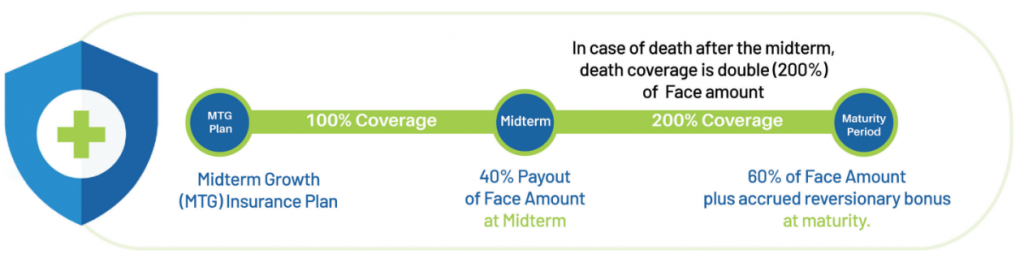

This plan is an anticipated endowment benefit with regular premium payments, where the policy owner participates in profits through reversionary bonuses. This means the policy owners benefit from investment returns. It is a truly unique offering in the Nepali market, as no other plan provides double death coverage and partial survival benefit payment within the same policy. Normally, if customers want to increase their life insurance coverage, they have to add a new policy during the existing tenure. However, MTG provides the best solution by automatically doubling the coverage value after the midpoint with the same premium for the existing policy.

Enrolling in this insurance plan might be a smart move for long-term financial goals. For example, a 30 year old can choose a maximum term of 22 years and after 11 years, the person will receive a payout that can help achieve his dreams, be it funding children’s education or planning for a comfortable retirement. So, this is for protection and long-term saving.

Similarly, with a small plan based on income capacity, policy owners not only can increase life coverage but also the assurance of a payout after the midterm. It can give them confidence knowing that they will have financial support when they need it most.

Hence, the target segment for MTG is professionals who anticipate the need to revise or increase their coverage in a few years’ time. MTG offers this option so customers do not have to purchase additional plans in between.

Furthermore, MetLife provides value-added services to its customers, including a life card facility that offers attractive discounts to cardholders and their dependents for treatment and care at 100+ medical centers across Nepal. With global coverage and 24-hour protection, MetLife policyholders can feel secure even when traveling or residing outside the borders of Nepal.

An Anticipated Endowment Benefit with regular premium payments in which the policy owner will participate in profits via reversionary bonuses.

Survival Benefit

Survival benefit will be paid in two phases as 40 percent of Face Amount (FA) at midterm of the policy term and 60 percent Face Amount (FA) plus accrued reversionary bonuses at maturity.

Death Benefit

If the insured dies between the policy’s inception date and the policy’s midterm, the beneficiary receives 100 percent of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident).

If the insured dies after midterm within the policy term, the beneficiary receives two times (200 percent) of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident). Partial survival benefit paid out as 40 percent of Face Amount (FA) will not be deducted from the death benefit. Incase of Paid-up policy, death benefit shall limit to paid-up value.

In case of child/juvenile, death benefits are payable subject to Graded Death Benefit Endorsement and maximum coverage amount for the child insured shall be Rs 5,000,000.

Special Provisions

Provisions of cash surrenders, policy loan facility and non-forfeiture options of paid-up and automatic premium loan.

Additional Riders

Personal Accident Rider Benefit

This rider pays benefits in case of death, dismemberment, and permanent total disability due to accidents up to the principal sum/face amount.

Issue Age: 18-65

Coverage Expiry Age: 70 years

Waiver of Premium Rider Benefit

Under this benefit, the future premium of base policy is waived in case of permanent total disability due to sickness and accidents.

Issue Age: 18-55 years

Coverage Expiry Age: 60 years

Critical Illness Rider Benefit

This rider pays 100 percent or 50 percent of face amount coverage if diagnosed with seven critical diseases (major cancer, first heart attack, stroke, benign brain tumor, serious coronary artery disease, heart valve surgery, and primary pulmonary hypertension).

Issue Age: 18-54 years

Coverage Expiry Age: 60 years

For more, click here.

Survival Benefit

Survival benefit will be paid in two phases as 40 percent of Face Amount (FA) at midterm of the policy term and 60 percent Face Amount (FA) plus accrued reversionary bonuses at maturity.

Death Benefit

If the insured dies between the policy’s inception date and the policy’s midterm, the beneficiary receives 100 percent of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident).

If the insured dies after midterm within the policy term, the beneficiary receives two times (200 percent) of the Face Amount (FA), plus reversionary bonuses (accrued till the date of the incident). Partial survival benefit paid out as 40 percent of Face Amount (FA) will not be deducted from the death benefit. Incase of Paid-up policy, death benefit shall limit to paid-up value.

In case of child/juvenile, death benefits are payable subject to Graded Death Benefit Endorsement and maximum coverage amount for the child insured shall be Rs 5,000,000.

Special Provisions

Provisions of cash surrenders, policy loan facility and non-forfeiture options of paid-up and automatic premium loan.

Additional Riders

Personal Accident Rider Benefit

This rider pays benefits in case of death, dismemberment, and permanent total disability due to accidents up to the principal sum/face amount.

Issue Age: 18-65

Coverage Expiry Age: 70 years

Waiver of Premium Rider Benefit

Under this benefit, the future premium of base policy is waived in case of permanent total disability due to sickness and accidents.

Issue Age: 18-55 years

Coverage Expiry Age: 60 years

Critical Illness Rider Benefit

This rider pays 100 percent or 50 percent of face amount coverage if diagnosed with seven critical diseases (major cancer, first heart attack, stroke, benign brain tumor, serious coronary artery disease, heart valve surgery, and primary pulmonary hypertension).

Issue Age: 18-54 years

Coverage Expiry Age: 60 years

For more, click here.