Anil Kumar Upadhyay: There is no injustice as said by private sector

Times are difficult for banks and financial institutions at present. International and domestic economic uncertainties have surrounded the Nepali financial system creating problems like a severe shortage of investment-grade liquidity, skyrocketing inflation rate, and problems in the external sector of the economy affecting the profits of banks. Anil Kumar Upadhyay, the President of Nepal Bankers’ Association and CEO of the Agricultural Development Bank, says that the current focus of banks is to sustain rather than earn profits. In a conversation with ApEx, he talked about the current problems surrounding the banking system, emerging challenges to the banks, and digitization, among other topics. Excerpts: Of late, umbrella organizations of the private sector have upped their ante against banks, accusing them of charging high-interest rates. As the President of Nepal Bankers’ Association, do you think that banks have treated businesses in unjust ways as claimed by businesspersons? The banking sector works under certain regulatory frameworks of the Nepal Rastra Bank. But those various regulations are applicable in different situations. When there is adequate liquidity in the banking system, we can have various offers to our customers but when the situation is difficult like at present, we are required to become very careful to sustain. So, this is not an injustice as said by businesspersons. This is just a result of the situation. Unless any bank demands interest rates higher than allowed by the central bank, it is not unjust. We have seen a shortage of liquidity at different times over the past couple of years. How is the current situation? Why does the acute shortage of investment-grade liquidity continue despite a sharp decline in demand for loans and a hike in deposit interest rates? Currently, the liquidity situation has improved. The recent festive season and the elections have helped the flow of cash in the market. But the fact is the banks have not aggressively invested and lent money to borrowers. Yet, we have a shortage of investment-grade liquidity because there is a huge gap in financial resources and demand for loans. It will take some time to get things back on track. These days, banks are more into portfolio management so that we would not hamper regulations. Given the current economic slowdown as well as the prolonged liquidity crunch, what major challenges do you anticipate for the banking sector in this fiscal year? The major challenges are the continued shortage of resources, inflationary pressure, and impacts of the global and domestic economic recessions. Besides, the adaptation of new technologies and the transfer of data from paper to online networks is also challenging. The expectations and demands of customers are also high which will be a challenge for us to meet. Unless there is wise management of resources, the banking sector will suffer during these uncertain times. Amid a slowdown in economic activities, are we seeing a surge in non-performing loans (NPLs) of banks as debtors are struggling to repay the loans? We have to extend loans no matter what the situation is. Even during the height of the Covid-19 pandemic, we disbursed loans. We have been helping customers whenever they are in need. However, we have fewer resources and this is a problematic situation. Now, when we didn’t receive installments and interest payments, we had to search for new incomes. There are no other choices left for us. The central bank has recently reduced the spread rate in the first quarterly review of the monetary policy. What impact will it have on the banking sector, especially on profitability? Definitely, the new monetary arrangement will reduce the profits of banks. However, given the current uncertain global economic situation, we are more focused on sustainability than on earning profits. What kind of impact will the recent mergers and acquisitions make in the Nepali banking sector? Are we heading towards large but few banks in our system? In other countries, whenever a bank sees a continuous decline in profit, has less capital, or is not in a position to afford the expenses, it opts to merge with another bank. In Nepal too, due to problems in the economy, our banks have felt the same. When the banks go for a merger, it reduces the expenses in various aspects but increases the size of the business along with the quality and service. Mergers provide a chance to improve competitiveness among organizations. So, it feels like we are really heading for a large but few banks in the system and I think it is good for the industry. Digital banking has taken a new direction post-Covid-19 pandemic. How is your bank digitizing products and services for customers? How will digitization shape banking in Nepal in the coming days? Digitization is the biggest achievement in the banking sector after the Covid-19 pandemic. In the Asia-Pacific region, I think Nepal is after India to progress digitally. In our bank too, we have updated ourselves digitally. Previously, we had only around 10,000 mobile user customers but now, this number has reached around half a million. So, we have extended our online and QR-based services in rural areas too. For the farmers, we have added content and information related to agriculture in our bank app. It provides a situation of farming, market and weather. We are also soon introducing a mobile loan service. Besides, like other banks, we have provided all the banking facilities to our customers digitally.

