Two-way traffic resumes along Narayangarh-Muglin road section

Two-way traffic along the Narayangarh-Muglin road section has resumed. According to the Area Police Office, Muglin, two-way traffic was disrupted this morning after a landslide occurred at Ichhakamana-5, bridge number three. The traffic movement has resumed after landslide debris were removed from the road, Chief of Area Police Office, Muglin Police Inspector Bishal Tamang said. The driver of a truck (Na 6 Kha 710) was also injured in a landslide this morning. Injured driver is undergoing treatment at Muglin Highway Hospital, police said. Earlier, the road that was closed since Saturday night had resumed on Sunday evening after 18 hours.

Elderly woman killed in Jhapa wild tusker attack

An elderly woman died after being attacked by a wild elephant at Mechinagar Municipality-10 in Jhapa on Monday. The deceased has been identified as Panna Devi Saha (80), Mechinagar ward 10 Chairperson Narayan Khanal said. He said the elephant attacked her on the road while she was on her way to pick flowers to offer worship. A permanent resident of Silgudhi, she has been living in her daughter's house for the past one year. Only six days ago too, a wild tusker had killed Giren Karmakar (53) of Halidibari Rural Municipality-2 while he was collecting mushrooms. Chief of Division Forest Office, Jhapa Meghraj Rai said that at least eight people have lost their lives in tusker attacks in Jhapa in the current fiscal year.

Narayangarh-Muglin road disrupted yet again

The Narayangarh-Muglin road has been obstructed yet again. Two-way traffic has been disrupted following a landslide at Ichhakamana Rural Municipality-5 in Chitwan on Monday. A driver sustained minor injuries when a landslide hit a truck (Na 6 Kha 710) this morning, police said. Efforts are underway to remove landslide debris. Police Inspector at the Area Police Office, Muglin, Bishal Tamang said that the two-way traffic along the Narayangarh-Muglin road has been disrupted following a mudslide triggered by torrential rainfall. The road section that saw disruption for around 18 hours on Sunday came into reoperation since last evening. Immediately after resumption, the landslide occurred and disrupted the road. It was quickly cleared off to bring the traffic into operation. Daily thousands of vehicles pass through the road. The passengers moving to and from different parts of the country have been hit hard due to frequent disruption of the road. The District Administration Office Chitwan has urged the people to not use the road section until and unless there is an emergency.

Mid-Term Growth Insurance Plan: MetLife offers unique benefits to customers

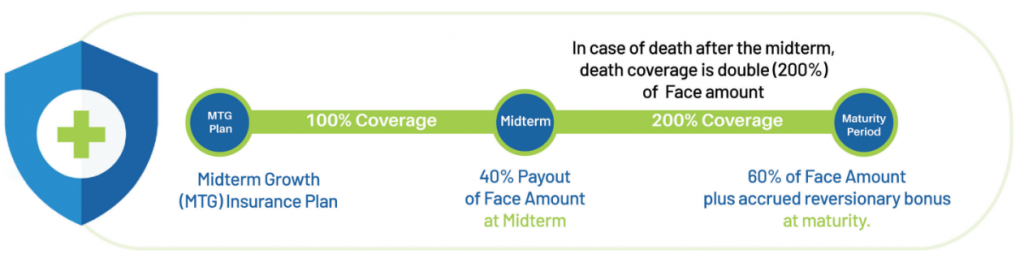

In its ongoing commitment to provide customers and the life insurance industry with innovative insurance plans, MetLife Nepal launched the Mid-Term Growth (MTG) plan on 1 Feb 2023. This unique endowment plan offers customers a high level of insurance protection with the unique benefit of a mid-term payout, along with double protection after the midterm. So for example, if the policy term is 20 years, then the customer can receive a payout after 10 years after which the face value of their death cover will double.

