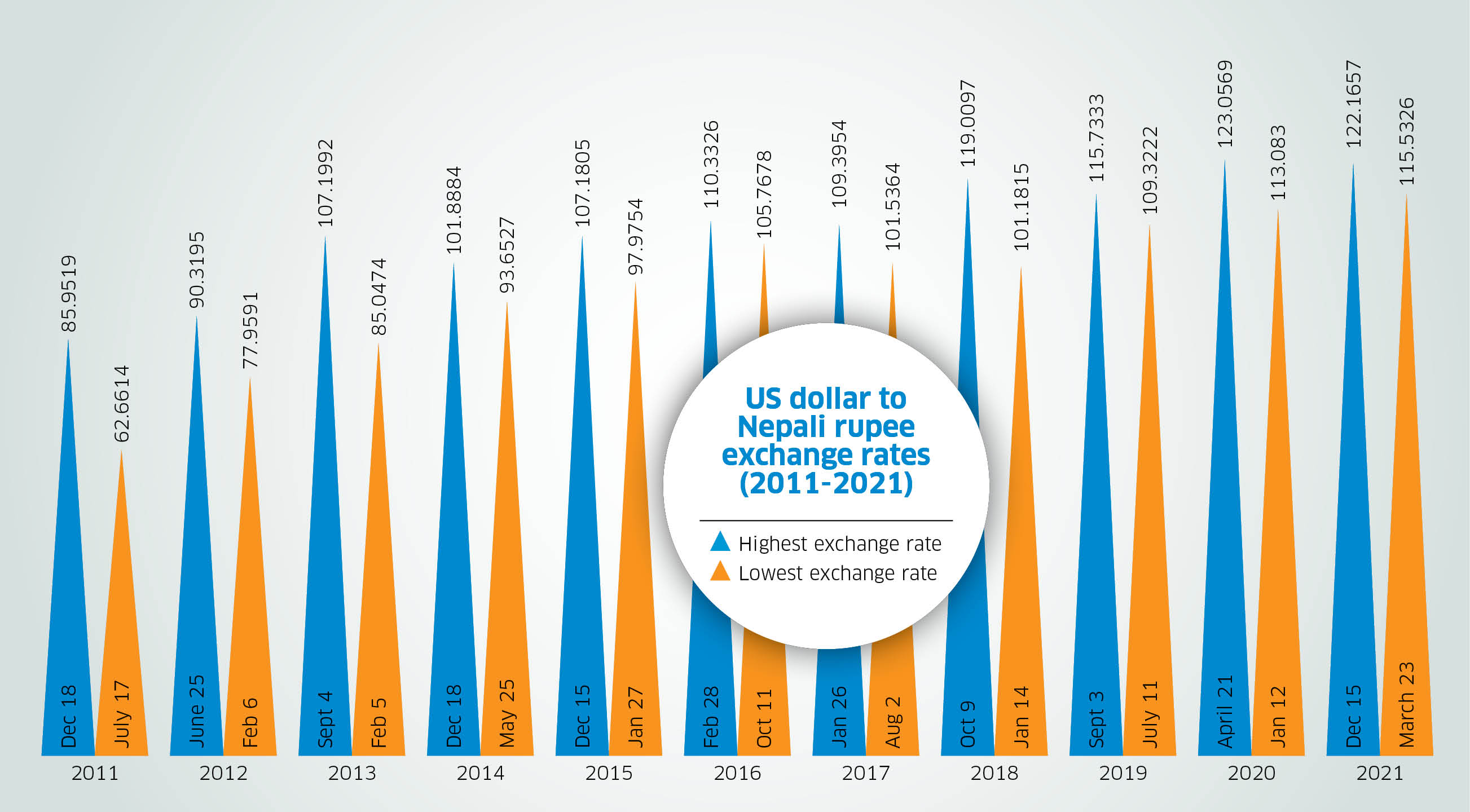

In the past decade, the dollar-Nepali rupee exchange rate has significantly increased. In 2011, the average exchange rate for a dollar was Rs 74. As the Nepali rupee weakened, a dollar fetched Rs 85 in 2012, Rs 93 in 2013, and Rs 97 in 2014.

The downward trend continued in the following years. As of 2022, the highest exchange rate is Rs 125 for a dollar.

If our economy was export-oriented, the dollar’s strengthening could have been an opportunity. But weak currencies make imports expensive and also create inflationary pressures on the economy. Similarly, the country incurs a loss while repaying foreign loans in dollars.

The immediate effect of the devaluation of the Nepali currency is reflected in the expansion of exports and contraction of imports, which tends to negatively impact balance of payments.

We could have benefitted from the appreciation of the dollar as remittances that migrant workers send home would then increase in value. Unfortunately, this is not the case as even remittances have gone down in recent times.

Unpegging would have made us another Sri Lanka

Chiranjibi Nepal

Ex-governor of Nepal Rastra Bank

Our international valuation relies on Indian forex as we have pegged our currency to that of India. The reason behind the depreciation of the Nepali rupee is the fall of the Indian rupee. In 2011, a dollar was equal to IRs 46, so the Nepali rupee was valued at Rs 74. Now, a dollar fetches IRs 77, which takes the valuation of the Nepali rupee to Rs 125. The depreciation rate is the same for both Indian and Nepali currencies.

There is an old question: why can’t we float our currency? This is because the currency is a very sensitive matter. International markets do not recognize our currency because of our poor economy. First, we have to increase our exports to India. Unless our goods can compete in Indian markets, it is impossible to enter the international arena.

Even if we lift our economy, the pegging to the international market should be a slow process. When a former governor of Nepal Rastra Bank had talked about unpegging our currency from the Indian rupee. This led to an acute shortage of Indian currency in Nepal and affected our trade. So unless we are independent in goods, our direct link to the international market should not be an option. If we had pegged ourselves with the dollar, our situation would have been worse than that of Sri Lanka.

The public should trust the currency. Once, because of lack of trust, Cambodian people stopped using their currency and shifted their transactions to the dollar.