Amid the fast depleting forex reserves, the government in April this year enforced import restrictions on certain ‘luxury’ goods. This move was also guided by the fact that the country could be heading in the direction of Sri Lanka which went through a severe forex reserves crisis earlier this year.

The central bank also introduced a tightened monetary policy for the current fiscal year, controlling the expansion of credit. Along with the tightening of credit, a prolonged liquidity crunch that resulted in higher interest rates in the banking system coupled with import restrictions has hit the country's economic activities. As imports decline along with economic activities slowed down, the government is now feeling the heat. The government’s major source of income, revenue, has been declining drastically. While the import restrictions on vehicles, expensive mobile sets, and foreign liquors, helped the country to avert the looming forex reserves crisis, the government is now facing another crisis as it struggles to collect the targeted revenue as current revenue collection is not sufficient even to meet growing recurrent expenditure. The government has failed to meet the revenue collection target in the first five months. According to FCGO, the government's revenue collection has a shortfall of Rs 138 billion of the target during this period. The government had set a target of collecting Rs 464 billion in revenue from mid-July to mid-December this year. But the FCGO data shows a total of Rs 326 billion in revenue has been collected by mid-December. The overall expenditure of the government during the same period stood at Rs 438.79 billion. The revenue collection of the government has continued to remain lower compared to the recurrent expenditure from the early days of the current fiscal year. Amid the slowdown in most types of economic activities, the Inland Revenue Department (IRD) is struggling to meet the target. The department's revenue collection in the first five months is 14 percent behind the target. The department, which aimed to collect revenue of Rs 174 billion by mid-December has managed to collect only Rs 150 billion. “As our revenue sources are heavily reliant on imports, restrictions on the imports of the major revenue generating items really hit the collection hard,” said economist Keshav Acharya. “The government must end over-reliance on imports for revenue generation and increase revenue from other sources, particularly internal revenue.” Customs revenue contributed nearly 40 percent of total revenue in the last fiscal year, according to FCGO. The government collected 17.82 percent of revenue from customs duty, 16.82 percent from import-based value-added tax (VAT), and 5.14 percent from import-based excise duty. With imports declining, customs revenue also has decreased in this fiscal. The slowdown in internal economic activities has hit the VAT and income tax collection, according to officials of the Finance Ministry. The federal budget has set a target of Rs 1403 billion in revenue collection for this fiscal. However, after the first five months, less than a quarter of the annual target (about 23 percent) has been collected. Given the current state of the revenue collection, it will become difficult for the government to raise the expenditure for daily administration and development expenses. The government has spent only 24.26 percent of the budget in the first five months. According to FCGO, the government's spending stood at Rs 435.21 billion till mid-December. As per the FCGO data, the government's capital expenditure has remained dismal. The government has utilized only 9 percent of the total capital expenditure in the first five months. According to FCGO, the capital expenditure till mid-December stood at Rs 33.99 billion. While the data shows the external sector is slowly recovering, economists cast doubt on the sustainability of the progress. "The external sector improved when the government imposed a ban on certain products. We have to see if the situation will be the same in the next three months," said Acharya. The recent government decision of lifting import restrictions, according to economists, could cost the economy dearly. As the government relaxed imports, there are fears that the country's external sector, which has finally come to a comfortable position, will again be under stress. According to them, instead of reducing the cost, the government went for a compromised solution to maintain fiscal balance. "The government, instead of cutting down the cost, opted for opening up the imports to increase revenue for maintaining fiscal balance," said Acharya. According to economists, the government should be clear on its priority. " Whether it wants to increase revenue to manage recurrent expenditure or go for structural reform to strengthen the country's external sector, is what the government should decide," said Acharya. As the government struggles to expedite capital expenditure, economists say controlling costs should have been the priority. While the government promises austerity measures, such measures have not been implemented effectively. The government is yet to implement the report of the Public Expenditure Review Commission. The government hiked the salary of the government staff by 15 percent and additional liability was created by lowering the eligibility age for elderly allowance to 68 years from 70 years. Before the recent parliamentary elections, the political parties promised to lower the eligibility age for elderly allowance and increase the amount of allowance, provide free electricity up to certain units and provide free drinking water to certain liters. “If you continue to increase recurrent liabilities, how can revenue sustain such liabilities,” the economist said. “You have to rely on domestic and foreign borrowing to meet growing resource needs.” Nepal’s public debt has been on the rapid rise in recent years. According to the PDMO, the country’s total public debt stood at Rs2.01 trillion as of the last fiscal year. The total debt stood at 41.5 percent of the Gross Domestic Product (GDP) in the fiscal year 2021-22, up from 30.3 percent in 2017-18. “ You have seen the economic crisis of Sri Lanka, Greece, and several Latin American countries and how overexposure to debt could create the crisis.” Box for graphics Government overall expenditure remains poor