Resurrecting economy: New government has its task cut out

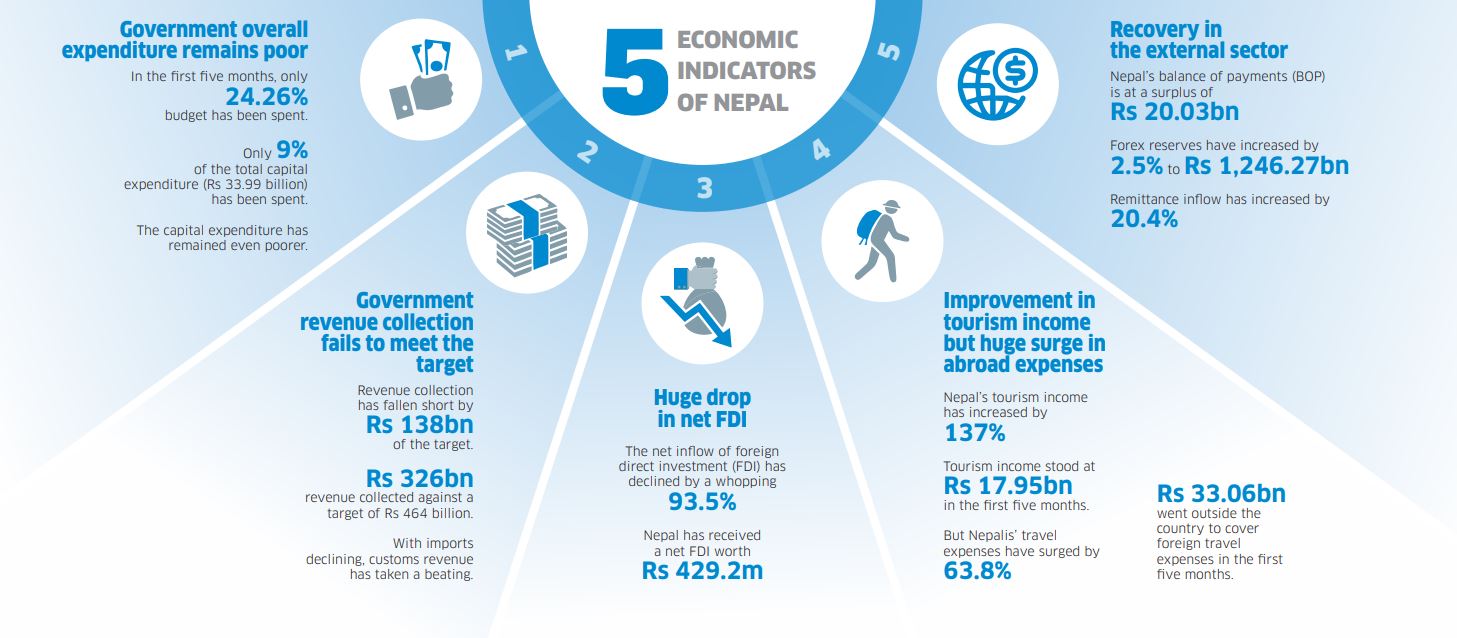

As the new government's formation gets pace, the new dispensation that will come to Singhadurbar, the country's main administrative center, will have a tough job ahead to resurrect the current state of the economy. As the economy grapples with multiple issues, data from different government agencies shows contrasting pictures. The Nepal Rastra Bank (NRB) last week published a new set of data that shows the country's external sector is on the path of recovery. At the same time, the data of the Financial Comptroller General Office (FCGO), which tracks the government's budgetary operation, shows revenue collection has plummeted drastically with capital expenditure remaining dismal as earlier. Amid the fast depleting forex reserves, the government in April this year enforced import restrictions on certain ‘luxury’ goods. This move was also guided by the fact that the country could be heading in the direction of Sri Lanka which went through a severe forex reserves crisis earlier this year. The central bank also introduced a tightened monetary policy for the current fiscal year, controlling the expansion of credit. Along with the tightening of credit, a prolonged liquidity crunch that resulted in higher interest rates in the banking system coupled with import restrictions has hit the country's economic activities. As imports decline along with economic activities slowed down, the government is now feeling the heat. The government’s major source of income, revenue, has been declining drastically. While the import restrictions on vehicles, expensive mobile sets, and foreign liquors, helped the country to avert the looming forex reserves crisis, the government is now facing another crisis as it struggles to collect the targeted revenue as current revenue collection is not sufficient even to meet growing recurrent expenditure. The government has failed to meet the revenue collection target in the first five months. According to FCGO, the government's revenue collection has a shortfall of Rs 138 billion of the target during this period. The government had set a target of collecting Rs 464 billion in revenue from mid-July to mid-December this year. But the FCGO data shows a total of Rs 326 billion in revenue has been collected by mid-December. The overall expenditure of the government during the same period stood at Rs 438.79 billion. The revenue collection of the government has continued to remain lower compared to the recurrent expenditure from the early days of the current fiscal year. Amid the slowdown in most types of economic activities, the Inland Revenue Department (IRD) is struggling to meet the target. The department's revenue collection in the first five months is 14 percent behind the target. The department, which aimed to collect revenue of Rs 174 billion by mid-December has managed to collect only Rs 150 billion. “As our revenue sources are heavily reliant on imports, restrictions on the imports of the major revenue generating items really hit the collection hard,” said economist Keshav Acharya. “The government must end over-reliance on imports for revenue generation and increase revenue from other sources, particularly internal revenue.” Customs revenue contributed nearly 40 percent of total revenue in the last fiscal year, according to FCGO. The government collected 17.82 percent of revenue from customs duty, 16.82 percent from import-based value-added tax (VAT), and 5.14 percent from import-based excise duty. With imports declining, customs revenue also has decreased in this fiscal. The slowdown in internal economic activities has hit the VAT and income tax collection, according to officials of the Finance Ministry. The federal budget has set a target of Rs 1403 billion in revenue collection for this fiscal. However, after the first five months, less than a quarter of the annual target (about 23 percent) has been collected. Given the current state of the revenue collection, it