This plan is open to individuals aged between 31 days and 60 years, and is especially relevant for those who have recently started working and embarked on their careers. They can start with a small MTG plan based on their income capacity, which will provide increased life coverage. And a payout of a sum that can be helpful for their financial needs after the midterm. For instance, an employed 30-year-old can enroll in a MetLife MTG plan with a maximum term of 22 years and an insurance amount ranging from Rs 250,000 to Rs 50m.

In addition to the basic plan, applicants can choose additional protection, or “riders,” such as a Personal Accident Rider Benefit, Waiver of Premium Rider Benefit, and Critical Illness Rider Benefit, at a minimal additional cost.

This plan is an anticipated endowment benefit with regular premium payments, where the policy owner participates in profits through reversionary bonuses. This means the policy owners benefit from investment returns. It is a truly unique offering in the Nepali market, as no other plan provides double death coverage and partial survival benefit payment within the same policy. Normally, if customers want to increase their life insurance coverage, they have to add a new policy during the existing tenure. However, MTG provides the best solution by automatically doubling the coverage value after the midpoint with the same premium for the existing policy.

Enrolling in this insurance plan might be a smart move for long-term financial goals. For example, a 30 year old can choose a maximum term of 22 years and after 11 years, the person will receive a payout that can help achieve his dreams, be it funding children’s education or planning for a comfortable retirement. So, this is for protection and long-term saving.

Similarly, with a small plan based on income capacity, policy owners not only can increase life coverage but also the assurance of a payout after the midterm. It can give them confidence knowing that they will have financial support when they need it most.

Hence, the target segment for MTG is professionals who anticipate the need to revise or increase their coverage in a few years’ time. MTG offers this option so customers do not have to purchase additional plans in between.

Furthermore, MetLife provides value-added services to its customers, including a life card facility that offers attractive discounts to cardholders and their dependents for treatment and care at 100+ medical centers across Nepal. With global coverage and 24-hour protection, MetLife policyholders can feel secure even when traveling or residing outside the borders of Nepal.

An Anticipated Endowment Benefit with regular premium payments in which the policy owner will participate in profits via reversionary bonuses.

Survival Benefit

Survival benefit will be paid in two phases as 40 percent of Face Amount (FA) at midterm of the policy term and 60 percent Face Amount (FA) plus accrued reversionary bonuses at maturity.

Death Benefit

If the insured dies between the policy’s inception date and the policy’s midterm, the beneficiary receives 100 percent of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident).

If the insured dies after midterm within the policy term, the beneficiary receives two times (200 percent) of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident). Partial survival benefit paid out as 40 percent of Face Amount (FA) will not be deducted from the death benefit. Incase of Paid-up policy, death benefit shall limit to paid-up value.

In case of child/juvenile, death benefits are payable subject to Graded Death Benefit Endorsement and maximum coverage amount for the child insured shall be Rs 5,000,000.

Special Provisions

Provisions of cash surrenders, policy loan facility and non-forfeiture options of paid-up and automatic premium loan.

Additional Riders

Personal Accident Rider Benefit

This rider pays benefits in case of death, dismemberment, and permanent total disability due to accidents up to the principal sum/face amount.

Issue Age: 18-65

Coverage Expiry Age: 70 years

Waiver of Premium Rider Benefit

Under this benefit, the future premium of base policy is waived in case of permanent total disability due to sickness and accidents.

Issue Age: 18-55 years

Coverage Expiry Age: 60 years

Critical Illness Rider Benefit

This rider pays 100 percent or 50 percent of face amount coverage if diagnosed with seven critical diseases (major cancer, first heart attack, stroke, benign brain tumor, serious coronary artery disease, heart valve surgery, and primary pulmonary hypertension).

Issue Age: 18-54 years

Coverage Expiry Age: 60 years

For more, click here.

Survival Benefit

Survival benefit will be paid in two phases as 40 percent of Face Amount (FA) at midterm of the policy term and 60 percent Face Amount (FA) plus accrued reversionary bonuses at maturity.