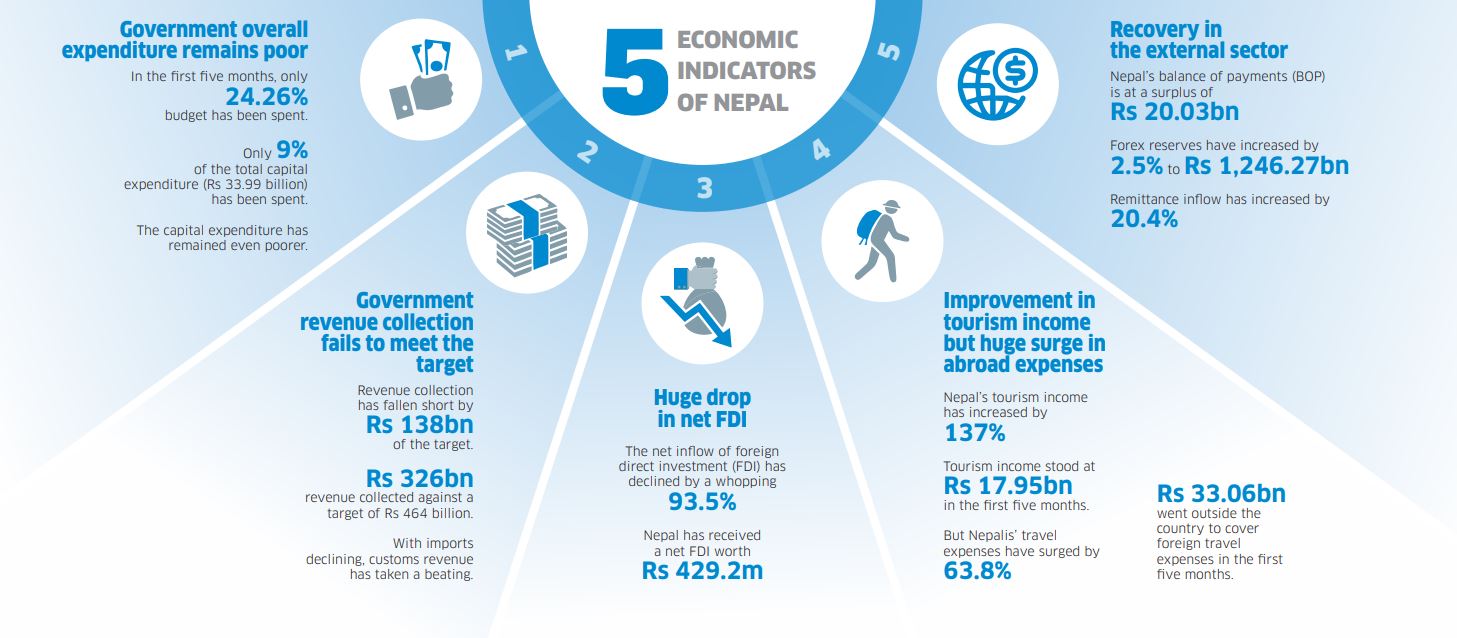

- In the first five months, only 24.26 percent of the budget has been spent.

- The capital expenditure has remained even poorer.

- Only 9 percent of the total capital expenditure (Rs 33.99 billion) has been spent.

- Revenue collection has fallen short by Rs 138 billion of the target.

- Rs 326 billion in revenue was collected against a target of Rs 464 billion.

- With imports declining, customs revenue has taken a beating.

- The net inflow of foreign direct investment (FDI) has declined by a whopping 93.5 percent.

- Nepal has received a net FDI worth Rs 429.2 million.

- Nepal's tourism income has increased by 137 percent.

- Tourism income stood at Rs 17.95 billion in the first five months.

- But Nepalis' travel expenses have surged by 63.8 percent.

- Rs 33.06 billion went outside the country to cover foreign travel expenses in the first five months.

- Nepal's balance of payments (BOP) is at a surplus of Rs 20.03 billion

- Forex reserves have increased by 2.5 percent to Rs 1,246.27 billion

- Forex reserve is sufficient to cover the merchandise imports for 9.7 months, and merchandise and services imports for 8.4 months.

- Remittance inflow has increased by 20.4 percent