will become difficult for the government to raise the expenditure for daily administration and development expenses. The government has spent only 24.26 percent of the budget in the first five months. According to FCGO, the government's spending stood at Rs 435.21 billion till mid-December. As per the FCGO data, the government's capital expenditure has remained dismal. The government has utilized only 9 percent of the total capital expenditure in the first five months. According to FCGO, the capital expenditure till mid-December stood at Rs 33.99 billion. While the data shows the external sector is slowly recovering, economists cast doubt on the sustainability of the progress. "The external sector improved when the government imposed a ban on certain products. We have to see if the situation will be the same in the next three months," said Acharya. The recent government decision of lifting import restrictions, according to economists, could cost the economy dearly. As the government relaxed imports, there are fears that the country's external sector, which has finally come to a comfortable position, will again be under stress. According to them, instead of reducing the cost, the government went for a compromised solution to maintain fiscal balance. "The government, instead of cutting down the cost, opted for opening up the imports to increase revenue for maintaining fiscal balance," said Acharya. According to economists, the government should be clear on its priority. " Whether it wants to increase revenue to manage recurrent expenditure or go for structural reform to strengthen the country's external sector, is what the government should decide," said Acharya. As the government struggles to expedite capital expenditure, economists say controlling costs should have been the priority. While the government promises austerity measures, such measures have not been implemented effectively. The government is yet to implement the report of the Public Expenditure Review Commission. The government hiked the salary of the government staff by 15 percent and additional liability was created by lowering the eligibility age for elderly allowance to 68 years from 70 years. Before the recent parliamentary elections, the political parties promised to lower the eligibility age for elderly allowance and increase the amount of allowance, provide free electricity up to certain units and provide free drinking water to certain liters. “If you continue to increase recurrent liabilities, how can revenue sustain such liabilities,” the economist said. “You have to rely on domestic and foreign borrowing to meet growing resource needs.” Nepal’s public debt has been on the rapid rise in recent years. According to the PDMO, the country’s total public debt stood at Rs2.01 trillion as of the last fiscal year. The total debt stood at 41.5 percent of the Gross Domestic Product (GDP) in the fiscal year 2021-22, up from 30.3 percent in 2017-18. “ You have seen the economic crisis of Sri Lanka, Greece, and several Latin American countries and how overexposure to debt could create the crisis.” Box for graphics Government overall expenditure remains poor

- In the first five months, only 24.26 percent of the budget has been spent.

- The capital expenditure has remained even poorer.

- Only 9 percent of the total capital expenditure (Rs 33.99 billion) has been spent.

- Revenue collection has fallen short by Rs 138 billion of the target.

- Rs 326 billion in revenue was collected against a target of Rs 464 billion.

- With imports declining, customs revenue has taken a beating.

- The net inflow of foreign direct investment (FDI) has declined by a whopping 93.5 percent.

- Nepal has received a net FDI worth Rs 429.2 million.

- Nepal's tourism income has increased by 137 percent.

- Tourism income stood at Rs 17.95 billion in the first five months.

- But Nepalis' travel expenses have surged by 63.8 percent.

- Rs 33.06 billion went outside the country to cover foreign travel expenses in the first five months.