Death Benefit

If the insured dies between the policy’s inception date and the policy’s midterm, the beneficiary receives 100 percent of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident).

If the insured dies after midterm within the policy term, the beneficiary receives two times (200 percent) of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident). Partial survival benefit paid out as 40 percent of Face Amount (FA) will not be deducted from the death benefit. Incase of Paid-up policy, death benefit shall limit to paid-up value.

In case of child/juvenile, death benefits are payable subject to Graded Death Benefit Endorsement and maximum coverage amount for the child insured shall be Rs 5,000,000.

Special Provisions

Provisions of cash surrenders, policy loan facility and non-forfeiture options of paid-up and automatic premium loan.

Additional Riders

Personal Accident Rider Benefit

This rider pays benefits in case of death, dismemberment, and permanent total disability due to accidents up to the principal sum/face amount.

Issue Age: 18-65

Coverage Expiry Age: 70 years

Waiver of Premium Rider Benefit

Under this benefit, the future premium of base policy is waived in case of permanent total disability due to sickness and accidents.

Issue Age: 18-55 years

Coverage Expiry Age: 60 years

Critical Illness Rider Benefit

This rider pays 100 percent or 50 percent of face amount coverage if diagnosed with seven critical diseases (major cancer, first heart attack, stroke, benign brain tumor, serious coronary artery disease, heart valve surgery, and primary pulmonary hypertension).

Issue Age: 18-54 years

Coverage Expiry Age: 60 years

For more, click here.

KMC serves 7-day ultimatum to remove temporary structures built inside the premises of Lalita Niwas

The Kathmandu Metropolitan City has given a seven-day ultimatum to remove the temporary structures built inside the premises of Lalita Niwas. The metropolis served the ultimatum by issuing a notice on Sunday. A team of Kathmandu Metropolitan City this afternoon had reached Baluwatar to inspect and fence the disputed land. The Central Investigation Bureau (CIB) of Nepal Police had concluded that fraud and forgery cases should be filed against 400 people for their alleged role in transferring the land at Lalita Niwas in Baluwatar. Police have concluded that 143 ropani land of Lalita Niwas has been transferred to private ownership. The Commission for the Investigation of Abuse of Authority (CIAA) has already filed a case at the Special Court claiming that the 136 ropani government land has been encroached upon.

9,590 employees recommended action for not submitting property details

A total of 9,590 employees in the federal and provincial governments did not submit their property details in the fiscal year 2078/9 BS. The National Vigilance Center has already handed a report to the Commission for the Investigation of Abuse of Authority (CIAA), recommending action against those employees. The CIAA has been recommended for taking a fine of Rs 5,000 each against them in accordance with the Provision Relating to Statement of Property (Clause 50), Corruption Prevention Act- 2002, according to Centre's information officer and Under-secretary Hari Prasad Sharma. Of them, 3,453 are from the civil service, 113 from Nepal Police, 1,158 are teachers and 1,902 are those appointed towards political appointment and on the contract. Similarly, 1027 employees of province level and 1,917 of local levels did not submit their property details.

Nepse plunges by 53. 70 points on Sunday

The Nepal Stock Exchange (NEPSE) plunged by 53. 70 points to close at 2,097.29 points on Sunday. Similarly, the sensitive index dropped by 12. 23 points to close at 390. 52 points. A total of 11,323,183-unit shares of 286 companies were traded for Rs 5. 08 billion. Meanwhile, BPW Laghubitta Bittiya Sanstha Limited was the top gainer today with its price surging by 10. 00 percent. Likewise, Shrijanshil Laghubitta Bittiya Sanstha Limited was the top loser with its price dropped by 9. 32 percent. At the end of the day, the total market capitalization stood at Rs 3. 07 trillion.

Bill to amend some Nepal Acts tabled in HoR

A Bill to amend some Nepal Acts- 2080 BS has been tabled in the House of Representatives. The Bill originated in the National Assembly was presented in the lower house session today by its secretary Padam Prasad Pandey.