- Nepal's balance of payments (BOP) is at a surplus of Rs 20.03 billion

- Forex reserves have increased by 2.5 percent to Rs 1,246.27 billion

- Forex reserve is sufficient to cover the merchandise imports for 9.7 months, and merchandise and services imports for 8.4 months.

- Remittance inflow has increased by 20.4 percent

Two students raped in Sundarharaicha of Morang

Two students have been raped in Sundarharaicha of Morang district. Police said both of them are 14 years old and eighth and ninth graders at a local school. The incident came to light after the parents started searching for the children, who had gone to the school, did not come home. DSP Deepak Shrestha of the District Police Office, Morang said that they had left home for the school on Friday. They had gone to Gaushala of Sundarharaicha to see a volleyball match after they found the school closed on that day. According to a preliminary investigation, Sachin Timinsina (20) of Sundarharaicha-2 and Pratap Tamang (23) of Sundarharaicha-6 lured the duo to a hotel and raped them. Police said that they kept the girls overnight in separate rooms on the second floor of the Hotel Inn Restaurant and Lodge at Belgachi in Sundarharaicha-7 and raped them. The parents urged police to search for the girls after they did not come home till late night. They returned home only on Saturday. DSP Shrestha said that they knew about the incident after the girls told their parents about the incident. Police arrested Timinsina and Tamang based on the complaint filed by the parents. They had filed a complaint at the Area Police Office, Belbari on Sunday. A team deployed under the command of Inspector Khagendra Dhamala nabbed them from their homes. Police have also apprehended Padam Karki (20) of Sundarharaicha-6 for helping Timinsina and Tamang. It has been learnt that police are preparing to send the girls to the Koshi Hospital in Biratnagar for the health check-up.

Gold being traded at Rs 100, 500 per tola today

The gold is being traded at Rs 100, 500 per tola in the domestic market on Monday. According to the Federation of Nepal Gold and Silver Dealers' Association, tejabi gold is being traded at Rs 100, 000 per tola. Similarly, the silver is being traded at Rs 1,380 per tola today.

Nepal shows no improvement

Nepal has continued to lag behind its neighboring countries when it comes to research and innovation. In the Global Innovation Index (GII) 2022, published by World Intellectual Property Organization (WIPO), Nepal has ranked in 111th position out of 132 economies. The WIPO report shows Nepal’s position has remained the same as that of last year. According to the report, Nepal performs better in innovation inputs than innovation outputs in 2022. Nepal is ranked 106th in innovation inputs, lower than both 2021 and 2020. As for innovation outputs, Nepal is ranked 111th which is higher than in 2021 but lower than in 2020. Nepal’s two immediate neighbors China and India have been ranked at 11th and 40th positions, respectively. The other South Asian countries Sri Lanka, Pakistan, and Bangladesh have been ranked higher than Nepal. Sri Lanka has been ranked at 85th position while Pakistan and Bangladesh are at 87th and 102 positions, respectively. GII ranks world economies according to their innovation capabilities. Consisting of roughly 80 indicators, grouped into innovation inputs and outputs, the GII aims to capture the multi-dimensional facets of innovation. The report has stated that Nepal’s performance is at expectations for its level of development. “Nepal produces less innovation outputs relative to its level of innovation investments,” says the report. Among the lower-middle-income group economies, Nepal performs above the group average in two pillars—market sophistication and business sophistication. Among the seven pillars of GII, Nepal's score is better in market sophistication and weakest in human capital and research. Nepal’s dismal performance in the area of innovation is basically attributed to the lack of government attention to creating an environment conducive to fostering innovation and creativity in the country. In the fiscal year, the government allocated Rs 196.4bn ($1.6bn) to the Ministry of Education, Science and Technology which is a nine percent increase from Rs 180.4bn in 2021. This increment, however, is insufficient to ramp up activities in scientific and technological research, according to experts. Nepal remains among the countries with low funding in the areas of science and technology as a percent of GDP. Government funding in science and technology stood at a meager 0.45 percent of GDP in FY 2022/23. Nepal’s ranking in GII

| Year | Position |

| 2022 | 111 |

| 2021 | 111 |

| 2020 | 95 |

South Korea to recruit 40,000 Nepali workers in 2023

At a time when employment opportunities are increasingly becoming scarce in Nepal due to the economic slowdown, there is good news for Nepalis looking to work abroad. South Korea has agreed to allow an additional 40,000 Nepali workers for jobs in the country in 2023. Dandaraj Ghimire, spokesperson of the Ministry of Labor, Employment and Social Security, said the Korean government will be taking the workers under the Employment Permit System (EPS). As of now, the East Asian country has permitted 69,000 workers on its land under the EPS system. “They have consented to increase the number to 110,000 in the next one year,” said Ghimire. South Korea is one of the lucrative destinations for Nepali workers looking to work abroad. The country had taken 7,000-8,000 workers every year from Nepal between 2016 and 2019. During the Covid-19 pandemic, there was a sharp fall in intake to 955 workers in 2020 and 389 in 2021 because of travel-related and other restrictions. In 2022, the country agreed to take more than 9,000 workers from Nepal. According to Ghimire, the Korean government has targeted to employ 72 percent of these workers in the manufacturing business, while the remaining 30 percent will be sent for agriculture and animal husbandry. The workers selected for manufacturing will be assigned to work from 2023. In the EPS examination taken in September this year, a total of 7,142 individuals passed the test. Nepal and South Korea signed a memorandum of understanding for EPS for the first time on July 23, 2007. Following the pact, Korea has been hiring the required manpower via EPS. Meanwhile, the Korean government has revised the rule of the minimum wage to be effective from the beginning of 2023. In the new rule, the minimum wage rate will be around five percent higher than the existing wage range. According to EPS Center Nepal, a worker will be getting a minimum of 9,620 Korean won per hour from 2023. As of now, the rate has been fixed at 9,160 won per hour. A worker working for an average of 209 hours a month will receive more than 2.01 million won. South Korea has been allowing workers from 16 countries including Nepal under the EPS program. Citing the honesty and hardworking nature, Korean authority appears more lenient to Nepali workers compared to other countries, according to Ghimire. During the impacts of the Covid-19 pandemic, a large number of Nepalis who passed the Korean language and skill proficiency tests under EPS, waited for a long time to go to Korea for work. With request from the Nepali authority, the Korean government later on allowed Nepalis to go there on the basis of chartered flight and some quarantine provision. Also, the Korean authorities extended the visa of such workers by an additional year. Government expedites process to send Nepali nurses to UK Meanwhile, the government has expedited the process to send 10,000 Nepali nurses to the United Kingdom. According to Ghimire, both governments are currently working to prepare an implementation protocol for the purpose. “We have planned to send 200 nurses in the pilot phase,” he said. On Aug 22, Nepal signed a deal with the UK government to send around 10,000 Nepali nurses and each of them will be paid around Rs 400,000 per month. The competitive application process would be launched in the next few months. The World Health Organisation, however, has put recruitment of Nepali health workers on its ‘red list.’ Experts have criticized the government for turning a blind eye to the possibilities of exploitation in the recruitment process. Charging of extra fees by the consultants and possible shortage of nurses in the country, making the people shortfall in getting good health services, which Nepali people have been facing are among the concerns of the international organization. Nepal has 21 nurses per 10,000 people, compared with the UK’s 84 per 10,000.

Rabi Lamichhane elected RSP PP leader

Rastriya Prajatantra Party Chairman Rabi Lamichhane has been elected as the party’s Parliamentary Party leader. Party Spokesperson and General Secretary Dr Mukul Dhakal said that a meeting held on Monday unanimously elected Lamichhane as the Parliamentary Party leader. Rastriya Swatantra Party has won 20 seats—seven seats directly and 13 seats through the proportional representation electoral system. The party, however, is yet to choose chief whip and whip among others.

Simrik Air rescues injured Spanish climber from Mt Amadablam (In pictures)

Simrik Air has rescued a Spanish climber who slipped and injured his leg while climbing Mt Amadablam in Solukhumbu.

Zapata López Soje Manuel was rescued from the height of 6,300 meters of Mt Amadablam.

Simrik Air rescued him by using a long line rope. He was brought to the base camp soon after rescuing him from the mountain.

Later, he was brought to Kathmandu by a Simrik Air helicopter for treatment.

Manuel was climbing Mt. Amadablam on Sunday. The incident occurred between the second and third camps.

He had gone for mountaineering from the 8k Expedition Company.

Simrik Air pilot Siddharth Gurung, rescue specialist Chiring Dendup Bhote and Ang Tasi Sherpa rescued Manuel from Mt Amadablam by using a long line.

They used the long line as it was difficult to land the helicopter in that place.

“We succeeded in rescuing Manuel even in the bad weather condition,” Sherpa said, adding, “We faced difficulties in rescuing him due to strong winds. Despite difficulties, we continued our rescue efforts.”